Navigating the intricacies of a German health insurance system can be a challenge, and Public Health insurance (gesetzliche Krankenversicherung or GKV) might not always suit you.

That’s where private health insurance (Private Krankenversicherung) comes to the rescue.

In this Feather health insurance review, we’ll see how good Feather is as a private health insurance provider.

We’ll be looking at its coverage, unique features, and pricing and provide an honest evaluation of the advantages and potential drawbacks.

If you’re an English-speaking expat in Germany seeking comprehensive health coverage, this is a must-read. Let’s go.

Feather

| Features | Details |

|---|---|

| No. of Plans | 2 |

| Coverage | Immediate – No waiting time! |

| English Customer Support | Yes |

| Worldwide Coverage | Yes |

| Mobile App | Yes |

| Excess (or Deductible) | €0 |

| Dental Included | Yes |

| Physical and Mental Therapies | Yes |

| Private Hospitals | Yes |

| Cancellation Notice | 24 Months |

| Monthly Price | Variable €232 €319 ** If you’re 30, self-employed, and earn €70,000 per year. |

English support and information available.

No compulsory deductible.

Mobile App available.

Yearly cashback.

Worldwide coverage with repatriation cost.

Extensive health coverage with dental and orthodontics treatments.

2-year contract, so you can’t cancel before that.

Limited dental coverage.

Feather Health Insurance Overview

Feather, established in 2018 by Rob Schumacher and Vincent Audoire, was born out of the founders’ personal experience with the complexities of Germany’s insurance industry.

Their mission is simple: to provide straightforward and easily understandable insurance solutions. So, Feather operates as an insurance broker or intermediary and offers coverage in collaboration with other insurance companies.

However, you can conveniently manage everything through your Feather account while they handle partner relationships and payments on the backend.

Feather Health Insurance | ||

| Standard Plan | Premium Plan |

1. General | ||

General Doctor Visits | Covered | Covered |

Specialists | 75-100% | 100% |

Medication | 80-100% | 100% |

Vaccination | 100% | 100% |

Transportation | Covered | Covered |

Income Protection | Up to 100% of net income | Up to 100% of net income |

2. Dental | ||

Dental Checkups, Cleaning, and Procedures | Covered | Covered |

Inlays, Tooth Replacement, and Orthodontics for Children | 70% | 100% |

Annual Limit | Up to €4,000 | Unlimited |

3. Treatment & Therapies | ||

Preventive Care Treatments and Radiation Therapy | Covered | Covered |

Therapeutic Measures and Medical Aids | 80% | 100% |

Mental Health Therapy | 70% | 90% |

Natural Health Treatments | Not Covered | Covered |

4. Vision | ||

Vision Aid | €150 every two years | €450 |

Refractive Eye Surgery | -- | €2500 |

5. Pregnancy & Childbirth | ||

Pregnancy Coverage and Midwife Support | Covered | Covered |

Fertility Treatment | Not Covered | Covered |

6. Hospital | ||

Board and Room | Shared Room | Private bedroom |

Private Hospitals | Included | Included |

Treatment From Head Physician | Not Covered | Covered |

7. Outside Germany Coverage | ||

Worldwide Coverage | Yes | Yes |

EU-wide Coverage | Yes | Yes |

Repatriation Costs | No | Yes |

Monthly Premium | €232 | €319 |

Important

The prices mentioned above are subject to change based on your profile.

These prices apply to someone who’s 30, self-employed, and earns €70,000 per year.

Feather Health Insurance Review for 2024

Here’s an in-depth review of Feather’s liability insurance features.

Plans

Feather’s health insurance comes with two plans: Standard and Premium.

Standard

The Standard plan covers:

General

- General Doctor Visits

- Specialists (75-100%)

- Medication (80-100%)

- Vaccination (100%)

- Transportation

- Income Protection

Dental

- Annual limit €4,000

- Dental Checkups

- Dental Cleaning (Zahnsteinentfernung)

- Dentist Procedures

- Inlays (70%)

- Tooth Replacement (70%)

- Orthodontics for Children (70%)

Treatment and Therapies

- Preventive Care Treatments

- Therapeutic Measures (80%)

- Mental Health Therapy (70%)

- Radiation Therapy

- Medical Aids (80%)

Vision

- Vision Aids (€150 for every 2 years)

Pregnancy & Childbirth

- Pregnancy Coverage

- Midwife Support

Hospital

- Board and Room (Shared Room)

- Private Hospitals

Outside Germany

- Worldwide Coverage

- EU-wide Coverage

Premium

The Premium plan covers everything in the Standard plan and offers the following added benefits:

General

- Specialists (Extended to 100%)

- Medication (Extended to 100%)

Dental

- No annual limit

- Inlays (Extended to 90%)

- Tooth Replacement (Extended to 90%)

- Orthodontics for Children (Extended to 90%)

Treatment and Therapies

- Therapeutic Measures (Extended to 100%)

- Mental Health Therapy (Extended to 90%)

- Natural Health Treatments (80%)

- Medical Aids (Extended to 100%)

Vision

- Vision Aids (Extended limit of €450)

- Refractive Eye Surgery (Limit of €2,500)

Pregnancy & Childbirth

- Fertility Treatment

Hospital

- Board and Room (Upgraded to 1-bed Private Room)

- Treatment from the Head Physician

Outside Germany

- Repatriation Costs

For pricing, let’s look at how the “premium” works for Feather’s private insurance.

Premiums

The prices of Standard and Premium plans or their monthly premiums depend on the following:

- Your age

- Your income

- Number of people you add

- Employment type

You will have a higher premium if you’re old, have a high income, and work outside Germany or are self-employed.

Similarly, the number of members will also increase the premium.

To give you an idea, if you’re 30, earn €80,000, live in Germany, and only want insurance for yourself, the Standard will cost you €235, and the Premium will be €322.

Similarly, the prices could be as high as €470 and €645, respectively, if you’re the same age and earn the same amount of money but work as a self-employed individual.

Excess or Deductible

An excess or deductible is the amount you pay as your contribution to the claim price.

Thankfully, you don’t have to pay any deductible with both of Feather’s health insurance plans.

Coverage Details

Here’s an overview of what Feather health insurance covers.

General

- General doctor’s visits, like a visit to a general practitioner, eye doctor, gynecologist, pediatrician, or emergency doctor, are fully covered.

- Specialist’s visit costs like that to a dermatologist, orthopedic doctor, or ear-nose-throat doctor are fully covered for Premium members, while those on the Standard plan get 75-100% coverage based on their case.

- Medication is also covered 100% on both plans.

- Vaccinations are 100% covered if they’re recommended by Robert Koch Institute.

- In case of an emergency, the insurance covers the cost of transportation via ambulance, taxi, or Uber to the nearest appropriate hospital or clinic.

- You’re also covered if you’re unable to work due to a sickness that lasts longer than 42 days.

Important

Work or travel-related vaccines are not included!

Dental

Feather’s coverage of dental insurance is also pretty good.

- Dental Checkups, Dental Cleaning, and Dentist Procedures are all fully covered.

- Inlays, Tooth Replacement, and Orthodontics for Children are covered 70% in the Standard plan and 90% in the Premium plan.

Treatment and Therapies

- Preventive Care Treatments and Radiation Therapy are covered 100% in both plans, while Natural Health Treatments are only covered 80% in the Premium plan.

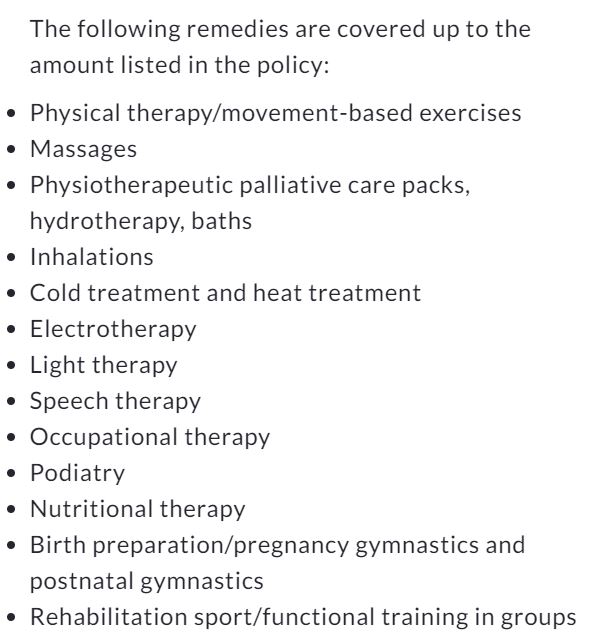

- Therapeutic remedies and medical aids are fully covered on the Premium plan, while the Standard plan has a limit of 80%. Feather covers the following remedies:

- Mental Health Therapy is covered 70% in the Standard plan and 90% in the Premium plan. However, both plans allow you to take an unlimited number of sessions every year.

Vision

- For Vision Aids, the Standard plan has a limit of €150, which you can claim every two years or if your eyesight worsens by a power of 0.5 within a year. For the Premium plan, the limit is €450.

- The Premium plan also pays €2500 for refractive eye surgeries like LASIK, PRK, RK, and others.

Pregnancy & Childbirth

- Feather insurance offers Pregnancy Coverage and Midwife Support on both Standard and Premium plans. Plus, it also offers fertility treatment to premium insurance holders.

Hospital

Both plans cover private hospital bills, including your expenses of stay. However, the Standard plan gives you access to a shared room, while the Premium plan lets you stay in a 1-bed private room.

Feather’s Premium plan also allows you to get the best treatment from a specialist or head physician.

Outside Germany

Both plans offer worldwide health coverage if you stay outside of Europe for up to one month. However, there’s no time limitation if you’re outside of Germany but within the EU.

But there’s more. The premium plan also covers repatriation costs to Germany if needed.

Contract Obligation and Notice Period

If you are moving to another EU country and taking up its mandatory health insurance, you can cancel Feather’s private health insurance right away.

However, if you have a different reason, you will have to give a 24-month notice to cancel.

Yearly Cashback

Feather offers yearly cashback if you don’t make any claim during a calendar year.

How does this work?

Well, first of all, there is a guaranteed cashback of €1200 per year.

You will automatically receive a monthly cashback of €100 to your bank account.

However, you will have to use this amount first in the event of a claim (just like a deductible).

If you make less than €1200 worth of claims in a year, you get to keep the difference.

On top of this, you will get an additional reward of €296 and €450 (respectively) based on whether you have a Standard or Premium subscription.

So, for the first year, you get a potential yearly cashback of €1496 and €1650 on the Standard and Premium plans, respectively.

Plus, these rewards or bonuses keep increasing every year up to a period of five years.

User Experience & Customer Support

Feather insurance offers a seamless user experience, especially for English-speaking expats in Germany. First of all, all the information on the website is available in English.

Secondly, the fully digital sign-up process, accessible via a user-friendly mobile app, eliminates the hassle of paperwork and makes enrollment a breeze.

Plus, they have amazing customer support, with the option for individual assistance via chat or video call for any questions or concerns related to:

- Your coverage

- Claims process

- Payment issues

- Adding family members

- Insurance documents

- Cancellation

- And anything you need help with

Limitations

Well, the percentage limits of all services/treatments have already been shared under the heading, Coverage Details.

For dental treatments, these are the annual limits.

- On the Standard plan, the limits are:

€500, €1000, €1500, €2000, and €4000 in the first five years. Then a flat limit of €4000 per year after that time.

- On the Premium plan, the limits are:

€1500, €3000, €4500, and €6000 in the first four years. Then, there’s no limit per year after that time.

Eligibility

Your eligibility for Feather’s private health insurance depends on your income and health.

The minimum income threshold depends on your occupation.

As an employed person, you need to earn more than €66,600, while as a self-employed individual, you can sign up with as low as €30,000 per year.

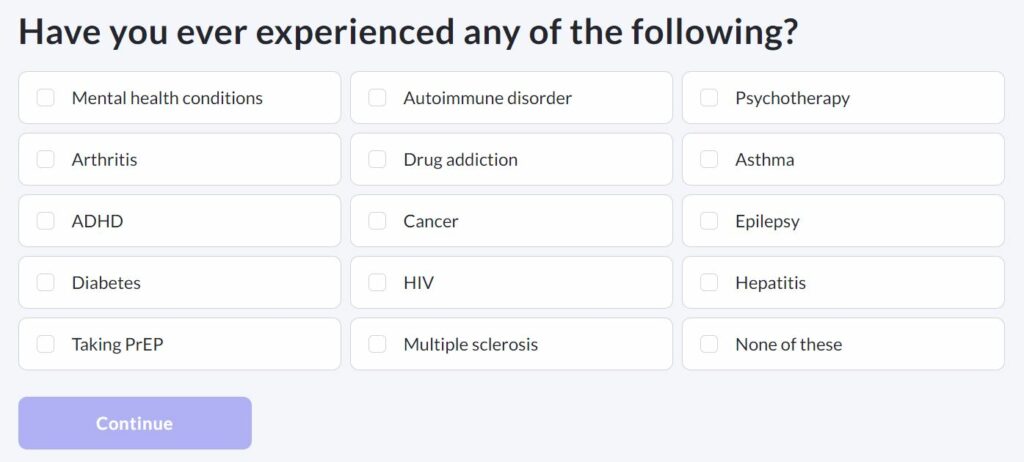

On the health side, the company will look at your medical history for any pre-existing conditions.

If you have any of the following conditions, you won’t be allowed to buy private health insurance:

Verdict

Feather Health Insurance proves to be a valuable option for English-speaking expats in Germany, offering a range of benefits.

The fully digital sign-up process and English-language support streamline the insurance experience, catering to those who seek ease and clarity in their interactions.

The absence of a mandatory deductible and the enticing yearly cashback scheme make Feather an attractive choice, particularly for individuals who prefer financial predictability and appreciate rewards for maintaining good health.

Moreover, The option for global coverage, including repatriation costs, caters to the needs of frequent travelers or those temporarily residing outside Germany.

However, it’s essential to consider the limitations of dental coverage, which might not fully satisfy individuals with extensive dental needs.

Also, Feather’s two-year contract requirement might not align with the plans of expats intending shorter stays.

Plus, individuals with pre-existing medical conditions may encounter challenges when seeking coverage, which is an important factor to consider for those with complex health histories.