Are you an expat living in Germany (or thinking about moving) and confused by the intricacies of the German health insurance system? You’re not alone.

Navigating health insurance in a foreign country can be challenging, especially if you don’t speak the language fluently.

In this comprehensive guide, we will walk you through the differences between private and public health insurance in Germany, offering you insights that will help you make an informed decision about which option is the best for you.

We’ll take a look at the costs, eligibility, coverage, benefits, and disadvantages of both public and private health insurance while answering a few important questions.

Quick Summary

- Public health insurance is mandatory for most residents in Germany, offering standard coverage for everyone, including people with pre-existing conditions, and protection for children and spouses.

- Private health insurance provides shorter wait times and customization options but can be expensive as you age.

- Eligibility for private insurance depends on factors like income (above 66,600€/year), age, employment, and health status.

- Switching from private to public insurance can be challenging and sometimes impossible, especially for older people, making initial choices critical for long-term coverage.

We cover in this article:

Understanding Health Insurance (Krankenversicherung) in Germany

Since the health insurance reform of 2007, every German resident is obligated by law to have health insurance (there’s a penalty fee if you’re not adequately covered). Plus, it’s a requirement for obtaining your residence permit.

You have two main choices for German health insurance: Public Health Insurance (Gesetzliche Krankenversicherung, GKV) and Private Health Insurance (Private Krankenversicherung, PKV).

The majority of Germans are insured by Public Health Insurance (around 89%). Only around 11% of German residents have Private Health Insurance.

Depending on your specific situation, you may be able to choose between both options or not.

Compulsory health insurance, also known as pflichtversichert, means you must have public health insurance.

Voluntary health insurance, also known as freiwillig versichert, means you can choose between public and private health insurance.

Your health insurance options will depend on your occupation and income.

If you’re employed, it will depend on the following:

- If you earn less than 66,600€ a year – you can only choose public health insurance.

- If you earn more than 66,600 a year – you can choose between public and private insurance.

- If you are a civil servant or a doctor – you can choose between public or private insurance.

If you’re self-employed, unemployed, or a student, you can choose between public and private health insurance.

If you’re a stay-at-home spouse you can choose between both insurances, and if your spouse is insured by public health insurance, you can join for free (familienversichert).

Public Health Insurance (Gesetzliche Krankenversicherung, GKV) in Germany

Public health insurance in Germany, also called statutory health insurance, is regulated by the German government and is mandatory for the majority of Germans.

Most of the employed population has a gross income of less than 66,600€ a year, so they have to be covered by public insurance.

Once you’re insured by public health insurance, you’re given a card that you have to provide to the clinic or hospital. With this card, your bill will be automatically covered by your public health insurance.

With statutory health insurance, you are automatically also insured for long-term care (Pflegeversicherung).

Cost

For both compulsorily insured and voluntarily insured members, contributions for public health insurance are made on incomes up to 4,987.50€ per month or 59,850€ per year (as of 2023). If you earn more than this, you don’t have to contribute more.

The general health insurance contribution rate stipulated by law is 14.6% of your income across all public health insurance funds.

Your employer covers half of this percentage.

There’s a reduced contribution rate of 14% for people who are not entitled to sick pay.

In addition, the health insurance companies can charge an additional contribution. This statutory average additional contribution rate is, on average, 1.6% (as of 2023).

It is not mandatory, but there is currently no statutory health insurance company in Germany without an additional contribution.

The nursing care insurance cost is 3.05% of your gross income if you have children and 3.3% if you don’t have children. Employers also pay half of this contribution.

Depending on whether you’re employed, self-employed, or a student, the public health insurance cost can range from 100€ to 925€ a month.

Employed people generally pay a maximum of around 470€. If you’re a trainee, you pay the same as other employees, however, there’s no minimum contribution. Trainees who make less than 325€ per month don’t have to contribute.

Self-employed people have to pay all health insurance contributions themselves. The maximum contribution for the self-employed in 2023 is around 800€ plus around 170 euros for long-term care insurance.

Self-employed people who make less than 1,131.67€/month pay around 220€ monthly for health insurance.

If you’re a student, and depending on your age, you can benefit from a reduced tariff, which is around 110€ per month. This applies to students who are aged up to 29 years old.

If you’re under 25 years old and your parents are insured through the public system, you can get insured through them for free. However, if you are a student with a job that pays over 520€/month, you have to get insurance yourself and pay the reduced student rate.

If you’re a student between 25 and 29 years old, you pay the reduced rate. If you make less than 485€ a month and have a spouse who is covered, you can get insured for free.

If you’re 30 years old or above, you can no longer benefit from the reduced student rate. In this case, you’ll pay the minimum rate of around 180€.

Benefits

The Public Health Insurance system presents several advantages that you should take into consideration.

- Free co-insurance for spouses and children – This is called Familienversicherung. Your children are covered until they are 23 years old, or 25 if they’re still students. Your spouse can also join if they are unemployed or earning below 485€ per month. In the private system, you have to pay for each, so it becomes more expensive.

- Affordable contributions for low-earners and students – Public health insurance contributions are income-dependent, which means that if you’re a student or earning a low income, you can benefit from more affordable contributions.

- No health check – unlike private health insurance, the public health insurance system accepts everyone whether you have pre-existing conditions or not.

- No obligation to pay contributions in the event of prolonged illness – if you’re dealing with a prolonged illness or incapacity to work, public health insurance companies don’t ask you to contribute during this period.

- Easy to use – When visiting doctors or hospitals, the costs are usually billed directly to your insurance provider. This simplifies the process and reduces the administrative burden on patients. Private insurance involves more paperwork.

Disadvantages

Statutory health insurance has a few downsides that are also important to keep in mind.

- Can be expensive if you’re single with a high income – you may have to pay the maximum rate of the GKV. In this situation, it may be more compensatory to get private insurance.

- Longer waiting times for doctor appointments – Due to the high demand for services within the system and some doctors preferring to take patients with private insurance, it may take some time to secure an appointment.

- Standard benefits for medical care – there are no luxuries in the public system. You have to pay the extra cost if you want more advanced treatments.

- No customization of your health insurance coverage – public health insurance plans are standardized and offer limited room for individual customization.

- Limited protection abroad – Statutory health insurance companies pay fixed standard rates for medical care. If treatment abroad is more expensive you have to pay the difference. Plus, outside of Europe, you’ll likely have no protection.

Coverage

Public health insurance in Germany covers all necessary medical care.

The range of services provided by statutory health insurance companies is regulated in Book V of the Social Security Code. These include early detection and treatment of illnesses, medical rehabilitation, and sick pay.

Let’s take a closer look at what is covered.

- Doctors’ fees – total coverage for approved services;

- Medication – only for prescribed medication. Some medications have a deductible of 5€ to 10€ per pack.

- Therapeutic treatments – treatments such as physiotherapy, speech, and occupational therapy are covered at 90% for people over 18 years old.

- Preventive examinations – for the early detection of cardiovascular diseases, kidney diseases, diabetes, and certain types of cancer.

- Inpatient care – hospital accommodations (typically in shared rooms), doctors’ fees, and hospice care are covered.

- Psychotherapy – Up to 300 sessions per treatment.

- Dental care – standard medically necessary care without any special extras (routine check-ups, dental cleanings, basic fillings, wisdom tooth removal).

Public health insurance providers typically don’t cover more sophisticated dental treatments and materials. Glasses for adults and contact lenses are also rarely covered.

Which Public Health Insurance Should I Choose?

There are 97 public insurance companies in Germany and the difference between all of them is not too significant.

The coverage and costs are regulated by the government, so the only differences you can find between statutory health insurers are the extra contribution rate and their customer service.

Techniker Krankenkasse is the biggest public health insurance provider and offers customer service in English.

Other public insurance providers offering English support are Barmer, AOK, and DAK.

Private Health Insurance (Private Krankenversicherung, PKV) in Germany

Private health insurance in Germany, also known as Private Krankenversicherung (PKV), is used by around 11% of German residents and is offered by a German or international insurance company.

There are around 50 private health insurance companies in Germany to choose from.

As with other private health insurance policies, PKV has the big advantage of offering freedom of contract.

However, as stated earlier, only certain people can choose private health insurance, namely employees who earn more than 66,600€/year, self-employed people, students, civil servants, and doctors.

The costs will also vary according to your age and health condition.

Private health insurance providers can reject your application if you have any pre-existing or chronic conditions. Older people will have to pay more.

Cost

The cost of private health insurance in Germany will depend on a few factors:

- Your age – Anyone who joins private health insurance at a young age often benefits from lower premium costs. The reason for this is usually better health and the longer savings phase for retirement provisions. It’s recommended that people who want to change to the private health scheme, do it before the age of 45.

- Your health status – private health insurers will always do a risk assessment, where you have to answer questions related to your health. The better the state of your health, the lower the premiums.

- Coverage level – can choose between tariffs with different service levels. The higher the insurance benefits, the higher the privately insured persons pay.

- Deductibles – the deductible is the amount you choose to pay for your medical bills before the private health insurance covers the rest. Typically you can choose between 0 to 1000€. The higher the deductible, the lower your premium is going to be.

The costs of private health insurance in Germany generally vary between 150€ and 1500€.

If you’re a healthy 35-year-old, you can expect to pay around 300€ to 500€ a month.

If you’re employed, your employer will still cover 50% of the cost, but only up to the maximum amount covered if you were publicly insured.

If you are self-employed or a student you have to bear the costs by yourself.

Benefits

Let’s take a look at the main advantages of the private health insurance system.

- Shorter waiting times – there tends to be preferential treatment compared to those who have public insurance, so you usually wait less time for a doctor’s appointment.

- Customized coverage – private health insurance allows you to choose and tailor your coverage according to your needs and preferences. If you want wider coverage with higher benefits, you can choose it.

- Affordable base tariffs – if you’re a young, healthy professional, you’ll likely find a cheaper plan compared with those from public health insurers. With private insurance, your premium is income-independent.

- Deductibles – you can choose a deductible and reduce your premium cost.

- Worldwide coverage – many private health insurers protect you abroad if you have an emergency and need medical treatment.

- No claim-bonus – private health insurance companies usually reduce your premium if you’re not going to the doctor, allowing you to save money.

Disadvantages

Unfortunately, private health insurance comes with a few downsides as well. Let’s take a look.

- No free coverage for family members – unlike the public health insurance scheme, with private insurance each family member has to pay their own contribution.

- It gets expensive as you age – when you’re older, you have to pay higher premiums. That’s why your private health insurance provider saves a part of your payments when you’re younger to help cover the costs later on.

- It’s expensive if you have a pre-existing condition – private insurance can reject you if you have a serious health condition. If they do accept you, they will charge a much higher premium.

- It can be challenging switching to public insurance – in the German health insurance system this process is complex and is subjected to specific conditions and regulations.

- More paperwork – private health insurance is not as straightforward in how it’s processed as public insurance, because you have to pay the bill first and then submit the bill to be reimbursed.

Eligibility

You can choose to have private health insurance if you are in one of these situations:

- If you are an employee and earn an income of more than 66,600€/year (before taxes). Your employer pays half of the insurance cost.

- If you are self-employed or a freelancer, regardless of your income level

- If you are a student, a doctor, or a civil servant

- Family members of privately insured people. This included unemployed spouses and children.

Important

Even if you meet these criteria, a private health insurance company can reject you if you have pre-existing illnesses.

Coverage

With private health insurance, your coverage will depend on the tariff you choose and the level of coverage it has.

In general, the higher the monthly premium, the wider the scope of services of your private health insurance plan.

You can expect the same services provided by the statutory health coverage, plus several extra services that you can add.

With private health insurance, you can have additional services like more advanced dental care (dentures and orthodontic treatment), eyeglasses, laser eye surgery, a single or double room in hospitals, and treatments provided by alternative practitioners.

Private health insurance in Germany also has the advantage of covering you all throughout Europe, and even worldwide, often with unlimited health insurance coverage.

German health insurance is, in general, quite robust, so you can expect good coverage and tailored options for your needs and preferences, depending on your private health insurance policy.

Which Private Health Insurance Should I Choose?

When deciding to join private health insurance, it’s crucial that you look at the options available, the conditions and services offered, and what best fits your needs.

The best health insurance option in the private system will really depend on your specific situation.

There are several German health insurance providers you can choose from. As an expat, there are a few private insurance companies that offer services in English.

Ottonova is a private health insurance company that offers 100% digital and English-speaking services. They offer affordable tariffs for employees, the self-employed, and students. They even have an expat health insurance tariff.

Getsafe and Feather are other options that offer private health insurance with English support.

Allianz is another popular German health insurance company offering comprehensive private health insurance.

It’s advised that you contact a health insurance broker who can help you find the best option for you.

Can I Switch From Private To Public Health Insurance?

The German health insurance system can make switching from private to public health insurance a difficult process.

Generally, it’s only possible to leave the private health insurance system if you lose your job or if your yearly income goes below 66,600€.

If you’re self-employed, only if you become employed and earn less than 66,600€ a year.

If you’re over the age of 55, it becomes almost impossible to switch back to public health insurance in Germany.

The aim is to prevent citizens from benefiting from the low premiums of private health insurance at a young age and then benefiting from the solidarity system of statutory health insurance in old age when private health insurance becomes expensive.

The public health system would collapse.

Expat Health Insurance: Is It A Good Idea?

Expat health insurance is temporary health insurance for people who are moving to Germany.

You can generally use it for a maximum of 5 years and companies offer it at affordable prices. However, don’t expect a very wide coverage.

This insurance can be beneficial as a temporary solution when you need to get your first residence permit. However, once you need to get a renewal of your residence permit, this type of insurance will most likely not be accepted.

That is why we recommend you switch to standard public or private health insurance in Germany as soon as possible.

Important

If you stay too long with expat health insurance, you reduce your chances of being accepted by regular insurance later on.

As an alternative, make sure you also get your European Health Insurance Card.

Private Vs. Public Health Insurance in Germany

Now that you have a good idea about the insurance benefits and drawbacks of both German health insurance systems, let’s put them side by side and get a closer look at the differences.

Comparison Table

| Public Health Insurance | Private Health Insurance |

Cost | Based on income (~100€ to 925€) | Based on age and health status (~150€-1500€) |

Eligibility | Available to any legal resident | Available to employees making more than 66,000€/year, students, self-employed, civil servants, and doctors |

Billing Process | Directly billed to insurance, no upfront payment | Upfront payment and later reimbursement |

Geographical coverage | Germany and EU (basic coverage) | EU and worldwide on certain tariffs |

Coverage for Family Members | Children and spouses can be covered for free | No family coverage |

Choice of hospitals and doctors | Free choice only within public system | Free choice |

Waiting time for Appointments | Longer waiting times, sometimes several months | Short waiting times |

General Coverage | Standard | Comprehensive |

Medication | 10% co-payment for prescription medications (min. €5, max. €10), no reimbursement for over-the-counter medications | Usually full reimbursement of all medication, a deductible may apply |

Psychotherapy | Reimbursement of costs for approved therapies, max. 300 sessions, approval required | Depending on the tariff, usually limited coverage (20-30 per year) |

Hospital Accommodations | Usually shared rooms | Usually single or double rooms |

Hospital Doctor | Doctor on duty | Chief physician (doctor on duty in a few tariffs) |

Dental Care | Basic care (eg. check-ups, amalgam fillings) | Comprehensive care even for advanced treatments (50% to 100% coverage, depending on tariff) |

Eyeglasses & contact lenses | Limited coverage | Comprehensive coverage |

Alternative treatments | Limited coverage | Comprehensive coverage |

Parental leave | Freedom from contributions, special rules for voluntarily insured people | Usually no exemption from contributions |

Deductibles & no-claim bonus | Not applied | Can apply to your contract |

Real-life example

Now we want to give a real-life example of the costs of health insurance in both public and private schemes.

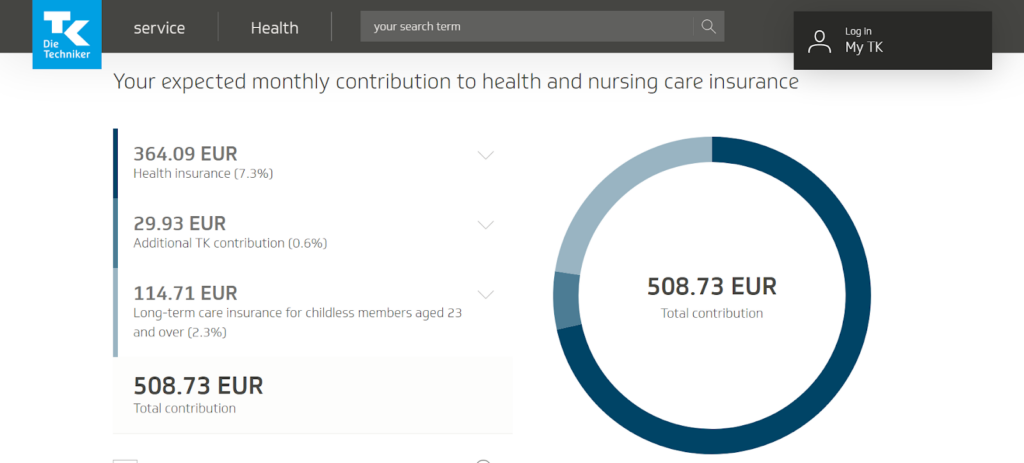

Let’s imagine you’re a 30-year-old person earning 70 000€ per year, and you choose Techniker Krankenkasse (TK) as your insurer.

As an employee, you pay 7.3% of your income, plus nursing care insurance (2.3%) and the additional TK contribution (0.6%). The total contribution for your health insurance fund is 508.73€/month.

Other public health insurers will have similar prices, although likely a bit more expensive.

With Barmer, for example, under the same conditions, you pay around 516€ and with AOK around 526€.

If you are self-employed and making the same amount of money, you would have to pay around 957.60€.

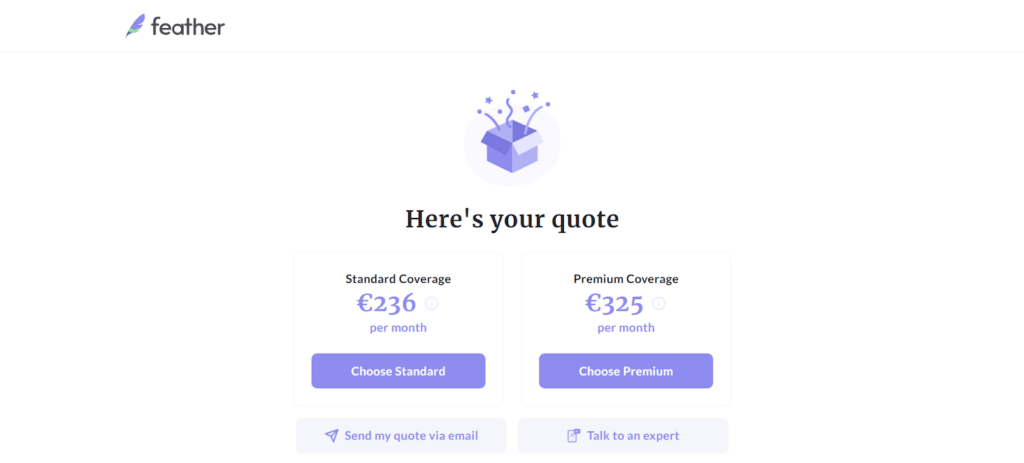

Now, for the private insurance calculation, let’s consider the same circumstances (single employee making 70000€ a year). For this example, let’s choose Feather as the insurer.

With this company, you have a monthly fee of 236€ for the standard coverage or 325€ for the premium coverage.

With other private insurers, you’ll find similar prices. Some will be slightly more expensive depending on the coverage offered.

Important

Be aware that prices will increase when you get older.

Which Health Insurance Is Better In Germany: Public Or Private?

The answer to this question will depend on your specific circumstances.

For most people, there’s not even an option. You have to get public insurance if you’re making less than 66.600€ a year.

If you make more than this amount, are a student, or are self-employed, it can be compensatory to have private insurance.

If you are young and healthy and don’t plan to retire in Germany, private health insurance is likely to be a better and more affordable option for you.

If you have a family, are older, and plan to retire in Germany, then public insurance might be the best option for you.

Always make a decision based not only on your present circumstances but also on the future ahead of you.

FAQs

Yes, expats are eligible for public health insurance.

German health insurance is linked to your employment, so you usually get it automatically if you have a job. It’s mandatory for all German residents to have health insurance.

It will depend on your specific situation, so there’s not a definitive answer.

As a freelancer, you can choose between public and private health insurance.

Yes, your spouse’s private health insurance status shouldn’t affect your eligibility for public insurance.

To be eligible to opt for private insurance, you need to have a gross income of at least 66,600€ a year.

Around 11% of Germans are covered by private health insurance.

Conclusion

German health insurance can be a tricky topic, because of all of the variables involved.

However, it’s inescapable to anyone living or wanting to live in Germany, since it’s mandatory to have health insurance for all residents and a requisite to get a residence permit.

Most people have no other option but to choose statutory health insurance.

Unless you are making more than 66,600€ a year, public insurance is mandatory. If you make more than this, are a student or a self-employed person, you can choose between public and private insurance.

The choice should always be made carefully and based on present and future circumstances.

Changing between systems can be complex and sometimes even impossible, so make sure you make the most informed decision.