American Express is a reputable credit card provider that has been paving its way in Germany for decades.

Although the usage of Amex cards in Germany has been less prevalent compared to other credit cards, the company has made an effort to refine its options.

As an expat in Germany, you may be wondering if it’s worth having one of these cards in your wallet.

In this guide, we will discuss the key features of four American Express credit cards to help you make an informed decision.

We cover in this article:

Recommendations

When choosing the ideal American Express Card for yourself, you should consider your lifestyle, spending habits, and particular interests and needs. These are our recommendations:

Quick Summary

- Best Card for Frequent Travelers (+ lovers of Exclusive Offers): American Express Platinum Card

This card stands out for the premium travel benefits, including comprehensive travel insurance and airline lounge access. There are also several exclusive offers that make this a very elite card.

- Best Card for Frequent Shoppers: PAYBACK American Express Card

This card rewards frequent shoppers with points that can be exchanged for rewards in various partner stores.

- Best Card for the Cost-Conscious: American Express Blue Card or American Express PAYBACK Card

These cards are a budget-friendly option, offering several benefits without the financial burden of annual payments.

- Best Card for People Who Value Safety + Perks: American Express Gold Card

The Gold card stands out having a nice insurance package while still offering some nice exclusive AMEX perks at a reasonable annual price.

Comparison Table

American Express Platinum Card | American Express Gold card | PAYBACK American Express card | American Express Blue Card | |

Annual Fee | 720 € | 140€ | Free | Free (Or 30€ annually if you want to access the Membership program) |

Type of Card | Charge | Charge | Charge | Charge |

Cash withdrawal fee | 4%, at least 5€ | 4%, at least 5€ | 4%, at least 5€ | 4%, at least 5€ |

Foreign transaction fees | 2% | 2% | 2% | 2% |

Welcome bonus | 100€ of starting credit | 72€ of starting credit | 1000 extra points | 25€ of starting credit |

Cashback Points (Rewards Program) | 1 point for every 1€ spent | 1 point for every 1€ spent | 1 point for every 3€ spent | 1 point for every 1€ spent - Optional for an extra fee |

Extra Credit | Up to 760€ credit a year for travel, shopping, and entertainment; status upgrades in hotels, airlines, and restaurants. | -- | -- | -- |

Other benefits | Access to Amex Offers and Experiences; Access to over 1,200 airport lounges worldwide | Access to Amex Offers and Experiences; Discounted priority pass | 90-day exchange policy for online and offline purchases | Access to Amex Offers and Experiences |

Travel Insurance | Very comprehensive travel insurance package | Comprehensive travel insurance package | Not included | Only transport accident insurance |

Additional cards | 1 Platinum Card as a partner card and 4 additional cards (American Express Card or Gold Card) | 1 free partner card | Free replacement card | 1 free partner card |

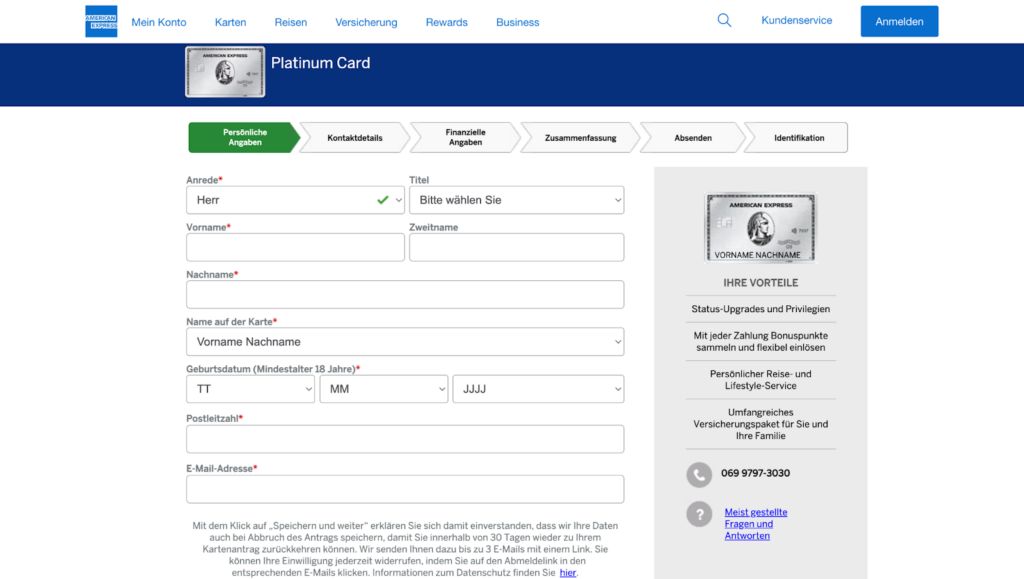

How Do You Apply For An American Express Credit Card In Germany?

To apply for an American Express credit card you need to follow these requirements:

- Be over 18 years old

- Being a resident of Germany

- Have a German bank account

- Be subjected to a Schufa check to evaluate credit history

If you fit these criteria, you can apply for an Amex card via the website.

There you can fill in an application form, where you have to provide your personal information, contact details, and financial information including income and professional status.

Finally, you will have to do online identification via video chat and later submit an identification document, which can be done online as well or offline using a POSTIDENT coupon.

As you can see, the process is quite easy.

After the application, it can take around two weeks for you to receive your credit card. The approval of your application will depend on several factors, including having a good credit score.

American Express Credit Cards Review For 2024

Compared to other credit cards in Germany, American Express cards stand out for their exclusive benefits, rewards programs, and prestige extras.

The higher-end cards also have some of the best travel insurance packages in the market.

The exceptional customer service and a centralized and easy user experience through the Amex app are also commendable.

However, you should know that all of the cards we review here have two drawbacks: the first one is that there is a 2% foreign currency fee, and the second one is a 4% fee or at least 5€ on every withdrawal, which is also unfortunate.

Unlike Mastercard or Visa, American Express cards are not accepted everywhere. If you are willing to look past these disadvantages, you will be pleased with the Amex cards’ performance overall.

Let’s take a closer look at each of the cards offered by American Express.

1. American Express Platinum Card

The Platinum card offered by American Express may be the most premium credit card in the German market. It isn’t for nothing that the annual payment for this card is a hefty 720€.

American Express Platinum Card

| Card Type | Charge |

| Annual Fee | €720 (Or €60/Month) |

| Effective Interest Rate | No interest (Payment made in full each month) Interest only applies on late payments: 5% on base rate (5% + 3.12%) |

| Domestic payments | €0 |

| Payments abroad | 2% fees |

| Domestic withdrawals | 4% fees, at least €5 |

| Foreign withdrawals | 4% fees, at least €5 |

| Limits for cash withdrawals in Germany and abroad | €1,500/Week |

| Credit Card limit | Variable, depends on creditworthiness |

| Credit Score Check | Yes |

| Additional Card | 1 Platinum Card as a partner card and 4 additional cards (American Express Card or Gold Card) |

| Google & Apple pay | Yes |

Wide range of benefits worth 760€ a year (Travel, shopping, entertainment, and events).

Very comprehensive travel insurance package.

Exclusive access to airport lounges worldwide (With a companion).

Status upgrade in hotels, airlines, restaurants, etc.

Free partner cards.

You earn points for every purchase.

24-hour telephone support.

Google & Apple Pay.

Higher annual fee of 720€.

2% fee on foreign currencies.

4% fee on all withdrawals.

Not all stores accept American Express.

- Very comprehensive travel insurance (You can find details here, unfortunately only in German).

- 200€ travel credit a year for flights, hotel stays, and booking rental cars.

- 200€ SIXT ride travel credit a year.

- 150€ a year for partner restaurants.

- 10€ a month for streaming services (Amazon Prime, Kindle, Audible, etc).

- 90€ shopping credit a year for MR PORTER or NET-A-PORTER.

- Access to over 1,200 airport lounges worldwide (And you can bring a companion).

- Valet parking and car rental valet service.

- Status upgrade in partner airlines, hotels, restaurants, etc.

- Free access to Rewards Program (Cardholders earn points for every purchase they make. 1 euro spent = 1 point, which can be exchanged for rewards).

- Access to Amex Experiences.

- 90-day return policy and protection for your purchases.

- 100€ starting credit.

- Free additional cards.

- Premium look (Made with metal).

For anyone who loves to travel frequently and comfortably, and enjoys extra perks in everyday life, this Platinum Card brings many benefits.

There is an annual total of 760€ worth of benefits, from travel to entertainment, as well as access to a large number of airport lounges worldwide. If you maximize the benefits, it can ultimately help you save some money.

Amex Platinum Card also offers a very comprehensive travel insurance package (Probably the most complete in the market), making it a great luxury travel card.

It includes the following:

- International travel health insurance

- Travel cancellation insurance

- Trip interruption and trip interruption insurance

- Luggage insurance

- Travel accident insurance

- Travel comfort insurance in the event of flight/luggage delays

- Travel personal liability insurance

- Rental car liability insurance and vehicle assistance

2. American Express Gold Card

At 140€ a year, the American Express Gold Card’s benefits are a bit more limited compared to the Platinum card, but there are still important perks to consider.

American Express Gold Card

| Card Type | Charge |

| Annual Fee | €140 (Or €12/Month) |

| Effective Interest Rate | No interest (Payment made in full each month). Interest only applies on late payments: 5% on base rate (5% + 3.12%) |

| Domestic payments | €0 |

| Payments abroad | 2% |

| Domestic withdrawals | 4%, at least €5 |

| Foreign withdrawals | 4%, at least €5 |

| Limits for cash withdrawals in Germany and abroad | €1,500/Week |

| Credit Card limit | Variable, depends on creditworthiness |

| Credit Score Check | Yes |

| Additional Card | 1 free partner card |

| Google & Apple pay | Yes |

Comprehensive travel insurance package.

Access to Membership Rewards Programs.

Discounts on rental cars.

Discount on Priority Pass for airline lounges.

72€ credit as a welcome bonus.

90-day return policy on purchase.

24-hour telephone support

Google & Apple Pay.

Annual charge of 140€.

2% charge on foreign currencies.

4% charge on all withdrawals.

Not all stores accept American Express.

- Comprehensive traveling insurance.

- Access to Membership Rewards Programs (Earn one point for every euro you spend in the supermarket, shopping online, etc, and change it for rewards in partner stores (statement credits, vouchers, trips, donations, etc).

- Up to 35% discount on Priority Pass for airport lounges.

- Discounts and upgrades on rental cars from selected partners.

- 72€ credit as a welcome bonus.

- 90-day return policy on purchase.

- 1 free partner card.

This card offers nice travel insurance that includes:

- Travel cancellation insurance

- Travel comfort insurance in the event of flight or luggage delays

- Europe-wide vehicle protection letter in the event of breakdowns at home and abroad

- Transport accident insurance

- International travel health insurance for medical assistance abroad

Amex Gold Card also offers a 90-day return policy on purchases, a 72€ credit as a welcome bonus, access to membership rewards, a Priority Pass at discounted rates, and 1 free partner card.

Like with the other AMEX cards, the disadvantage lies in the withdrawal and foreign currency charges.

3. PAYBACK American Express Card

The PAYBACK card is a free credit card with no annual fees, making it a great option for anyone who wants to save money. It does not include insurance for traveling.

PAYBACK American Express Card

Annual Fee

€0.00

Eff. Interest Rate

0%

Welcome bonus

Up to 4,000 Extra Points

| Card Type | Charge |

| Annual Fee | Free |

| Effective Interest Rate | No interest (Payment made in full each month). Interest only applies on late payments: 5% on base rate (5% + 3.12%) |

| Domestic payments | €0 |

| Payments abroad | 2% |

| Domestic withdrawals | 4%, at least €5 |

| Foreign withdrawals | 4%, at least €5 |

| Limits for cash withdrawals in Germany and abroad | €750/Week |

| Credit Card limit | Variable, depends on creditworthiness |

| Credit Score Check | Yes |

| Additional Card | Free replacement card |

| Google & Apple pay | Yes |

No annual payment.

2,000 points for new customers.

1 point for every 3€ spent.

90-day return policy on purchases with the card above €30*.

24-hour telephone support.

Google & Apple Pay

* New, undamaged purchases only for personal use, from a store (online or physical) with a German address.

No travel insurance.

2% fees on foreign currency transactions.

4% fees on all withdrawals.

Not accepted in all stores.

- 1000 bonus points for new customers.

- Extended 90-day exchange policy for online and offline purchases (A maximum of €300 per item and €1,200 per year can be refunded).

- Payback points can be exchanged for award miles on the flyer program Miles & More.

The PAYBACK card has the benefit of giving cardholders points every time they make a payment. For every 3€ you spend on your everyday purchases (including online purchases), you gain a point.

These payback points can then be exchanged for rewards through the PAYBACK rewards store.

You can use the Payback App to cash out your points. When you receive your PAYBACK card, you will get 2,000 points credited within 4 to 6 weeks.

Like with the other cards, the Payback card has no annual interest rates since you must repay your debts every month, which will be deducted from your linked bank account. You just have to be careful with late payments.

4. American Express Blue Card

AMEX Blue offers you zero annual payments, a 25€ starting credit, and comes with an additional credit card. It also includes transport accident insurance.

American Express Blue Card

| Card Type | Charge |

| Annual Fee | Free |

| Effective Interest Rate | No interest (Payment made in full each month). Interest only applies on late payments: 5% on base rate (5% + 3.12%) |

| Domestic payments | €0 |

| Payments abroad | 2% |

| Domestic withdrawals | 4%, at least €5 |

| Foreign withdrawals | 4%, at least €5 |

| Limits for cash withdrawals in Germany and abroad | €750/Week |

| Credit Card limit | Variable, depends on creditworthiness |

| Credit Score Check | Yes |

| Additional Card | 1 Additional card |

| Google & Apple pay | Yes |

No annual payment.

Transport accident included.

Entry to rewards programs.

25€ credit as a welcome gift,

24-hour telephone support.

Google & Apple Pay.

No travel insurance.

2% charge on foreign currency transactions.

4% charge on all withdrawals.

Not accepted in all stores.

Rewards program is subject to a cost (30€ annual fee).

- 25€ welcome credit.

- American Express Membership program with 5000 points upon registration (30€ annually).

- American Express Offers and American Express Experiences.

- Transport accident insurance.

With this card, you can participate in the Membership Rewards program, where you receive 5000 points for the activation which can be exchanged for purchases from many shops. It is not free of charge, as you have to pay 30€ annually, but it is optional.

Cardholders also have access to the American Express Offers program, where you get cashback rewards from stores, as well as American Experiences.

Unfortunately, AMEX Blue does not include travel insurance.

Is It Worth It To Have An American Express Credit Card In Germany?

As we’ve seen, having an American Express card brings several advantages, especially if you enjoy having extra perks in everyday life. The wide range of benefits, such as rewards programs and comprehensive insurance, makes having one of these cards worth it.

However, you should know that American Express cards are not accepted everywhere usually because of higher merchant fees.

Some places, especially smaller local businesses, only accept Mastercard or Visa cards (and some only accept debit cards). Larger businesses often accept Amex credit cards.

Still, we believe it can still be worth having an Amex card for the benefits, especially for people who make transactions in the Eurozone and can use another card for free withdrawals.

FAQs

Amex cards have many acceptance points in Germany.

Although not widely accepted as other brands, you can still use it in many places, especially larger businesses.

There isn’t one definitive answer to this question, as it will depend on your individual interests and lifestyle.

Still, the free Payback Amex card is a great option for everyday use, as you earn points when you pay, and you have no annual fees.

If you are a frequent traveler and want to enjoy a card full of perks, then the best card for you is the Amex Platinum Card.

The Membership Rewards program is a points system, where you gain points for every purchase you make, starting from 1€.

These points can then be exchanged for rewards, such as travel, shopping, or donations.

Depending on the card, you can have comprehensive travel insurance, entrance to airline lounges, and discounts on trips and hotels.

Conclusion

Finding the best American Express credit card for yourself will depend on your lifestyle, spending habits, and the benefits you value.

Whether you prioritize travel perks, shopping rewards, or low annual fees, American Express has a card to suit your needs.

If you can look past some of the drawbacks (charges on foreign currency transactions and withdrawals, and a lower acceptance rate in Germany), you will likely be satisfied with the performance of these cards.

Hopefully, this guide gave you the insights that help you make an informed decision.