If you are an expat or a digital nomad, you are probably looking for a bank that seamlessly integrates with your mobile lifestyle, offering you convenient, innovative, and flexible features.

N26 and Bunq are two digital banks challenging traditional banking services with their disruptive mobile experience.

Both fintechs offer attractive features and similar benefits, but how do they really compare, and which bank stands out?

In this article, we will dissect both banks’ unique features, benefits, and fees, revealing their strengths and weaknesses to help make the best-informed decision for yourself.

Bunq Vs. N26 Germany Comparison Table

Let’s briefly compare the key components of N26 Bank and Bunq Bank.

N26 Bank | Bunq Bank | |

Subscription options available | 4 | 4 |

Fully licensed as a bank | Yes | Yes |

Monthly fees | From 0€ to 16.90€ | From 0€ to 17.99€ (the free account is only for savings) |

International payments | Free | 0.5% - 2% of the amount paid |

Cash withdrawals | Starting at 3 free withdrawals (2€ after that) | 1.70% abroad | Starting at 0.99€ for the first 5 withdrawals (2.99€ thereafter) |

German IBAN | Yes | Yes |

Investment options | Crypto trading | Investment in sustainable companies |

Customer support | In-app chat | In-app chat |

Overdraft option | Yes | ✘ |

<18 accounts | ✘ | Yes |

Travel Insurance | Yes, in premium plans | ✘ |

Trustpilot rating | 3.7 | 3.5 |

Dimension | 8 million users | 9 million users |

Bunq Vs. N26 Detailed Comparison In 2024

Let’s take a look now at the key features of both online banks, where we will highlight differences and similarities, and showcase unique aspects about their services.

Bunq is a Dutch online bank founded in 2012 (but only launched to the public in 2015) by serial entrepreneur Ali Niknam, with a team of other programmers.

The Dutch digital bank operates under a full European banking license given by the Dutch Central Bank.

The Dutch bank offers a user-friendly app full of useful features and no hidden fees, making online banking easy and accessible to everyone.

One of Bunq’s unique selling points is the sustainable approach that can appeal to eco-conscious customers.

N26 is a German fintech founded in Berlin in 2013 by Valentin Stalf and Maximilian Tayenthal. It is the first 100% mobile bank to have been granted a full German banking license from BaFin.

N26 is known to be a well-rounded, low-cost online bank for all your everyday banking needs.

With free payments worldwide, the German bank stands out as a great option for travelers or if you live abroad. Unlike Bunq, it also offers personal loans and overdrafts.

Although neither Bunq nor N26 offers multi-currency accounts, both integrate Wise within their apps, allowing you to send money in around 40 currencies at very competitive exchange rates.

Subscription Options

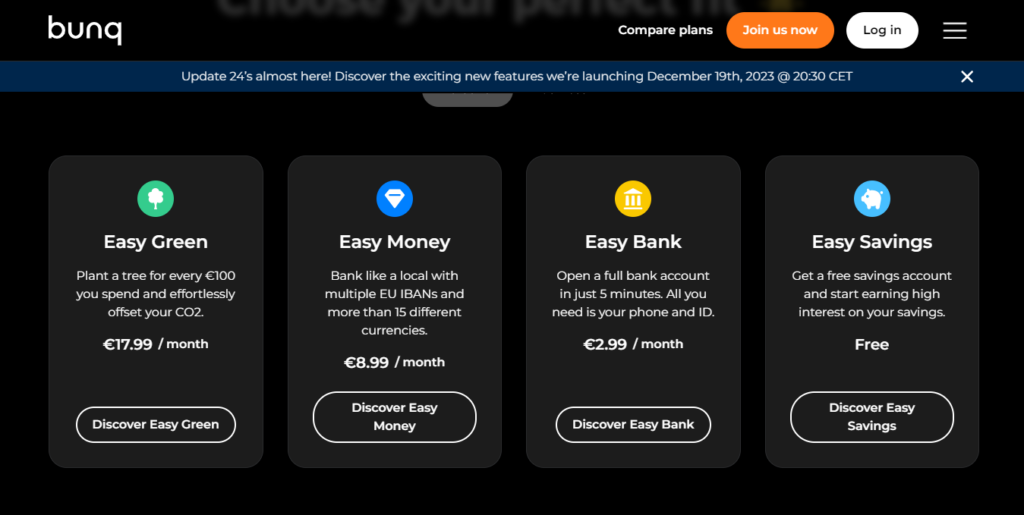

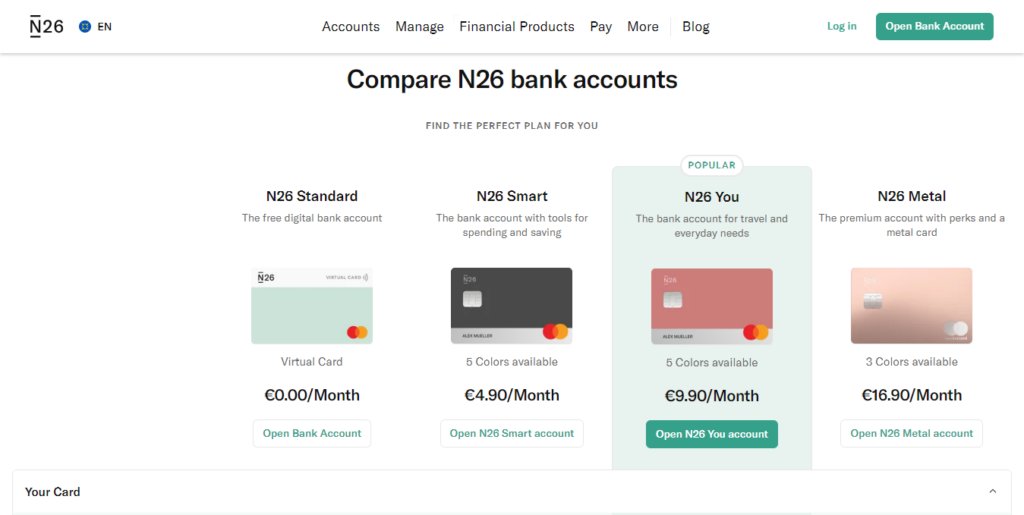

Both N26 and Bunq offer 4 subscription plans but with one big difference.

While N26 has a free plan, which includes a virtual card that you can use for your basic banking needs, Bunq’s only free plan is not a true bank account that you can use every day.

It is simply a savings account, and there is no card associated with it.

Let´s take a look at the free plans and premium accounts from both fintechs.

• Bunq Bank

Easy Savings | Easy Bank | Easy Money | Easy Green |

Free | 2.99€/month | 8.99€/month | 17.99€/month |

• Just a savings account | • Includes 1 virtual card but no physical card | • The same benefits of Easy Bank + • 3 physical cards | • The same benefits of Easy Money + • 1 tree planted for every 100€ spent |

• N26 Bank

N26 Standard | N26 Smart | N26 You | N26 Metal |

Free | 4.90€/month | 9.90€/month | 16.90€/month |

• Virtual debit card and optional physical card for 10€ | • The same benefits of N26 Standard + • 5 free domestic withdrawals per month | • The same benefits of N26 Smart + • Unlimited free withdrawals abroad | • The same benefits of N26 You + • 8 free domestic withdrawals |

As you can see, both banks have similarities in their subscription plans.

One of the main differences is the fact that N26 offers travel insurance in the higher-end plans, while Bunq does not.

Bunq also doesn’t have a plan with free withdrawals.

On the other hand, the premium plans offer you 25 subaccounts with their own IBAN, which can help manage your money.

There is also a difference when it comes to cash withdrawals. Bunq offers no free cash withdrawals on the Easy bank plan, while N26 Smart offers 5 free withdrawals.

Both Bunq and N26 also offer business plans.

While N26 is for freelancers and not businesses, Bunq’s business accounts are for people with a registered company.

N26 offers the extra benefit of having cashback every month on all card purchases of 0.1%, and Bunq has a feature called AutoVAT where the Bunq app automatically calculates and sets aside on a savings account the VAT on all your incoming and outgoing payments.

You can also integrate your bookkeeping software with Bunq in seconds.

Fees & Charges

There are a few fees to consider for both banks, and we will take a look at the most significant ones.

We recommend you take a look at the full price list here (Bunq) and here (N26) to avoid missing any hidden costs.

In both cases, you can request and send money between N26 and Bunq clients in several countries of the world for free and instantly within the App.

a) Cash Withdrawals

With N26 Bank, if you go above the free withdrawal monthly limit (3 to 8, depending on the plan), you are charged 2€ on domestic withdrawals.

N26 withdrawals in the EU are free without limitations.

Withdrawing money from abroad in other currencies is free in the “You” and “Metal” plans, but there’s a 1,7% fee for the “Standard” and “Smart” plans.

Bunq, on the other hand, offers 6 free withdrawals per month anywhere in the world on the Easy Money and Easy Gree plans, after which you pay 0.99€ on the next 5 withdrawals (each), and 2.99€ thereafter.

In the Easy Bank plan you pay 0.99€ per withdrawal on the first 5, and 2.99€ thereafter.

b) International Payments

When it comes to N26, card payments worldwide are free in all plans, with no foreign currency surcharge (they use the Mastercard exchange rate).

Transfers within and among EEA states and Switzerland in Euro are free.

Bunq, on the other hand, charges 1.5% of the amount plus 0.5% (network fee) on the Easy Bank Plan, and 0.5% on the Easy Money and Easy Green Plans, making it a less appealing option compared to N26 for card payments outside of your country.

Both N26 and Bunq integrate a Wise account for international money transfers, so you can send and receive money with very competitive currency exchange rates within the App.

c) Incoming SWIFT Bank Transfers

When it comes to incoming SWIFT bank transfers, N26 charges 12.50€ + 0.1 % of the transaction amount (maximum fee is 100€, and transactions below 150€ are free of charge).

It doesn’t apply to Metal customers.

Bunq charges 5€ per payment up to 10,000€, 10€ between 10,000€ and 100,000€, and 25€ above 100,000€.

d) Outgoing SWIFT Bank Transfers

With N26 you are not able to do an outgoing SWIFT bank transfer, only receive.

Bunq charges you between 10€ and 45€ for an outgoing SWIFT bank transfer, depending on the amount.

e) Additional Cards

Ordering additional cards from N26 costs you 10€ per card (45€ if you order a Metal card).

Bunq charges you €9.99 to order a card plus €3.49 per month per card (the Bunq Metal card costs 89.99€).

Bank Cards

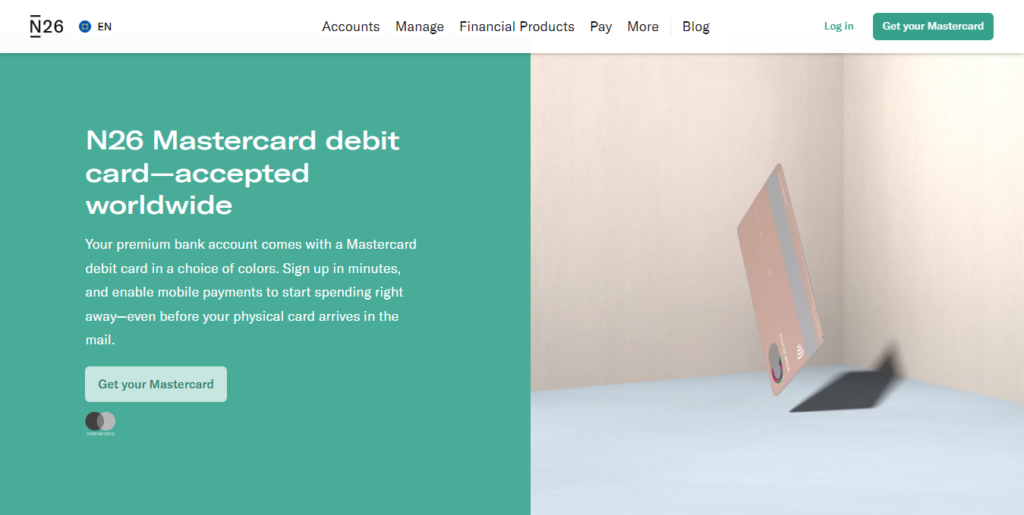

Both N26 and Bunq use Mastercards.

All cards come with contactless NFC technology, and you can conveniently link them to Apple and Google Pay.

• N26 Mastercard

If you’re a premium customer, your N26 Mastercard is included with your membership, and you can pick between 5 colors.

All N26 bank accounts come with a virtual debit card.

Residents in Germany, the Netherlands, and Austria can also order a Maestro card to accompany their primary debit Mastercard.

Unlike Bunq, N26 doesn’t currently offer credit cards.

However, you can activate an overdraft, which allows you to borrow up to 10,000€ through your checking account.

The interest rate applied to your overdraft is 8.9% above the ECB rate.

You can also get a loan through the N26 bank, between 1000€ and 25,000€, with an interest rate of 5.89% p.a.

• Bunq Mastercard

In the Easy Bank plan you have access to one physical debit card.

Easy Money and Easy Green customers have 3 physical debit cards and up to 25 virtual cards.

You can use these cards for online payments and to spend money in Europe and outside.

You can have a debit Mastercard or a Mastercard credit card, which are connected to your bank account.

Bunq’s credit card is an official credit card but it works as a prepaid card.

This means you need to add money to your Credit Mastercard before you can use it for payments.

There is no credit line, but it can be advantageous for certain payments that may not accept debit cards.

Bunq doesn’t offer overdrafts or loans.

Cashback Benefits

When it comes to cashback benefits, Bunq has the lead since N26 only offers this perk on business accounts.

On Bunq’s Easy Money and Easy Green plans you have a 1% cashback on payments with your credit or debit card in Restaurants and Bars.

With Easy Green, on top of the 1% cashback on restaurants and bars, you also have a 2% cashback on public transportation, intending to promote a greener way of transport.

N26 offers 0.1% cashback on all card payments, or 0.5% cashback for Business Metal customers, but only with a business account.

Perks & Benefits

Both banks offer strong benefits that make banking easy.

Many of these perks are similar in both banks, including:

- The Wise account integration

- “Insights” that track and categorize your spending

- Subaccounts with multiple IBANs

- Joint accounts to manage money together with other people.

In both cases, you can also send and receive money instantly between other N26 and Bunq customers, and make in-store cash deposits.

Unlike Bunq, N26 offers travel insurance in premium plans, including medical emergencies, personal liability, baggage coverage, daily insurance, travel delay and cancellation, and trip interruption.

The Metal plan also offers phone coverage and purchase protection.

The German bank also gives its customers savings accounts, where you earn interest on your savings; up to 10 sub-accounts with unique IBANs to organize and save your money; joint account with up to 9 other people; discounts on partner brands; and solutions such as overdrafts and personal loans, which Bunq doesn’t have.

N26 also offers discounts on partner brands.

Bunq, on the other hand, stands out for its eco-conscious benefits, even though it’s mostly tied to the premium Easy Green account, which plants a tree for every 100€ spent.

There is also a feature called Green Tribes which allows you to plant trees with other friends and compete with other teams.

In premium plans, Bunq allows you to hold multiple accounts with different local IBANs, supports transactions in over 15 currencies, and offers savings accounts with interest.

Unique features include Bunq.me (create your payment link with a personalized URL to share with anyone who wants to send you money), Wheel of Fortune (one spin every day for the chance to win prizes), and Places (discover all the places your friends recommended to you).

Investments

N26 has limited investment options, and at the moment they only allow you to buy and sell cryptocurrencies. There are over 180 coins available for trading.

N26 Metal customers will be able to make transactions with a 1% transaction fee applied for trading Bitcoin and 2% for all other available cryptocurrencies.

All other users have a 1.5% fee on Bitcoin and a 2.5% fee for other cryptocurrencies.

Bunq, on the other side, offers you a feature called Easy Investments, available for premium and joint users (Easy Money and Easy Green), where you can automatically invest some of your money.

You will have to choose between 3 risk levels, from lower risk and less expected return, to higher risk and higher expected return.

You can choose to add to your investments every time you pay, by having your payments round up to the nearest euro, and the spare change added to your investments portfolio.

Bunq has partnered with Birdee, an investment platform that has a focus on sustainability and a portfolio of socially responsible companies.

Mobile App

Both Bunq and N26 offer a mobile banking app for Android and iOS devices, offering a user-friendly and seamless experience in English, paired with a modern-looking interface.

You can create an account in only a few minutes and the process is very simple.

Keeping track of your finances and categorizing expenses, as well as instant push notifications for any transactions are present in both apps. You can also access Wise to transfer money easily to another country.

Sending money to other users is instant.

The N26 “Spaces” feature allows you to create virtual sub-accounts for specific savings goals, and you can also share them with other users (with a premium account). This feature helps you budget and save money.

The Bunq mobile app has similar options, where you can create multiple subaccounts, and joint and savings accounts. All features are integrated into the mobile app.

Security Features

Both finance companies put in place strong security features to protect your money. As a start, they both have deposit protection of up to 100,000€.

Both have two-factor authentication, face and fingerprint recognition, the possibility to freeze the card, change the PIN and CVC, or cancel the card with just a few taps within the app, and instant notifications.

All in all, we can say that the security features of both fintechs are equivalent.

Sometimes, anti-fraud security measures lead to blocked accounts.

Last year there were reports of several N26 accounts being wrongfully closed, and people lost access to their money. This is a potential problem that you should be aware of.

Customer Service

Customer support has mixed reviews in both banks, and it’s not the strongest aspect of either N26 or Bunq.

Some people complain about unresponsive and unhelpful support, which is not so uncommon for 100% digital banks.

You can reach one of N26’s agents through the website, or by using the chat function in the app. They are available from 7 am to 11 pm CET, every day.

You can request a call from them, but only for suspicions of fraud or account security reasons.

You can also send them an email or reach out to Neon, an automated N26 Chatbot, 24 hours a day. Unlike most German banks, the support is available in English.

Bunq has a 24/7 in-app chat where you can get assistance from guides in your local language. This is likely the fastest way to get support.

You can also contact customer support through email if you prefer to seek assistance this way.

Verdict: Which One Is Better?

Both Bunq and N26 offer exciting features and services that make banking easy to manage.

The choice of which is the best option for you will depend on your personal preferences and needs.

Bunq is a nice option if you value personalization and eco-conscious banking. You can have a large amount of subaccounts with different IBANs and several cool mobile features that help you manage and organize your money efficiently.

The possibility to invest in sustainable companies is also a plus.

Unfortunately, they don’t really offer any free accounts, the fee structure is a bit more complex, and the cheapest plan has a 2% foreign currency fee. There is also no travel protection available, as well as overdrafts or loans.

All in all, N26 has a slight edge over Bunq.

It is a better option for fee-free foreign transactions and cash withdrawals. It also offers travel insurance, which is great if you are a frequent traveler.

The option to have an overdraft or a loan can also be an advantage for some people, but the investing options are limited.

FAQs

Overall, N26 is cheaper, especially because it offers a free bank account with basic features. The fees also tend to have lower costs.

It depends on your specific needs and interests.

Bunq is better for someone who values sustainability and more advanced banking options. N26 is better for travelers and people who want low-cost everyday services.

Conclusion

Both Bunq and N26 offer competitive online services with advantageous features for expats.

While N26 stands out for fee-free foreign transactions and worldwide cash withdrawals, Bunq differentiates itself with a sustainability approach and a user-centric mobile app.

Hopefully, this article sheds some light on the biggest advantages and disadvantages of each bank to help you make an informed decision.