Are you an English-speaking expat in Germany on the lookout for an online bank that seamlessly caters to your language needs?

Well, a Vivid money account might just be what you need.

But is it a legit bank account? What does it offer? How good is it?

In this comprehensive review, we’ll delve into Vivid Bank’s pros and cons, highlighting all it has to offer. So, let’s dive in!

We cover in this article:

Vivid Bank: Key Takeaways

Quick Summary

- Vivid is an online bank (neobank) supported by Solaris SE (A reliable physical bank)

- Quick, easy sign-up with the Vivid mobile app.

- German IBAN with both Vivid Standard (free) and Vivid Prime (€9.90 per month).

- Holding money in up to 107 different currencies in 15 sub-accounts (pockets).

- Generous cashback rewards that go as high as 25%.

- Invest in stocks, ETFs, and cryptocurrencies directly from the app.

- Earn up to 5.39% on your deposits with the Interest Rate Pocket (A kind of savings sub-account)

- Free virtual credit card.

- Above all, protection up to €100,000 under the German Deposit Guarantee Scheme (DGS) – just like regular banks!

Comparison Table

Vivid Standard | Vivid Prime | |

Monthly Fee | €0 €3.90 per month if inactive | 1st month free After that €9.90 |

German Banking Account | Yes | Yes |

Pocket accounts (Sub-accounts) | 3 | 15 |

Currencies in Pocket accounts | Up to 40 | Up to 107 |

Cashback | Up to 25% Up to €20 per month (Not available on all brands) | Up to 25% Up to €100 per month |

Free First Debit Card | Yes | Yes |

Metal card with express delivery | ✘ | Yes |

Free Virtual Credit Card | ✘ €1 issuing fee | Yes (One-time) |

Local and foreign payments and transfers | Free | Free |

Live customer support chat | ✘ | Yes |

How Do You Open A Vivid Bank Account In Germany?

Since it’s a neobank (online bank), Vivid has made it really simple for users to sign up and create an account.

Here’s what you need to open a Vivid account:

- Be 18 years of age

- Valid email and phone number

- German (or European) residence permit

- Proof of identity (Passport or residence card)

If you have these things, opening a Vivid is a piece of cake. Simply download the mobile app, fill in all your details, and get a free account or buy the premium one (Vivid Prime).

Important

Depending on your nationality and country of residence, you might have to prove your identity via photo or video verification. So, keep your documents handy while applying for an account.

If things go smoothly it should just take a few minutes to open a new Vivid bank account.

Vivid Bank Germany Review For 2024

Vivid (also known as Vivid Money) is a rather new entrant in the German neobanking industry that started in 2019.

However, this all-digital platform quickly gained fame because of its convenience, investing features, and cashback programs.

When you sign up for Vivid, you get a free German bank account. But there is a paid plan as well. Let’s look at all of its features and pricing.

Plans

When opening a vivid account, you can choose one from the following two plans: Vivid Standard and Vivid Prime.

a) Vivid Standard

This is Vivid’s basic account, which is free if you’re an active user.

What’s an active user?

According to their own website, “A customer is considered an active customer if one of the conditions is met:

- At least one transaction has occurred on the card during the month

- The account balance is at least €1,000.”

If you fail to meet any of the two conditions, you will be considered inactive, and a €3.90 fee will be charged.

Important

Vivid may charge an additional fee in case of longer inactivity duration.

b) Vivid Prime

Vivid Prime is a premium account and has a monthly fee of €9.90.

Both accounts get you a German banking account and let you enjoy cashback rewards and free investment features.

However, the premium account gives you added benefits like:

- Live chat support

- Free first virtual card

- Cashback on personalized brands

- Unlimited free trades

- Metal card with express delivery

The rest of the features are almost the same, but Vivid Standard offers slightly fewer benefits than Vivid Prime.

You can refer to the overview table above for a detailed comparison.

Thankfully, you can try the Prime version for free for one month, and you won’t be charged next month without consent.

Pocket Accounts

Vivid’s sub-accounts, also known as “Pockets” or pocket accounts, are one of the most interesting and money-saving features.

These have their own SEPA-compliant IBANs that exist in your main account. Standard users get 3, while Prime users get up to 15 free sub-accounts.

Interestingly, these accounts can hold multiple currencies. You can hold up to 40 currencies in the Standard plan and up to 107 currencies in the Prime plan.

Fees & Charges

Both Vivid Standard and Prime offer free of cost:

- Local and foreign transactions

- Money transfers

- Direct debits

- ATM withdrawals (limited)

The applied limits are stated below:

Vivid Standard | Vivid Prime | |

Currency Exchange | Up to 40 currencies (At live exchange rate) | Up to 100 currencies (At live exchange rate) |

Free Cash Withdrawals | Up to €200 per month, if min. €50 withdrawn 3% After that | Up to €1,000 per month, if min. €50 withdrawn 3% After that |

Bank Cards (Debit & Credit)

Both Standard and Prime accounts allow you to get virtual and physical cards. On both accounts, you get a free Visa debit card (one-time).

However, the Prime account also gives you a free virtual credit card and allows you to order a Metal Card as well.

All of these cards work with Apple and Google Pay and let you make contactless payments worldwide.

Sadly, Vivid doesn’t offer a physical credit card.

Vivid Standard | Vivid Prime | |

Plastic or Personalized Cards | Yes | Yes |

Metal card with express delivery | ✘ | Yes |

Card issuing fees (For subsequent cards following the first free card) | €19.90 | €19.90 |

Free Virtual Credit Card | ✘ | Yes |

Virtual Card Issue Fee | €1 | 1 for free €1 after that for each card |

Virtual card usage monthly fee | Free for 1 card €0.99 for each additional card | €0 |

Cashback Benefits

Vivid has some amazing cashback rewards, especially in the Prime plan.

Each month, you can specify the industry categories for which you would like to receive cashback.

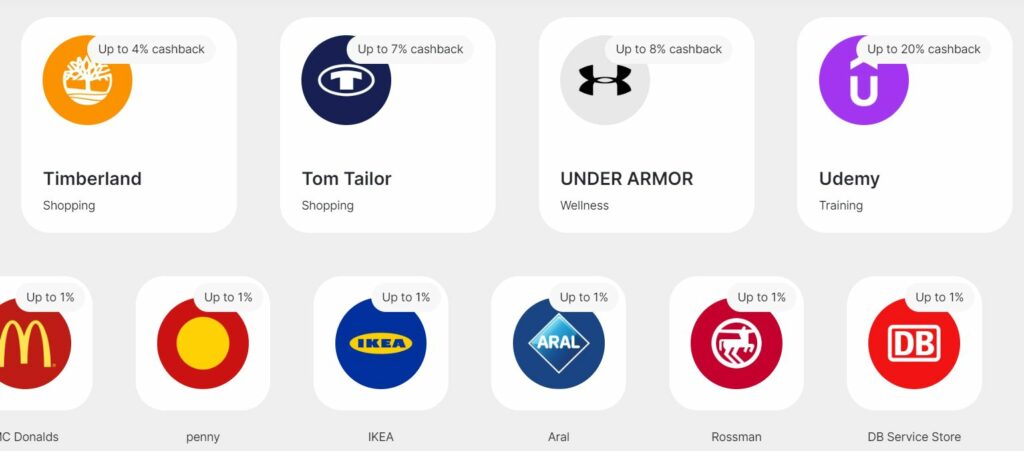

For example, you can choose from food, clothing, furniture, and others and have different percentages of cashback for each. (See the below image for an example).

With its Standard and Prime plans, you can choose up to three and four categories, respectively.

Vivid Standard | Vivid Prime | |

Cashback | 3% to 25% Up to €20 per month (Not available on all brands) | 3% to 25% Up to €100 per month |

However, there’s one catch. You will only be eligible for cashback if you have a balance of at least €1,000 or have €100 in assets or investments.

Perks & Benefits

Vivid doesn’t offer any particular travel perks, but it lets you save money on fees while traveling.

How do you do that?

Well, the trick is to store your travel spending in a separate pocket. Since you can store up to 100 currencies, you can hold the currency of your destination in a separate sub-account.

Now, when you make a payment abroad, Vivid automatically spots that currency and uses funds from that Travel Pocket, avoiding extra fees.

You don’t even have to re-link your card to that specific account – all of it is pre-programmed.

Investments

Vivid’s investment is another great functionality.

Yes – the app lets you invest in shares and ETFs. You can buy stocks of popular US and European companies and also buy cryptocurrencies, such as Bitcoin, Ethereum, and others.

The app will give you instant price alerts so you can make quick decisions.

Plus, withdrawing your profits is easy, too. You can sell and receive your profits within seconds without any fees or commissions.

And you only need €2 to start investing. Great, isn’t it?

Well, there’s more. You don’t have to pay any commission when you withdraw your profits.

On top of this, your investments are fully secured by the Dutch Investor Compensation Scheme up to €20,000.

And if you’re a beginner, Vivid has got you covered. It offers learning resources if you’re just starting out.

Vivid Standard | Vivid Prime | |

Easy-Access Crypto Investing | ||

Trades | 1.49% per trade, minimum €0.79 | Unlimited free trades |

Investing in Real Shares | ||

Instant top-up via Apple and Google Pay or cards | Free €100 monthly Fee applies after | Free €1,100 monthly Fee applies after |

Trading Fee | €1 | €1 |

FX Markup for the 1st month since Invest 2.0 Pocket opened | 0.5% | 0.25% |

FX Markup starting from the 2nd month, based on the last month’s turnover | 1.00% (Default) 0.50% (Turnover from €100) 0.25% (Turnover from €500) | 0.50% (Default) 0.25% (Turnover from €100) 0.20% (Turnover from €1,000) |

Interest Rate Pocket

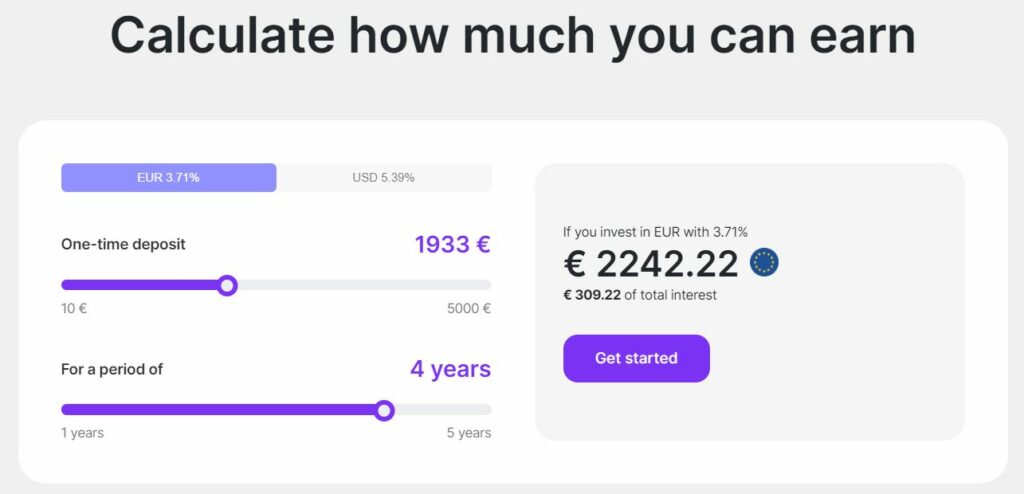

Interest Rate Pocket is Vivid’s latest offering that lets you earn money.

How does it work?

Remember the sub-accounts (pockets)? Well, there’s one for this purpose. Keep your USD and EUR funds in the Interest Rate Pocket and earn an interest rate as high as 5.39% a year on your deposits.

Returns will be added to your Interest Rate Pocket every day, and you can access them anytime.

The good thing is that you can easily calculate how much you will make with Vivid’s online calculator.

Now, that’s another way to make money using your Vivid money account.

Mobile App

Well, there’s nothing really to say about the app because it has pretty much everything!

A user-friendly interface, English language, and multiple handy features, such as:

- Instantly send, receive, or request money

- Manage virtual credit card and debit card details

- Drag-and-drop money between different pockets

- Intelligent subscription control for budgeting

- Scheduling payments in advance

- Instant notifications and spending analytics

Plus, there are other great features that enhance your overall Vivid experience.

Security Features

Vivid keeps your account safe and secure in many ways.

For instance, your physical card details (number, expiry date, and CVV) are not printed on the card. Instead, these are available inside the app, so your details are safe even if you lose the card.

Plus, you can protect your account with a PIN, face recognition, and fingerprint to level up its security.

Moreover, you can easily block/unblock your debit and credit cards if you fear your credentials have been compromised.

Besides everything above, your Vivid money account is protected up to €100,000 under the German Deposit Guarantee Scheme (DGS) – just like all regular banks!

Customer Service

Thankfully, Vivid is an all-English platform, so you don’t have to be worried about customer support language. You can reach out to Vivid representatives via their chat support feature or website form.

However, if you’re a Vivid Prime user, you can access live chat support for more swift responses.

And there’s more. Besides English, Vivid offers customer support in German, French, Spanish, and Italian.

Their support is overall good, but you might be frustrated to know there’s no option to reach support by call.

Vivid Bank Pros & Cons

Pros

English website and support.

Free trial available.

Intelligent pocket accounts to store and spend multiple currencies.

Exclusive cashback offers.

No credit history or SCHUFA check is required.

Cons

No special travel or insurance benefits (As compared to Revolut and others).

Not accessible on Laptop/PC.

FAQs

Yes. Vivid banking is safe.

You can protect your app with a PIN, face recognition, and fingerprint. Plus, you can activate or block your card instantly from the app.

Moreover, your money deposited in the account is also safe. It is protected up to an amount of 100,000 euros by the German Deposit Guarantee Scheme (DGS) via the partner solarisBank, where the account is ultimately opened.

Technically speaking, Vivid itself isn’t a bank – it’s a fintech startup, and its banking is empowered by Solaris SE (“Solaris” or “Solarisbank”), which is a fully regulated European bank authorized and supervised by the Federal Financial Supervisory Authority (BaFin).

And just like other legal banks, Vivid offers a German Deposit Guarantee to protect your money.

So, a bank or not, Vivid gets you everything you need.

Vivid is a German startup backed by Solaris Bank, which has a German banking license. So, it’s not technically a German bank, but it does give you a German IBAN.

Vivid uses Solaris Bank as its banking partner. Any IBAN and debit or credit card that can be accessed via the Vivid App is, in fact, provided by Solaris SE.