Germans often opt for supplemental dental insurance (Zahnzusatzversicherung) alongside their public health coverage to dodge those hefty out-of-pocket expenses.

We’re talking about crowns, root canals, dental cleaning, implants, and others. General health insurance doesn’t cover those completely.

If you’re trying to do the same, you’re in the right place.

In this best dental insurance Germany guide, we’ll walk you through the top four reliable options so you can enjoy those treatments without breaking the bank.

So, let’s dive right in.

We cover in this article:

Comparison Table

Ottonova | Feather | Getsafe | Barmenia | |

Insurance Plans | 3 | 2 | 1 | 5 |

Coverage | Immediate (No waiting time) | Immediate (No waiting time) | Immediate (No waiting time) | Immediate (No waiting time) |

English Customer Support | Yes | Yes | Yes | Not mentioned |

ReimbursementTime | Within 48 Hours | 2 to 6 Weeks | Within 48 Hours | -- |

Mobile App | Yes | No | Yes | No |

Cancellation Period | Monthly ** After 2 years | Monthly ** After 2 years | Monthly ** After 2 years | Daily ** After 1 year |

Monthly Price | €8.8 €9.81 €15.42 | €10.9 €16.1 | €9.62 | €4.6 €7.1 €9.5 €10.9 €9 |

Which Dental Health Insurance Is Right For You?

The right dental health insurance depends on your individual preferences and priorities.

Whether you prioritize extra coverage, affordable prices, short-term commitments, access to English-speaking support, or other specific needs, there’s likely a dental insurance plan in Germany that suits you best.

It’s essential to evaluate your requirements and compare available options to make the right choice for your dental health.

Quick Summary

- Best Value For Money: Getsafe

- Best English Support: Ottonova

- Multiple Plan Options: Barmenia

- Best For Unlimited Coverage: Feather

Best Dental Insurances in Germany 2024

1. Ottonova

Ottoniva has been a game-changer in Germany’s insurance scene. They kicked off in 2017 and shook things up by going all-digital – they were the first ones to do it in the health insurance industry.

Why are they on our radar? Well, in 2019 and 2022, they snagged the top spot in a major test for the best private dental coverage by Stiftung Warentest. Plus, they’ve got English services.

Ottonova offers three different dental plans, so you’ve got options to choose from. And if you’re an international dweller in Germany looking for dental backup without burning a hole in your wallet, they’re worth checking out.

Plans

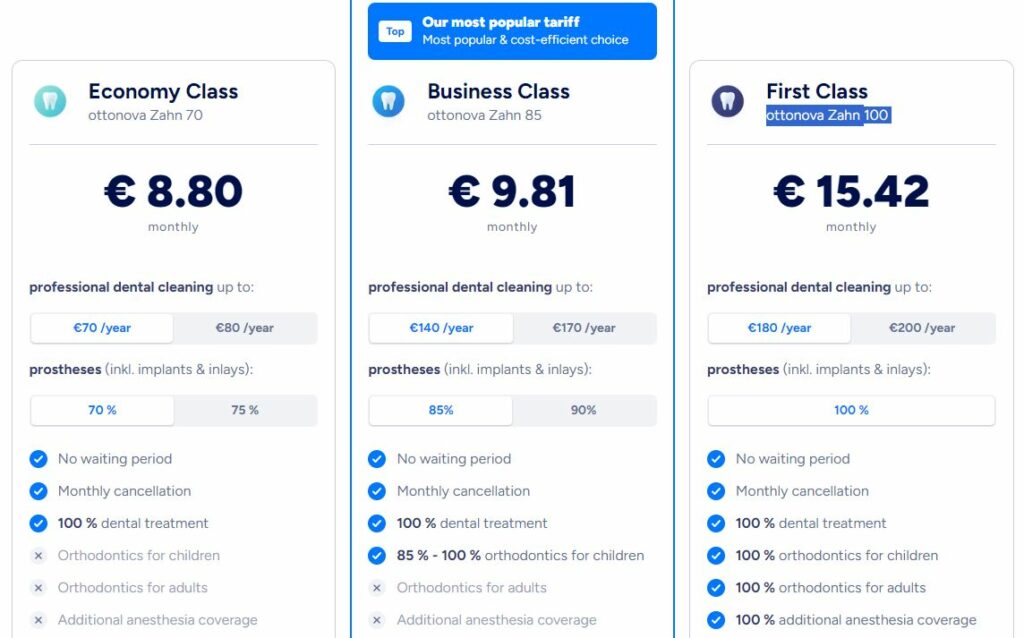

Ottonova offers the following three plans:

- Economy Class (ottonova Zahn 70)

- Business Class (ottonova Zahn 85)

- First Class (ottonova Zahn 100)

Economy Class (ottonova Zahn 70)

Starting from €8.80 per month, this package includes:

- Up to €70 per insurance year for Dental cleaning (Zahnsteinentfernung)

- Other prophylactic treatments, diagnostic tests to predict your risk of cavities, and fissure sealants

- Dental treatments like root canals (Wurzelkanal), periodontal, and plastic fillings (100%)

- Dental prostheses, including implants and inlays (70%)

- Functional analysis and functional therapy (70%)

Business Class (ottonova Zahn 85)

Starting at €9.81 per month, this package includes Economy Class features plus:

- Dental prostheses, including implants and inlays (85%)

- Orthodontics for children (85 – 100%)

- Two dental cleaning sessions (Up to €70 per session)

- Functional analysis and functional therapy (85%)

First Class (ottonova Zahn 100)

Starting from €15.42, the package comes with Business Class features plus:

- Dental prostheses, including implants and inlays (100%)

- Orthodontics for adults

- Functional analysis and functional therapy (100%)

- Orthodontics for children (100%)

- Two dental cleaning sessions (Up to €90 per session)

- Additional anesthesia (Vollnarkose) coverage (100%)

All of these packages come with no waiting periods and can be canceled at one month’s notice once you have completed the 2-year contract period.

However, all three packages come with a dental level limitation of €3200, €4000, and €5000 up to 48 months, respectively.

The prices mentioned are for the 18 to 29 years range and vary for younger and older people.

Pros

24/7 English-speaking customer service representatives.

Chat support is available.

Fast reimbursement (within 48 hours).

No waiting periods.

Complete digital experience.

Cons

Not so budget-friendly.

On rare occasions, you might have to deal with German-only documents.

2. Feather

Next up is Feather – a 2018 creation by Rob Schumacher and Vincent Audoire.

These two founders knew the struggle of dealing with Germany’s insurance scene, so they decided to keep things simple. Feather’s all about no-nonsense insurance that’s easy to understand.

What’s cool about Feather? They’ve gone digital and helped people from over 150 countries sort out their insurance needs. Now, when it comes to private dental insurance, Feather’s got two plans: Basic and Advanced.

The best part? Your dental coverage starts the very next day; no waiting games. Simple and hassle-free.

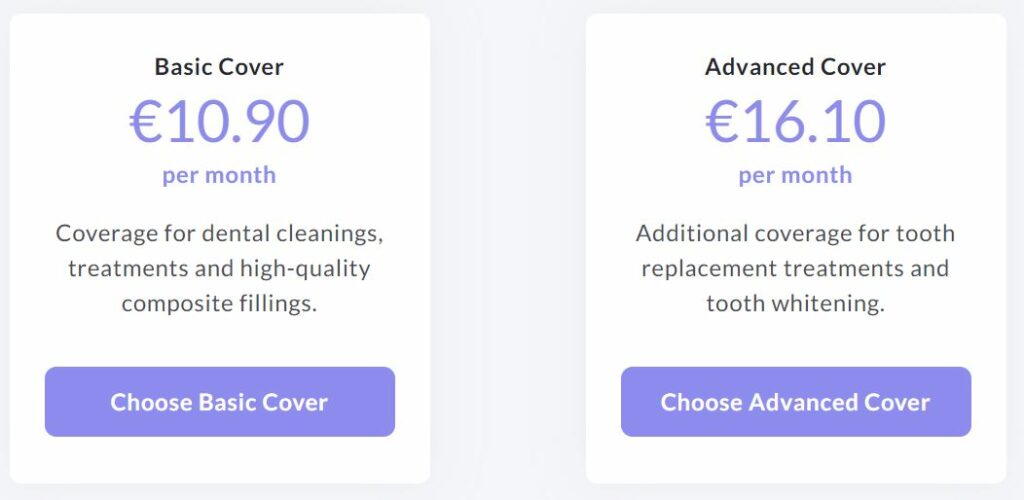

Plans

Feather offers two plans: Basic and Advanced.

Basic Plan

Starting at €10.9, the Basic Plan includes:

- Dental cleaning (Up to €150 per year)

- Dental procedures like root canals, composite fillings, periodontal disease treatments, and mouthguards

- Anesthesia, pain relief, and orthodontics treatment

Advanced Plan

Starting at €16.10, the Advanced plan includes the Basic plan plus:

- Tooth replacement procedures like bridges, crowns, inlays, and others (90%)

- Excess for replacement procedures covered by public health insurance (100%)

- Teeth whitening/bleaching at €200 every two years

But of course, there are some limits.

Treatment Type | Basic | Advanced | ||||

1 Year | 2 Years | 3+ Years | 1 Year | 2 Years | 3+ Years | |

Dental Cleaning | €150 | €150 | €150 | Unlimited | Unlimited | Unlimited |

Plastic or Composite Fillings | €150 | €300 | Unlimited | Unlimited | Unlimited | Unlimited |

Root and Paradontal Treatments | €150 | €300 | Unlimited | Unlimited | Unlimited | Unlimited |

Bite Splints | €150 | €300 | Unlimited | Unlimited | Unlimited | Unlimited |

Anesthetic and Anxiety | €150 | €300 | Unlimited | Unlimited | Unlimited | Unlimited |

Orthodontics | €150 | €300 | €2000 | €150 | €300 | €2000 |

As you can see, the advanced option will get you “Unlimited” access to most services, while the Basic Plan will have limits. However, the Basic Plan also offers unlimited services when you buy it for 3+ years (except for Dental Cleaning and Orthodontics).

Also, the Basic Plan doesn’t cover teeth replacement, and the Advanced Plan has some limits (as seen below).

Another thing to note is that the tooth replacement prices vary based on your age.

Pros

No waiting time.

English services available.

Cancel anytime after one year.

Unlimited cleanings on the Advanced Plan.

Cons

Orthodontics not covered.

No mobile app.

Long reimbursement time.

3. Getsafe

Let’s delve into Getsafe, a company making waves in the insurance industry. Founded in 2015 by Christian Wiens and Marius Simon, Getsafe is known for its innovative approach and has over 500,000 customers.

Getsafe’s goal is to simplify insurance by cutting through the complications and paperwork often associated with traditional providers.

They achieve this through their mobile app, which allows policyholders to effortlessly manage and adjust their insurance policies with a few taps on their smartphones. This convenience extends to updating coverage, submitting claims, and accessing policy documents.

Let’s see what they offer.

Plans

Getsafe has just one straightforward plan. Starting at €9.62 per month, Getsafe offers:

- Up to €80 of the cost of dental cleaning

- 100% cost of composite, resin, or dental cement fillings (Zahnzementfüllungen)

- 100% cost of root canal treatments

- Full cost of periodontal treatments

- 75% cost of teeth replacement (crown, inlays, outlays, denture)

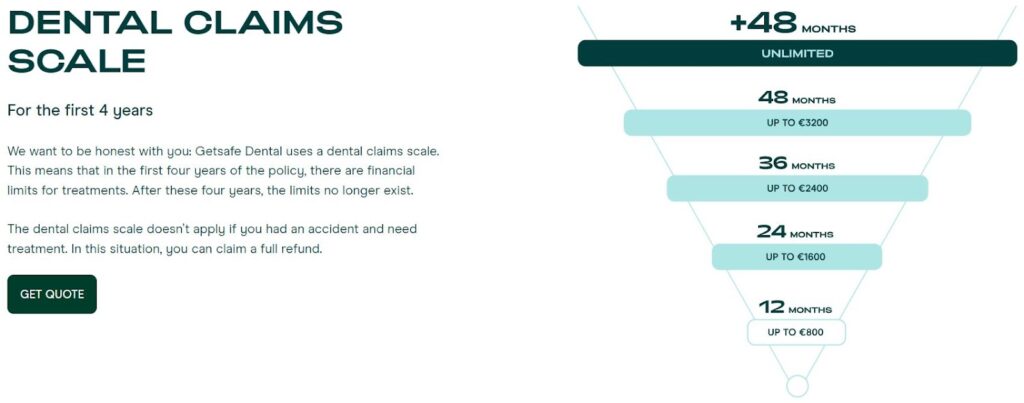

As with other dental insurance options, there are some financial limits with Getsafe. They call it the “Dental Claims Scale,” and Getsafe is transparent about it.

Here’s how it works:

- In the first 12 months of your policy, the maximum you can claim is €800.

- After 24 months, your maximum claim limit increases to €1,600.

- At the 36-month mark, it goes up to €2,400.

- After 48 months, you can claim a maximum of €3,200.

- Beyond 48 months, there are no limitations, and you can claim an unlimited amount for dental treatment.

But there’s good news, too.

If you need dental treatment due to an accident, these claims scale limits don’t apply.

Getsafe will offer full coverage without any cost limitations, ensuring you receive the necessary dental care without worrying about the maximum claim amounts.

Amazing, isn’t it?

Pros

English support.

Mobile App available.

Transparent policies.

No waiting times.

User-friendly platform with convenient claim filing.

Fast reimbursement (as soon as within 48 hours).

Cons

Just one plan (limited options).

Some users report slow response times.

4. Barmenia

Barmenia is a diverse insurance group catering to a wide range of needs.

The Barmenia Group comprises several insurance companies, with Barmenia Krankenversicherung AG taking the lead as the largest and highest turnover entity. This key player not only offers health insurance but also provides supplementary dental coverage.

The name “Barmenia” itself is a nod to its origins, hailing from the Barmen district in Wuppertal.

Why have we included them in this review?

Well, Barmenia knows one size doesn’t fit all, so they’ve got a variety of products and tariffs to pick from. Whatever your budget or needs, they’ve got an insurance option that’s just right for you.

Let’s explore their plans.

Plans

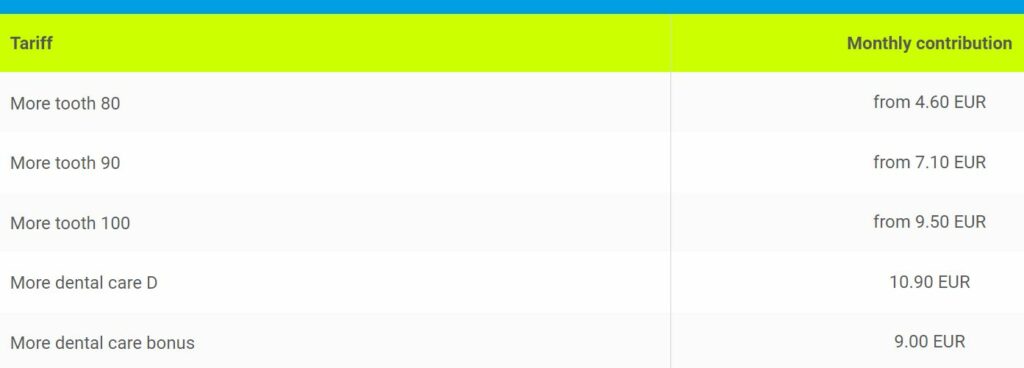

- More Tooth 80 (Mehr Zahn 80)

- More Tooth 90 (Mehr Zahn 90)

- More Tooth 100 (Mehr Zahn 100)

- More Dental Care D (Mehr Zahnvorsorge D)

- More Dental Care Bonus (Mehr Zahnvorsorge Bonus)

All of the Barmenia’s More Tooth (Mehr Zahn) plans cover the following dentures (Zahnersatz):

- Inlays & Onlays

- Prostheses

- Pin teeth, bridges, crowns, and implants

- Ceramic and plastic veneers

- Functional analysis and functional therapy services and augmentative services (bone reconstruction)

The difference lies in how much they cover. For the above-listed special cases:

The More Tooth 80 plan covers 80% and starts at €4.6 per month

The More Tooth 90 plan covers 90% and starts at €7.1 per month

The More Tooth 100 plan covers 100% and starts €9.5 per month

However, all three plans cover 100% of the cost of dentures, including pre and post-treatment, as part of the standard care from the GKV (Gesetzliche Krankenversicherung), your statutory health insurance.

More Dental Care plans can be added on top of the basic (More Tooth) plans.

More Dental Care D will add another €10.9 to your monthly installment and offer the following:

- Professional dental cleaning up to €150 per year (100%)

- High-quality plastic fillings (100%)

- Root and periodontal treatment (100%)

- Bite Splints (100%)

- General anesthesia & acupuncture (100%)

- Orthodontics (one-time up to €2000)

If you want more features. You can add the More Dental Care Bonus for another €9 per month. This plan will add the following:

- 100% of Fissures sealing (Fissuren-Versiegelung)

- Teeth whitening/bleaching up to €200 every two years

As with other dental insurance plans, there are some limits to the refund amounts in initial years; however, they don’t apply to accidents.

Pros

Multiple pricing options.

Highly economical.

Easy cancellation.

Supportive in accidents.

Cons

Not so friendly for non-English speakers.

Slow reimbursements.

No App.

Is It Worth It To Buy Supplemental Dental Insurance In Germany?

Yes, it is definitely worth considering Supplemental Dental Insurance in Germany.

Why? Because dental treatments in Germany can be relatively expensive, and public health insurance typically covers only a fraction of these expenses.

Supplemental dental insurance steps in to cover a significant portion, sometimes even the entire cost of your dental treatments. This not only alleviates the financial strain but also opens up the possibility of more advanced treatment options.

For example, you might have the opportunity to opt for a tooth implant instead of a bridge, thanks to the additional coverage.

Plus, dental insurance is economical, as some plans start as low as 10 Euros per month, offering comprehensive coverage. So, it’s a win-win situation for your oral health and your wallet.

Important

Only buy additional dental insurance if you have GKV. You won’t need to buy supplemental dental insurance if you already have private health insurance (PKV or private Krankenversicherung) because most of them cover dental treatments.

What To Keep In Mind While Choosing A Dental Insurance in Germany?

When selecting dental insurance in Germany, here are key factors to keep in mind:

- Coverage: Ensure the plan covers the specific dental treatments you anticipate needing, such as cleanings, fillings, or more extensive procedures like implants or orthodontics.

- Contract Period: Understand the duration of the insurance contract, as some policies may require longer commitments.

- Limits: Be aware of any limits or caps on coverage, both yearly and over the policy’s lifetime, as these can impact your ability to access certain treatments.

- Reimbursement Times: Check the insurance provider’s reimbursement times, as prompt reimbursements can be crucial in managing your expenses.

- Support: Assess the availability of customer support, including whether they offer services in your preferred language and have responsive channels for inquiries or claims.

- Price: Compare the cost of premiums against the coverage and benefits provided to ensure you’re getting value for your investment.

Taking these factors into account will help you make an informed decision when choosing dental insurance providers that align with your needs and budget in Germany.

FAQs

Ottonova and Getsafe are two of the most popular English-speaking dental insurances in Germany.

Barmenia is probably the cheapest dental insurance in Germany. (1)

Yes. There is a minimum contract period with all German dental insurance companies. Most companies require you to sign a contract for two years, while some companies only ask for one year.