Are you in search of exceptional supplementary dental insurance coverage (Zahnzusatzversicherung) that secures your oral health?

Look no further, as in this in-depth review, we’re set to explore the world of Feather Dental Insurance.

In this comprehensive guide, we’ll guide you through the intricacies of Feather Dental Insurance, providing insights into its coverage offerings, policy limits, pricing details, and pros and cons.

So, without further ado, let’s delve in and see if it’s the right choice for you.

Feather

| Features | Details |

|---|---|

| No. of Plans | 2 |

| Coverage | Immediate – No waiting time! |

| English Customer Support | Yes |

| Reimbursement Time | 2-6 Weeks |

| Mobile App | No |

| Contract Period | 12 Months |

| Limitations | Yes |

| Cancellation | Monthly (After completing your 1-year contract) |

| Monthly Price | €10.9 €16.10 |

Fully digital platform.

English services available.

Short contract binding (12 months).

Unlimited cleanings on the Advanced Plan.

Orthodontics not covered.

No mobile app.

Long reimbursement time.

Feather Dental Insurance Overview

Started in 2018 by Rob Schumacher and Vincent Audoire, Feather had just one goal: to keep things simple.

However, they’re not exactly an insurance company themselves. They are licensed as an insurance intermediary and offer insurance through a number of insurance partners.

For dental insurance, they’re currently partners with Barmenia.

But the good thing is you get to stay on their platform with your Feather account while they manage their partners and your payments on the back end.

Basic | Advanced | |

Dental Cleaning | €150 per year | Unlimited |

Preventive Care | Yes | Yes |

Teeth Whitening | No | €200 every 2 years |

Composite Fillings | Yes (Limited for 2 years) | Yes (Unlimited) |

Root and Periodontal Treatment | Yes | Yes |

Mouthguards | Yes | Yes |

Anesthetic & Anti-anxiety Treatment | Yes | Yes |

Tooth Replacement (Crowns, Bridges, Inlays, Overlays, and Others) | No | Yes |

Orthodontics | No Only covered when: • You’re under 21 | No Only covered when: • You’re under 21 |

Price | €10.9 per month | €16.1 per month |

Feather Dental Insurance Review for 2024

Let’s take an in-depth look at Feather’s offerings.

Plans

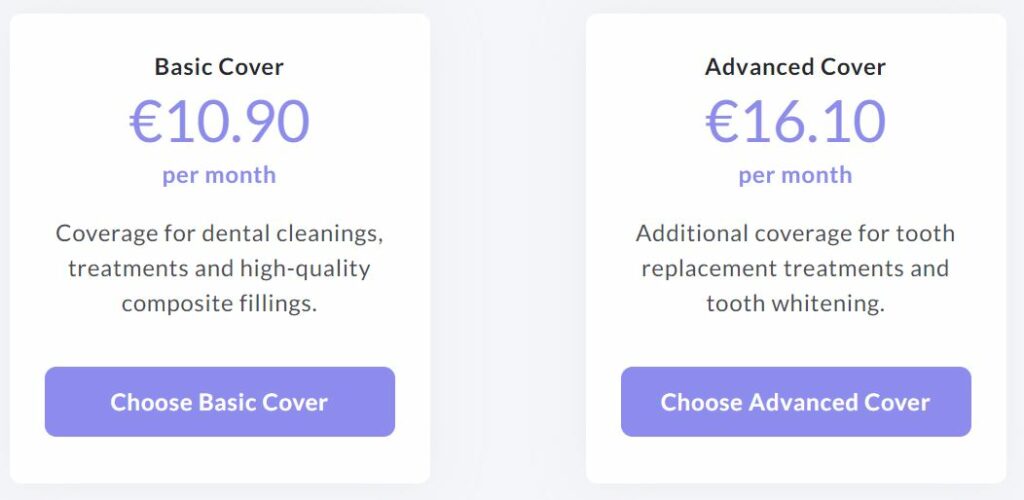

Feather Dental Insurance offers two plans: Basic and Advanced.

Basic Plan

Starting at €10.9, the Basic Plan includes:

- Dental cleaning (Zahnsteinentfernung) up to €150 per year

- Dental procedures like root canals (Wurzelkanal), composite fillings, periodontal disease treatments, and mouthguards

- Anesthesia, pain relief, and orthodontics treatment

Advanced Plan

Starting at €16.10, the Advanced plan includes the Basic plan plus:

- Tooth replacement procedures like bridges, crowns, inlays, and others (90%)

- Excess for replacement procedures covered by public health insurance (100%)

- Teeth whitening/bleaching at €200 every two years

Are there any limits?

Yes. (More on this later)

** Prices vary based on your age.

Premiums

Like with any other insurance, you have to pay a monthly premium for Feather dental insurance. Usually, insurance companies calculate your premium based on your:

- Plan price

- Age

- Dental condition

Feather, however, doesn’t change the price with your dental condition. It just puts some limits on your coverage depending on how many teeth you’re missing. (Explained more in the section, Limitations)

Important

You might not get insurance if you’re missing many teeth.

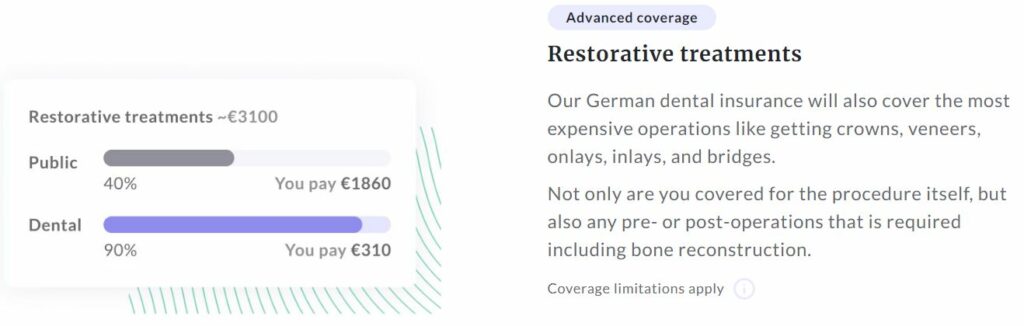

Also, remember that paying a monthly premium doesn’t mean that you won’t have to pay anything later.

Depending on contract conditions, you will either pay a small part yourself or you will pay nothing at all. For instance, Feather covers only 90% of tooth replacement.

So, how much will you pay in that case?

See the image below to understand:

Dental Work Covered

Let’s see what both plans do and do not cover.

Dental Cleaning (Zahnsteinentfernung)

Both Basic and Advanced plans cover dental cleaning. This also includes preventive care, such as fluoride treatment, sealants, and treatment of sensitive teeth.

However, the Basic plan’s coverage is limited to €150 per year, while the Advanced plan offers unlimited coverage from the start of the insurance.

On top of this, the advanced dental insurance also includes teeth whitening (bleaching) with dental coverage limited to €200 for every two years.

Plastic or Composite Fillings (Kunststoff-Füllungen)

Feather dental insurance will cover the cost of high-quality fillings, including composite fillings and dentine bonding agents.

Both plans cover 100% of the costs, but remember that the basic coverage is limited to €150 the first year, €300 the second year, and is unlimited from the third year.

Root Canal and Periodontal Treatments (Parodontosebehandlungen)

Both the basic and advanced plans offer 100% coverage for root canal and periodontal treatments. This also includes access to anesthesia and pain relief required during these procedures.

Additional Anesthetic (Vollnarkose) Coverage

Besides the above, Feather’s supplemental dental insurance offers additional anesthetic procedures and anxiety treatments like acupuncture, laughing gas, hypnosis, and others.

Dental Prostheses (Zahnersatz) or Teeth Replacement

Feather’s advanced plan covers 90% to 100% of expensive teeth replacement procedures like implants, crowns, bridges, veneers, inlays, onlays, and dentures.

The basic plan doesn’t include any of this.

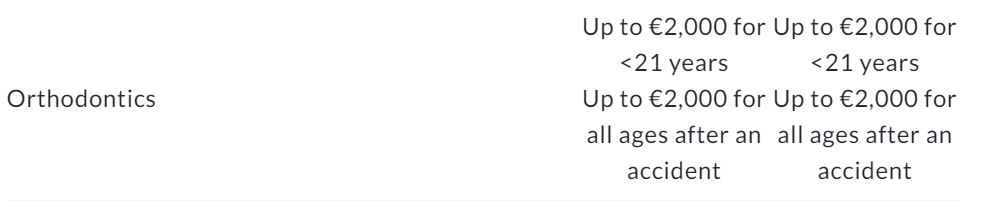

Orthodontics

Both the basic and advanced plans of Feather Insurance cover 100% of orthodontics’ costs up to a total of €2000 during the contract period.

But there’s a catch.

As you can see, only patients under the age of 21 are covered for orthodontics.

However, all hope is not lost. There is no age limit in the case of accidents that occur after the start of the contract for which orthodontic treatment is required.

Limitations

The Basic Plan offers limited coverage, while the advanced option will get you “Unlimited” access to most services.

However, the Basic Plan also offers unlimited services when you buy it for 3+ years (except for Dental Cleaning and Orthodontics).

Here’s a detailed look at the limitations.

Treatment Type | Basic | Advanced | ||||

1 Year | 2 Years | 3+ Years | 1 Year | 2 Years | 3+ Years | |

Dental Cleaning | €150 | €150 | €150 | Unlimited | Unlimited | Unlimited |

Plastic or Composite Fillings | €150 | €300 | Unlimited | Unlimited | Unlimited | Unlimited |

Root and Paradontal Treatments | €150 | €300 | Unlimited | Unlimited | Unlimited | Unlimited |

Bite Splints | €150 | €300 | Unlimited | Unlimited | Unlimited | Unlimited |

Anesthetic and Anxiety | €150 | €300 | Unlimited | Unlimited | Unlimited | Unlimited |

Orthodontics | €150 | €300 | €2000 | €150 | €300 | €2000 |

As already mentioned, the Basic Plan doesn’t cover teeth replacement, and the Advanced Plan has some limits (as seen below).

User Experience

Feather is a fully digital platform that offers a user-friendly experience to its customers.

How?

First, you don’t have to wait for the coverage to be activated. The day you sign up and pay your first month’s payment, you’re eligible to access all the benefits mentioned in your contract.

Secondly, Feather Insurance offers English support, which is a sigh of relief for expats as the majority of them can’t speak or understand the German language.

In fact, unlike many insurance providers, Feather lets you download complete details of their offerings in partial English translation.

This makes it easy for English-speak expats to understand and use their service.

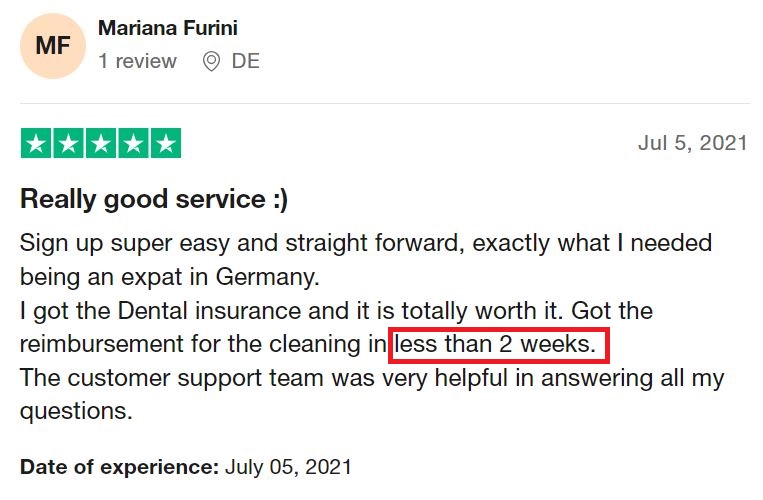

Reimbursement Process & Time

Their reimbursement process is pretty straightforward.

You have to pay upfront for your dental treatment. As always, your public insurance will (or will not) cover some of it, and you will pay the rest.

Then, you need to submit the signed bill to your Feather account under the “My policies” page.

Feather will reimburse the costs of dental services in line with the service costs outlined in the Fee Schedule for Dentists (Gebührenordnungen für Zahnärzte, GOZ) and/or the Fee Schedule for Doctors (Gebührenordnungen für Ärzte).

How long will it take?

Well, as per their website, you’ll be reimbursed in 3 – 6 weeks, depending on the treatment and amount of the claim. However, there have been instances when people have been reimbursed faster.

Contract Period & Cancellation

Feather has a minimum contract period of 12 months.

This means you can’t cancel your policy before one year. Once you’ve completed the contract period, you can cancel your insurance any month.

Eligibility

Finally, who’s eligible for Feather’s insurance?

Well, in terms of age, there are no upper or lower limits.

The only condition that matters is whether you have public or private insurance as your expat health insurance.

Important

Only individuals who are insured in the German public health insurance system (gesetzliche Krankenversicherung, GKV) or who are entitled to other state-provided therapy are eligible for Feather’s dental insurance.

Verdict

Feather Dental Insurance is a compelling option for individuals seeking comprehensive coverage for their dental health in Germany.

Its appeal lies in its simplicity, efficient digital platform, and immediate coverage activation, making it an excellent choice for those who value hassle-free access to dental care.

This insurance is particularly well-suited for expats and English-speaking residents, thanks to its English support and downloadable, partially translated insurance documents.

Additionally, the short 12-month contract period provides flexibility for those uncertain about long-term commitments.

The Advanced Plan offers great value with unlimited dental cleanings and coverage for various dental procedures, making it an attractive choice for individuals requiring extensive dental care.

However, Feather Dental Insurance may not be ideal for those in need of orthodontic treatment, as it has limited coverage in this area.

Also, individuals who prioritize quick reimbursement may find the 3 to 6-week wait time less appealing. Additionally, the absence of a mobile app may inconvenience users who prefer mobile access to their insurance details.

Overall, Feather Dental Insurance caters well to those seeking affordable dental coverage with minimal administrative hassle and a digital-first approach.

It’s an excellent fit for expats and individuals with basic dental needs, but those with specific orthodontic requirements may want to explore other insurance options.