Tomorrow and N26 are two German banks that have been gaining popularity in the online banking world for their mobile banking approach and fully digital features.

You are probably wondering which is the best option for you and we are here to help.

In this article, we will give you a full overview of how the two fintech players compare, delving into their account types, fees, benefits, and much more. Let’s dive right in.

Tomorrow Bank Vs. N26 Germany Comparison Table

Let’s take a look at the key components of both banks.

N26 Bank | Tomorrow Bank | |

Subscription options available | 4 | 3 |

Card system | Mastercard | Visa |

Monthly fees | From 0€ to 16.90€ | From 3€ to 15€ |

International payments | Free | Free |

Cash withdrawals | Starting at 3 free withdrawals (2€ after that) | 1.70% abroad | Starting at 2€ per withdrawal |

German IBAN | Yes | Yes |

Investment options | Crypto trading | Investment in sustainable companies |

Customer support | In-app chat | Phone line and in-app chat |

Overdraft option | Yes | Yes |

<18 accounts | ✘ | ✘ |

Travel insurance | Yes, in premium plans | No |

Trustpilot rating | 3.7 | 3.4 |

Dimension | +8 million users | +120,000 users |

Tomorrow Bank Vs. N26 Detailed Comparison In 2024

Tomorrow is an eco-conscious banking platform founded in Germany in 2018 by Inas Nureldin, Jakob Berndt, and Michael Schweikart with the “vision of using money as a lever for positive change”.

Customer deposits are entirely invested in sustainable projects, including the restoration of ecosystems, carbon offsetting, renewable energy, sustainable agriculture, and affordable housing.

The German fintech doesn’t have a banking license yet, so they teamed up with a banking service provider, the Berlin-based technology company Solaris which is licensed as a bank.

This means that all banking services and all Tomorrow accounts are with Solaris.

N26 is a German fintech founded in Berlin in 2013 by Valentin Stalf and Maximilian Tayenthal. It is the first 100% mobile bank to have been granted a full German banking license from BaFin.

N26 is known to be a well-rounded, low-cost online bank for all your everyday banking needs.

With free payments worldwide and travel insurance, the German bank ditches the high fees and stands out as a great option for travelers.

Both banks offer a sleek and modern mobile experience and free payments worldwide, as well as a simple account opening process with no Schufa check.

Let’s take a closer look at how the subscription plans compare.

Subscription Options

The main difference between the N26 and Tomorrow subscription plans is the fact that Tomorrow Bank doesn’t offer a free account, which can be a big deciding factor if you are just looking for a free card with basic banking features.

N26 also offers 3 free withdrawals a month in the free plan, which doesn’t happen on Tomorrow’s cheapest account. However, both banks offer free international payments.

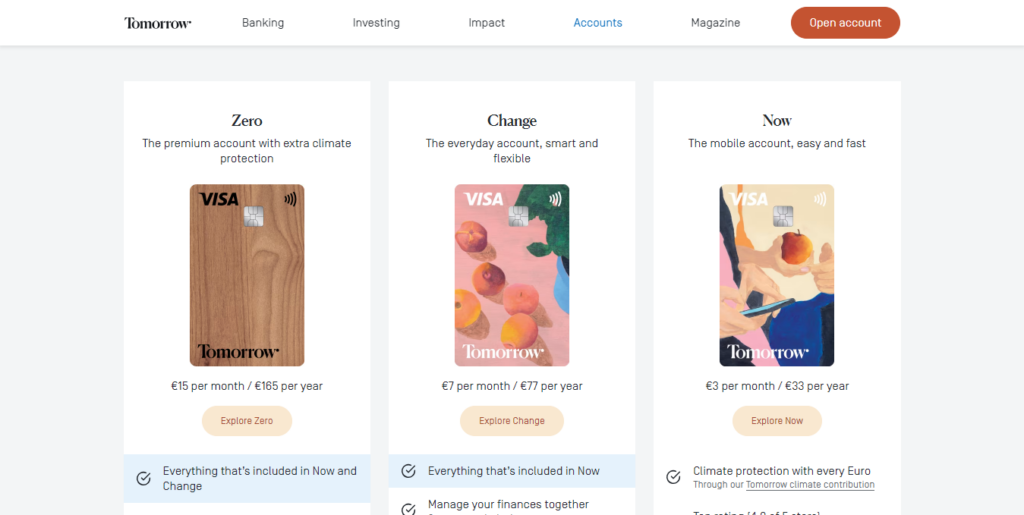

• Tomorrow Bank

Tomorrow Now | Tomorrow Change | Tomorrow Zero |

3€/month* | 7€/month* | 15€/month* |

• Free payments worldwide | • All benefits of Now plan + • 5 free ATM withdrawals per month worldwide | • All benefits of Change plan + • Unlimited free withdrawals worldwide |

*From 01.03.2024 there will be the option of a annual or monthly fee, with a price increase: • Now: 4€/month or 44€/year | ||

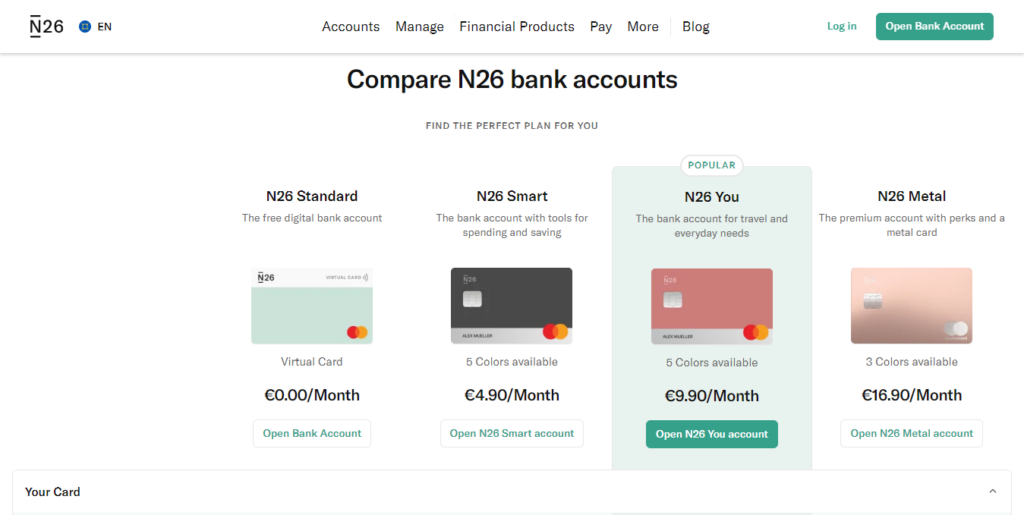

• N26 Bank

N26 Standard | N26 Smart | N26 You | N26 Metal |

Free | 4.90€/month | 9.90€/month | 16.90€/month |

• Virtual debit card and optional physical card for 10€ | • The same benefits of N26 Standard + • 5 free withdrawals per month | • The same benefits of N26 Smart + • Unlimited free withdrawals abroad | • The same benefits of N26 You + • 8 free domestic withdrawals |

Unlike Tomorrow, N26 also offers business accounts for freelancers and self–employed people (not companies), but it’s only possible to have either a personal or a business bank account.

You have all the main features from the personal accounts, plus 0.1% cashback on all card payments.

Regarding the personal accounts of both online banks, we can see that they have comparable features.

The N26 Metal premium account stands out for offering travel insurance plus mobile and purchase protection, while Tomorrow Zero offers unlimited free withdrawals and subaccounts plus carbon offsetting.

Fees & Charges

Let’s take a closer look at how the fees from both banks compare.

Make sure you check the full price lists for any possible additional fees. You can find them here (Tomorrow) and here (N26).

Tomorrow | N26 | |

Monthly fee | Now: 3€ Change: 7€ Zero: 15€ | Standard: Free Smart: 4.90€ You: 9.90€ Metal: 16.90€ |

Cash withdrawals | Now: 2€ per withdrawal

Change: 5 free a month (2€ after that)

Zero: Unlimited free | Standard: 3 free domestic withdrawals (2€ after that); Free in the EU; 1.70% outside EU

Smart: 5 free withdrawals (2€ after that); Free in the EU; 1.70% outside EU

You: 5 free withdrawals (2€ after that); Unlimited free abroad

Metal: 8 free withdrawals (2€ after that); Unlimited free abroad |

Payments abroad | Free | Free |

Replacement card | 10€ for standard cards and 20€ for wooden cards. | 10€ for standard cards and 45€ for metal cards. |

Cash deposits | 1.5% of the amount deposited | 1.5% of the amount deposited |

Refusal of direct debit due to insufficient funds | 1€ per refusal | 3€ per refusal |

Bank Cards

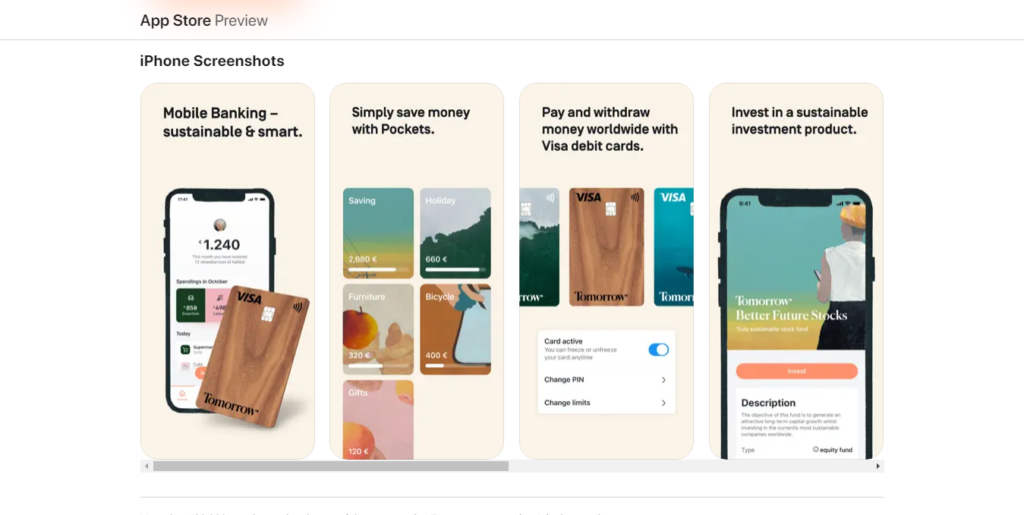

Tomorrow offers you a Visa debit card for free for every account, and you can choose between several cool designs.

It’s a universal card directly linked to your current checking account.

You can pay contactless, and the virtual cards can be linked to your Google and Apple Pay wallet for convenient online shopping.

Tomorrow Bank does not offer any credit cards currently.

However, you can apply for an overdraft by Solaris in your Tomorrow app and activate it after a Schufa check. In case you need to overdraw your account, the digital bank charges an interest of 10.99% p.a.

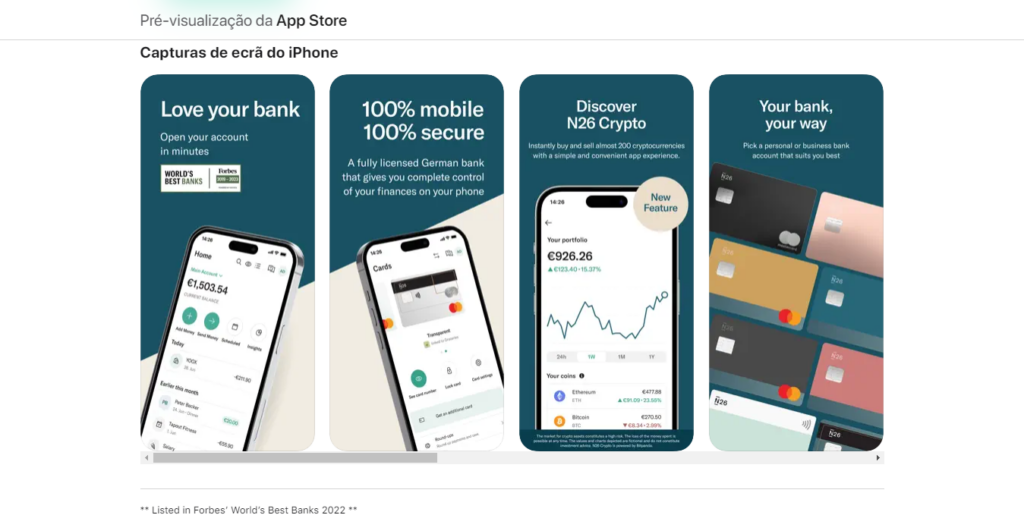

N26, on the other hand, works with the Mastercard system.

If you’re a premium customer, your N26 Mastercard is included with your membership, and you can pick between 5 colors.

All N26 bank accounts come with a virtual debit card that can be linked to Apple and Google Pay.

Residents in Germany, the Netherlands, and Austria can also order a Maestro card to accompany their primary debit Mastercard.

Just like Tomorrow Bank, N26 doesn’t currently offer credit cards.

However, you can activate an overdraft, which allows you to borrow up to 10,000€ through your checking account. The interest rate applied to your overdraft is 8.9% above the ECB rate.

You can also get a loan through the N26 bank, between 1,000€ and 25,000€, with an interest rate of 5.89% p.a.

Money Transfers

Both banks allow instant payments within the app to other Tomorrow and N26 contacts.

Transfers made and received within the SEPA area are all possible with no extra charges.

However, foreign transfers to the non-Euro area are currently not possible with a Tomorrow bank account.

N26, on the other hand, has Wise integrated into the app, allowing you to send money overseas in over 38 currencies at fair, real-market exchange rates.

Cashback Benefits

Currently, Tomorrow Bank doesn’t offer any cashback benefits.

N26, on the other hand, offers 0.1% cashback on all card payments, or 0.5% cashback for Business Metal customers, but only with a business account.

Personal accounts don’t benefit from this feature.

Perks & Benefits

Comparing both banks’ benefits, Tomorrow stands out for the climate contribution, while N26 users can benefit from travel insurance, depending on the account type.

Both offer the possibility to send and receive money instantly from the app between users of the same bank and offer free international payments.

Let’s look at both online banks’ benefits side-by-side.

Tomorrow Bank | N26 Bank |

• Wise integration for international money transfers | • Pockets feature - sub-accounts to organize and save your money |

Investments

Tomorrow Bank allows you to make sustainable investments easily within the Tomorrow app.

You invest in the Tomorrow Better Future Stocks Fund, where all the companies are selected carefully through a list of criteria.

Through the Tomorrow banking app, you can open a free securities account, select the investment fund and sum, and buy your shares. You can start investing with as little as 1€.

N26 has limited investment options, and at the moment they only allow you to buy and sell cryptocurrencies. There are over 180 coins available for trading.

N26 Metal customers will be able to make transactions with a 1% transaction fee applied for trading Bitcoin and 2% for all other available cryptocurrencies.

All other users have a 1.5% fee on Bitcoin and a 2.5% fee for other cryptocurrencies.

Mobile App

Both Tomorrow and N26 offer a mobile banking app for Android and iOS devices, offering a user-friendly, safe, and seamless experience in English, paired with a modern-looking interface.

You can create an account in only a few minutes and the process is very simple.

Tomorrow has a classification of 3.6 stars on Google Play and 4.9 stars on Apple Store. N26 has 3.2 stars on Google Play and 4.6 stars on Apple Store.

In the Tomorrow app, you have access to a monthly summary that gives you a quick overview of your spending, as well as your sub-accounts and joint accounts where you can organize and manage your money, depending on your plan.

Through the Tomorrow Bank app, you can invest in sustainable projects easily and have access to investing guides that can help you get started.

You can also activate an overdraft through the app if you need a backup for unexpected expenses. All mobile banking features are integrated into the app.

In the N26 app, categorized spending insights break down your expenses, giving you a clear picture of your financial habits.

The “Spaces” feature allows you to create virtual sub-accounts for specific savings goals, and you can also share them with other users (with a premium account).

This feature helps you budget and save money.

In both cases, real-time push notifications keep you updated on transactions and access to your bank account is easy.

Both banking apps are available in English.

Security Features

Both German banks have similar security features.

These include:

- Two-factor authentication (password and another authentication method such as fingerprint recognition)

- Instant push notifications about any transaction made with the card

- In-App Card Locking, meaning you can quickly lock your card or change your PIN directly through the app

- Device-Paired Access, meaning your bank account is exclusively accessible through your paired smartphone

Both Tomorrow and N26 protect your funds up to 100,000€ through the Deposit Protection Scheme.

Customer Service

Customer satisfaction seems to be higher with Tomorrow Bank, compared with N26.

Tomorrow is, however, a smaller bank with fewer users, and that may influence the support available.

Tomorrow Bank has an e-mail and a phone line available Monday to Friday. All members can use the phone hotline, which is a plus considering that some other banks don’t have this option.

There is also the option of in-app chat for members. Customer support is also available in English and German, which is great for expats.

Reviews of N26’s customer support tend to be a bit less positive, with a few complaints of unresponsive and unhelpful assistance. Still, you can reach one of N26’s agents through the website, or by using the chat function in the app.

They are available from 7 am to 11 pm CET, every day. You can request a call from them, but only for suspicions of fraud or account security reasons.

You can also send them an email or reach out to Neon, an automated N26 Chatbot, 24 hours a day. The service is also available in English.

Verdict: Which One Is Better?

Both fintechs have strengths and weaknesses, but overall they are great alternatives to traditional banks.

Tomorrow is a great option for anyone who values sustainability and wants a bank that is committed to making a positive impact on the world and the environment.

If you also want to enjoy free payments abroad and don’t expect to need to make withdrawals or transfers outside the EU, then it may be a good option for you.

However, N26 it’s still a more well-rounded option, especially if you are interested in low-cost banking.

Unlike Tomorrow, you can have a bank account with no monthly fees, while still benefiting from free payments abroad and other core features.

You also benefit from a few free withdrawals a month with the free plan and the possibility to earn interest on your savings is also very appealing.

If you are a frequent traveler, the travel insurance offered by N26 makes it also a better option for you.

In the end, the best banking solution for you will depend on your personal needs, interests, and lifestyle.

FAQs

Overall, N26 is likely cheaper than Tomorrow, considering the fact that N26 offers a free plan and Tomorrow doesn’t.

However, the fees from both banks are similar.

Yes, N26 is a more established bank, with over 8 million users worldwide. By comparison, Tomorrow has around 120,000 users.

It depends on what you value. If it’s sustainability and eco-conscious banking, then Tomorrow may be considered better than N26.

However, N26 is overall a more solid banking product.

Conclusion

In conclusion, the choice between Tomorrow Bank and N26 depends on your specific preferences and requirements.

Both German fintechs offer compelling features, innovative solutions, and a commitment to redefining the banking experience.

Hopefully, you found this article informative!