The quest to find the right health insurance in Germany can be difficult. There are so many options and, as an expat, navigating all possibilities can be challenging.

However, it’s very likely that you’ve heard about Techniker Krankenkasse (TK) public insurance and are wondering if it’s worth it.

In this article, we are going to do a TK health insurance review, giving you a clearer picture of what you can expect from this public health insurance company.

We will talk about costs, coverage, benefits, and the process of how to get TK health insurance.

Quick Summary

- Considered by many, including Focus Money Magazine, as the best public health insurance in Germany

- Reasonable contribution rate of 15.8% of gross income

- Wide range of medical coverage that goes beyond standard services and nice benefits to its members

- Several digitized services with good customer support in English

Techniker Krankenkasse (TK)

| Features | Details |

|---|---|

| Eligibility | Most Germany residents |

| Reputation | Very good |

| User experience | Very good (But website is not fully in English) |

| Customer Support | Very good, 24h |

| Contribution rate | 15.8% (14.6% + 1.20%) |

| Coverage for dependants | Yes |

| General doctor appointments | Yes |

| Specialist doctor appointments | Yes |

| Medication | 90% |

| General vaccinations | Yes |

| Travel vaccinations | Yes |

| Medical transport | Yes |

| Dental cleanings | Up to €40/year |

| Dentist treatments (eg. filings) | Basic treatments |

| Tooth replacement (eg. dentures, implants, crowns) | 75% |

| Preventive health treatments | Yes |

| Therapeutic treatments (eg. physiotherapy) | 90% |

| Mental health therapy | Yes, only pre-approved |

| Alternative treatments | Osteopathy up to 120€/year; Homeopathy; Acupuncture; Naturopath |

| Medical aids | 75%-90% |

| Vision aids | With limitations |

| Pregnancy cover | Yes |

| Hospital accommodations | Shared room |

| Choice of hospital | Only public hospitals |

| English support | Yes |

| Bonus program | Up to 400€ |

Strong medical treatment coverage and a wide range of services for reasonable prices.

English-speaking services and support.

Medical advice via smartphone.

Bonus program that rewards engagement in health activities.

Extended travel insurance coverage for trips abroad.

24-hour service with quick assistance.

Family members are insured for free.

Simple and fast sign-up process.

Some pages of the website, including the private area (Mein TK) are not available in English.

Limited coverage for dental care and visual aids.

We cover in this article:

Who Can Get TK Health Insurance?

Most people living in Germany are eligible to get TK insurance or any other public health insurance.

However, you may get rejected if you’re a student over 30 years old or in preparatory or language courses, and if you’re a freelancer who just moved to Germany.

Still, in most cases, you are eligible for TK health insurance.

You should know that it is mandatory for every resident in Germany to have health insurance.

If you are an employee with a gross income of less than 66,600€, you are obliged to get public health insurance. If you make more than that, are self-employed, a student, or a civil servant, you can choose between public or private health insurance.

Unlike private health insurance, statutory health insurance (gesetzliche Krankenversicherung or GKV) can accept your application regardless of your age, health status, and pre-existing conditions.

For families and older people, public health insurance is often more advantageous than private insurance.

TK Health Insurance Review for 2024

Techniker Krankenkasse, TK is the largest health insurance company in Germany, with over 11 million members. It was founded in 1884 and is based in Hamburg.

It has consistently been rated the best or one of the best public health insurance companies by several entities that perform insurance tests and reviews.

More recently, the magazine Focus Money named TK “Germany’s Best Health Insurance Company” (Focus Money, 7/2023 issue). This is the 17th time in a row.

As an expat, you’ll also be happy to know that TK fulfills all the health insurance requirements for a visa application.

Cost / Contribution Rates

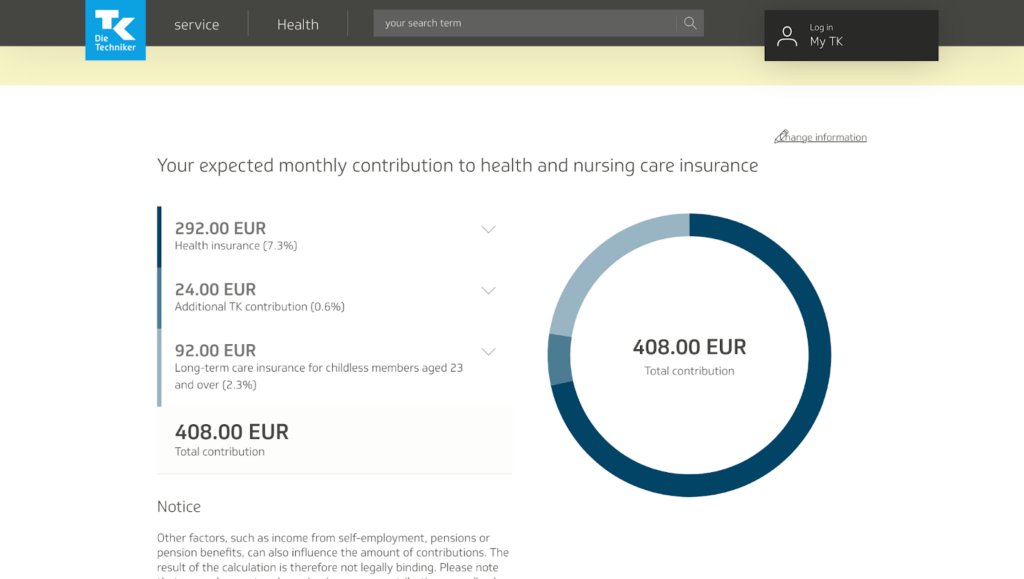

So, how much does TK health insurance cost? TK is considered to have an average cost, although slightly below average. It’s not the cheapest nor the most expensive among public health insurance companies.

In Germany, the public health insurance costs consist of a fixed contribution rate of 14.6% plus an additional contribution rate that every statutory health insurance fund is allowed to apply. The average additional contribution rate is around 1.6%.

In TK’s case, this additional rate is 1.2%, which makes it a total cost of 15% of your gross income.

The more you earn, the more your health insurance contributions increase in proportion.

However, there’s a salary cap at a maximum of 4,987€ per month, so if you earn more than this, you don’t need to pay a higher insurance premium.

If you are employed, you pay half of the costs (automatically subtracted from your payslip) and your employer pays the rest.

If you are self-employed/freelancer, you have to bear the costs on your own.

That is why many young freelancers choose private insurance, as it usually ends up having much more affordable prices. If you earn less than 1,131.67€ per month you pay the minimum amount of around 207€.

If you’re a student, you will pay a reduced rate of around 115€-125€ a month.

Additionally, you have to pay for nursing care insurance.

The nursing costs are either 3.05% or 3.3% of your income, depending if you have children or not. If you’re an employee, your employer also pays half of these costs.

As an example, an employee without children earning 4000€ a month has a total contribution of 408€ per month.

You can calculate your contribution here (if you use Google Chrome, you can use the Google Translate feature to translate the page).

What Does TK Insurance Cover?

German public health insurance is regulated by the government, which means that all public health insurers have the same catalog of standard medical care that they have to provide to their members by law.

Insurers can expand on those services, as TK does.

TK covers a wide range of medical expenses and treatments.

Pretty much all you are going to need medically, without any big luxuries, you’ll get it covered by TK.

It includes:

- General Physician Appointments: you can choose your doctor as long as they are licensed to treat patients covered by the public healthcare system. You can find a doctor through the TK appointment service or by yourself.

- In-Hospital treatment: TK covers hospital care and surgeries, however, there is a co-payment amount of 10€ per day for up to 28 days on a calendar year.

- Preventive examinations and out-patient treatments: you can have screening examinations for certain types of cancer (eg. skin cancer examinations from the age of 20, and colon and stomach cancer prevention for people above 35).

- Basic dental care: TK insurance covers basic dental examinations twice a year, dental cleanings up to 40€ a year, and tooth replacements are partially covered.

- Medication: the medication your doctor prescribes you is covered, with a co-payment of between 5€ to 10€, depending on the medication.

- Pregnancy: TK insurance covers all necessary examinations during pregnancy, as well as a 500€ subsidy per attempt for artificial insemination and a 250€ subsidy for a midwife on-call service.

- Vaccinations: All vaccines recommended by the Standing Vaccination Commission are covered.

- Visual aids: TK partially covers glasses and other visual aids up to a fixed amount between 19.31€ and a bit over 100€.

- Travel insurance: On the back of your TK health card you have the equivalent of the European Health Insurance Card, which allows you to receive urgent medical assistance in a foreign country inside Europe (same benefits as locals).

- Alternative treatments: TK covers a range of alternative treatments up to a certain amount.

- Free family insurance: Immediate family members can be covered at no additional costs.

What Isn’t covered?

Tk health insurance doesn’t cover advanced dental procedures.

In general, public health insurance in Germany has limited dental coverage, since it only covers basic treatment and materials.

If you want more advanced procedures, such as braces or tooth replacements with more advanced materials, you will need to get supplementary private dental insurance.

When it comes to glasses and other visual aids, TK also offers limited coverage. Out-of-pocket costs will always be there.

TK also will not cover visits to a private doctor, private hospitals, and private room accommodations.

User Experience

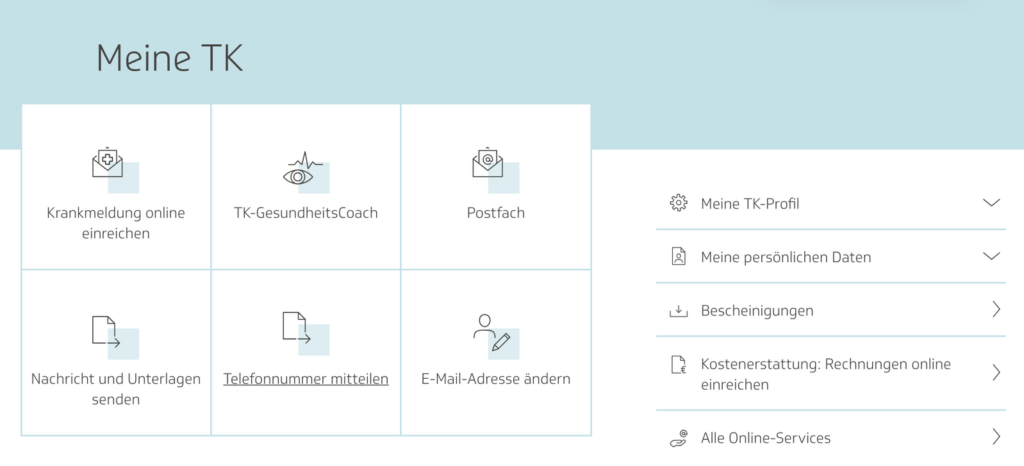

TK makes sure all its digital resources and platforms are user-friendly.

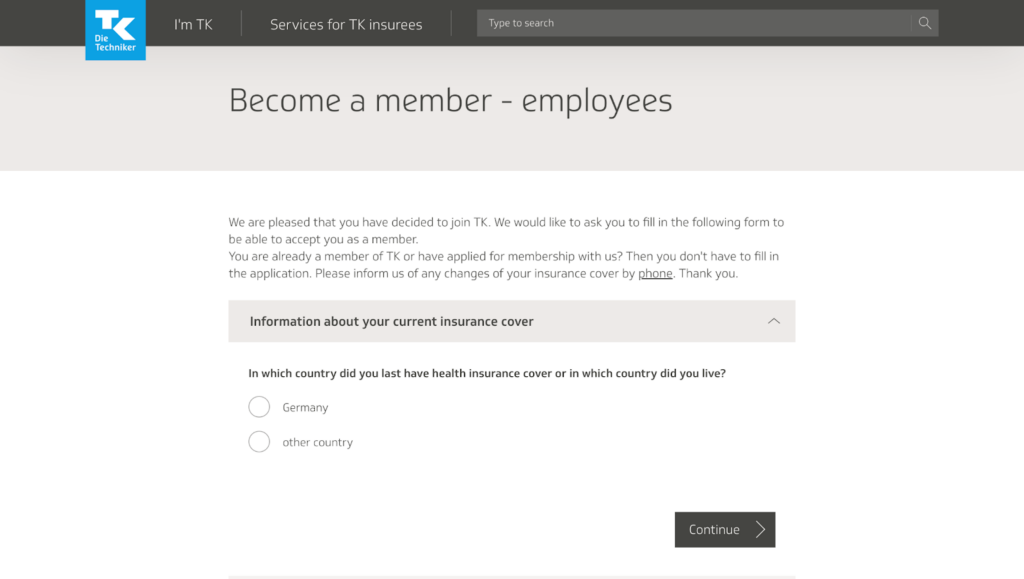

To sign up, you can do it directly on their website where you have to fill in an online application form with information about your current insurance coverage, your employment, and your personal data.

TK website is not only available in English but also in Turkish, Mandarin, Spanish, Polish, and Arabic.

However, once you are a member, your private area “Mein-TK” is unfortunately only available in German.

In your private area, you can submit and download documents to your employer or the immigration office, update your personal information, submit sick leave, and choose to receive mail online.

You can also let TK find a doctor’s appointment for you.

You can download the TK App to deal with any health insurance-related concerns, and have access to Meine TK in English.

There you can receive letters from TK, send messages to the insurer, use the TK bonus plan fully digitally, use a fitness program compatible with your usual health and fitness app, and much more.

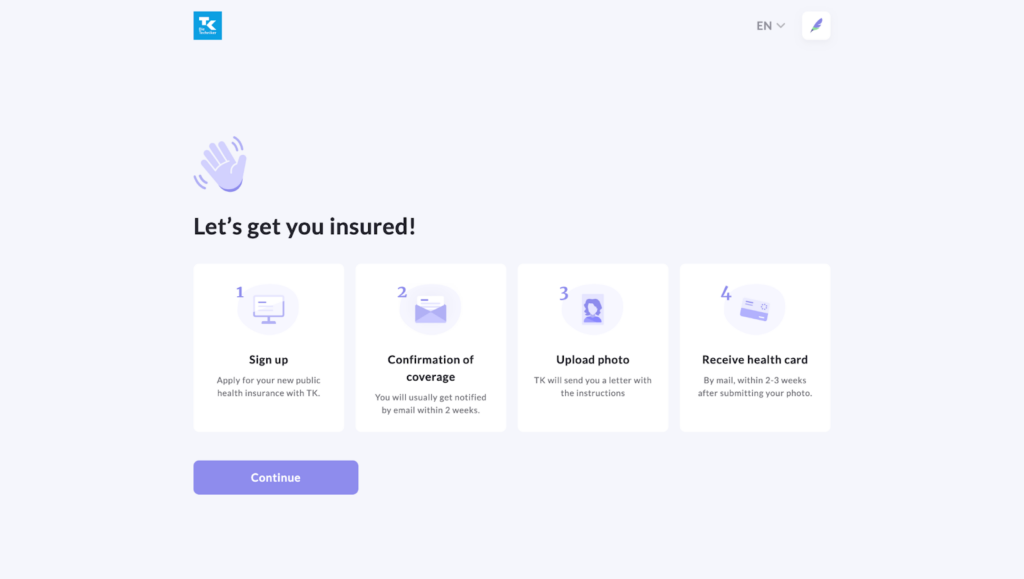

You can also sign in through Feather, a private insurance broker.

The service is free, all in English, and fully digital. Feather makes the sign-up process very smooth, fast, and user-friendly.

TK has very good customer service.

It works around the clock, and you can call them, ask them to call you, or use the online chat. They usually answer quickly and you don’t have to worry about your German fluency.

The support is available in English.

TK Benefits

If you choose TK health insurance you will be provided with a wide range of benefits tailored to your personal situation. It includes the following:

- Bonus program of up to 400€ that rewards engagement in health activities.

- TK-Doc App, where you can get expert medical advice from a doctor.

- TK-Coach App, where you can access over 130 relaxation and fitness exercises, healthy recipes, and self-tests to track progress.

- Appointment service where you’ll get your doctor’s appointments scheduled for you.

- TK-Fit program that allows you to track your physical activities.

- Home help for your children under 14 if you can’t look after them on health grounds.

- Alternative treatments such as acupuncture, osteopathy, homeopathy, anthroposophic, and herbal remedies.

- Travel vaccinations that are recommended for your destination country. This includes hepatitis A and B or malaria prophylaxis.

TK Bonus Program

TK has a nice bonus program that rewards members for their health-conscious choices.

There are many activities that earn you 1000 points. Joining a fitness or sports club, going for cancer screenings or dental appointments, for example. You can check the list here.

You get 10€ per activity or 20€ as a health dividend.

Then you are paid out up to 200€ per year of participation or up to 400€ with the health dividend.

You need to document your activities in your TK App.

The health dividend can help you save money as it can be exchanged for a large number of services, such as glasses and contact lenses, gym membership, fitness equipment, health courses, dental and eye care, and much more. The full catalog is available here.

How to Get TK Health Insurance in Germany

Getting TK Health Insurance is quite simple.

You can do it on TK’s website, by filling out a form. You will provide information about your current insurance, your employment, and your personal data, and finally, you will have to submit a photo for your eHealth card.

You can also sign up with Feather by filling out a simple form. After signing up, you usually get a confirmation by email within 2 weeks.

Then you’ll receive a letter from TK to follow some instructions, including submitting a photo. Finally, you’ll receive your insurance card by mail within 2 to 3 weeks.

FAQs

Outside of Germany, you can only use your European Health Insurance Card, which is on the back of your TK card.

You can access medically necessary care in Europe (same treatment as locals).

The easiest way will be to inform TK insurance (you may need to send them a form) and also contact the insurer you want to switch to, to help you with the transition.

Yes, eye check-ups are covered. Glasses and lenses are only partially covered.

Yes, TK offers support in English.

Yes, freelancers can get insured by TK.

However, if you’re just arriving in Germany, you may get rejected. Check with the insurer.

Conclusion

Techniker Krankenkasse (TK) is considered, among public health insurers, one of the best health insurance options out there.

With wide medical coverage and a strong set of benefits, TK is a great option for any German resident.

We hope this TK review provides you with some insights that will help you make an informed decision.

We always recommend that you do your own research first and if necessary, seek professional advice from an independent insurance broker who will help you pick health insurance fitted to your needs.