N26 and Revolut are two major players in the fintech world, challenging traditional banks with their fully digital banking features that help with everyday financial planning.

Holding attractive conditions for expats in Germany, you may wonder which is the best option for you.

In this article, we will dissect the strengths and weaknesses of both digital banks, comparing their core services, unique offerings, benefits, fees, and much more.

Let’s dive right in.

Revolut Vs. N26 Germany Comparison Table

N26 Bank | Revolut Bank | |

Subscription options available | 4 | 5 |

Monthly fees | From 0€ to 16.90€ | From 0€ to 50€ |

Multicurrency accounts | ✘ Only Euro | Yes |

International payments (Free plan) | Free | Free up to 1,000€ a month (1% if you go above the limit), except on the weekends (always 1% fee) |

ATM withdrawals (Free plan) | 3 free withdrawals (2€ after that) | 1.70% abroad | Limit: €200/month or 5 withdrawals (2% fee if you go above the limit) |

Investment options | Crypto trading | Stocks, shares, crypto, and precious metals |

Customer support | In-app chat | Phone support and in-app chat |

Overdraft option | Yes | ✘ |

<18 accounts | ✘ | Yes |

Travel Insurance | Yes, in premium plans | Yes, in premium plans |

Trustpilot rating | 3.7 | 4.3 |

Revolut Vs. N26 Detailed Comparison In 2024

Let’s take a look now at the key features of both online banks, where we will highlight differences and similarities, and showcase unique aspects.

Revolut was founded in 2015 and is headquartered in London. Although it’s not considered a bank in every country it operates in, it is licensed as a bank in the EU, facilitated by the Bank of Lithuania, and offers deposit protection.

Revolut offers its customers a multi-currency bank account with the possibility to send money in more than 29 currencies.

N26 is a German fintech founded in Berlin in 2013. It is the first 100% mobile bank to have been granted a full German banking license from BaFin.

Unlike Revolut, N26 does not provide a multi-currency account, only in Euros. However, N26 doesn’t charge fees for payments in foreign currencies.

N26 has around 8 million customers across 24 countries, not enough to beat the giant Revolut, which currently has 35 million customers in 37 countries.

Subscription Options

Regarding subscription options, both Revolut and N26 offer a few paid plans plus a free account, which is great if you want to benefit from essential services without a monthly or annual fee.

Revolut offers you 5 plans: Revolut Standard (free), Revolut Plus (2.99€/month), Revolut Premium (7.99€/month), Revolut Metal (13.99€/month), and Revolut Ultra (50€/month).

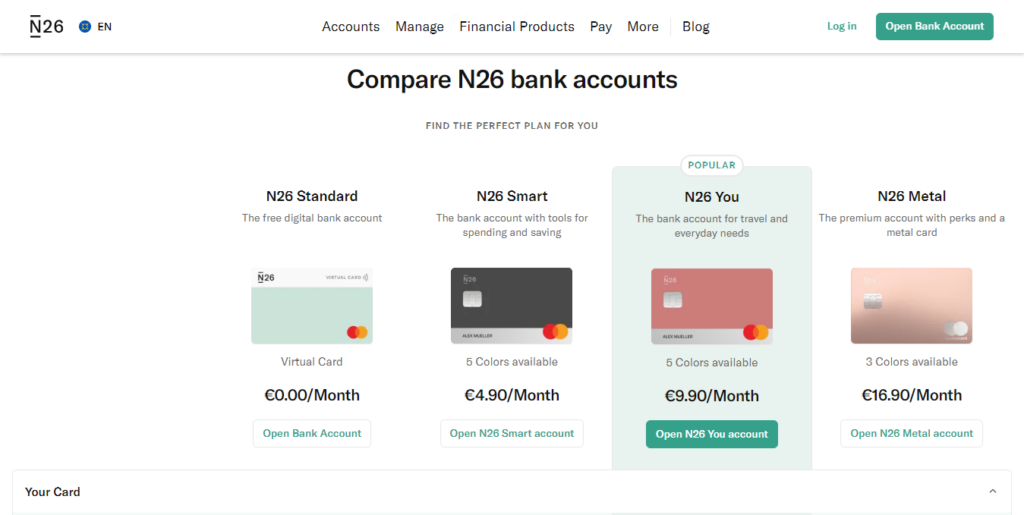

N26, on the other hand, offers you 4 plans: N26 Standard (free), N26 Smart (4.90€/month), N26 You (9.90€/month), and N26 Metal (16.90€/month).

Let’s briefly compare two of the plans so that you have a better idea of each bank’s offering.

For the purpose of this comparison, we will put the free plans side-by-side, as well as the Revolut Premium and the N26 You premium account plans.

These are popular plans.

• Revolut Standard Vs. N26 Standard

Revolut Standard (Free) | N26 Standard (Free) |

• Virtual debit card and optional physical card (shipping costs apply) | • Virtual debit card and optional physical card for 10€ |

• Revolut Premium Vs. N26 You

Revolut Premium (7.99€) | N26 You (9.90€) |

• Personalized premium card | • Debit Mastercard in your choice of 5 colors |

More expensive plans from both banks offer fewer restrictions and limitations when it comes to payments and withdrawals.

The biggest difference between Revolut Metal and N26 Metal is that you get cashback on Revolut card payments (0.1% in Europe and 1% everywhere else).

With N26 you only have cashback on business accounts and the Metal plan is likely not worth it compared with the N26 You, since the offering is pretty similar.

Both Revolut and N26 offer business accounts.

Revolut Pro is a service made for freelancers, where you can manage your own business expenses, create and send invoices, and request professional payments through a link or QR code.

You can get this plan through your personal account, and benefit from up to 1.2% of cashback on purchases with your Pro card.

The British company also offers Revolut Business, similar to Pro, but targeted at companies instead of individuals.

N26 Business plans are made for freelancers and self-employed people (not for companies), with the extra benefit of having cashback every month on all card purchases of 0.1%.

The remaining conditions are the same as the personal plans. However, unlike Revolut, you can only have either a personal account or a business account. Not both.

Fees & Charges

There are a few fees to consider for both banks.

We recommend you take a look at the full price list here (Revolut) and here (N26) to avoid missing any hidden costs.

In both cases, you can send and request money between N26 and Revolut users for free and instantly within the app. This makes money transfers a very easy process that will help you save money.

Now, back to the fees.

a) ATM Withdrawals

With Revolut, in the Standard and the Plus plans you can only take up to 200€ a month for free. Above that, Revolut charges a 2% withdrawal fee.

With Premium, Metal, and Ultra, you can withdraw more money per month (from 400€ to 2000€ depending on the plan), but there is still a 2% fee after you reach the limit.

N26 also has limitations for domestic withdrawals, as you can only make a certain number of ATM withdrawals (from 3 to 8, depending on the plan), before incurring a 2€ withdrawal fee.

Still, it’s easier to get around the limitations if you make large withdrawals, which you cannot do with Revolut.

N26 withdrawals in the EU are free without limitations.

Withdrawing money from abroad in other currencies is free in the “You” and “Metal” plans, but there’s a 1.7% fee for the “Standard” and “Smart” plans.

b) International Transfers

Local Revolut payments and payments within the Single Euro Payment Area (SEPA) are free. In the Standard and Plus plans it’s limited to 1000€ a month.

On the weekends, there is always a 1% fee for international transactions on top of the interbank exchange rate that Revolut uses.

When it comes to international payments outside SEPA, a fee applies (except with Ultra, which is always free).

This fee is variable, depending on the amount you are paying and the currencies in question, and it goes between 0.30€ and 5€. You can check it here in more detail.

Premium and Metal users have a 20% discount and 40% discount respectively on international transfers.

When it comes to N26, cashless payments worldwide are free in all plans, with no foreign currency surcharge (they use the Mastercard exchange rate).

Transfers within and among EEA states and Switzerland in Euro are free.

N26 integrates Wise for international money transfers, so you can send and receive money with very competitive currency exchange rates.

c) Additional Cards

Revolut charges 6€ plus card delivery costs to replace a Standard card.

With the paid plans, the first two cards are free (shipping costs apply), and you have a replacement card every year.

Additional cards will cost you 10€. Additional metal cards cost 40€ and Ultra cards cost 50€.

As for N26, additional cards are only available to users with a premium account, and they cost 10€.

Bank Cards

Both Revolut and N26 cards are widely accepted, as they work with Mastercard and Visa.

Revolut offers you a prepaid debit card, either a Mastercard or a Visa.

You can charge a specific amount to your Revolut account from your main bank account with a regular bank transfer, and you can use it normally like a debit card up to the loaded amount.

You can also conveniently link your virtual card to Apple Pay and Google Pay wallet for easier online payments.

Revolut also offers disposable virtual cards for safer online shopping.

Physical cards can be customized, but only for paid plan Revolut customers.

All N26 cards are debit Mastercards.

As a debit card, your Mastercard is connected to your bank account, so the money you spend will be immediately deducted from your N26 bank account.

If you’re a premium customer, your N26 Mastercard is included with your membership, and you can pick between 5 colors.

For Standard members, you have a virtual card, and you can order a physical card for 10€. Virtual cards can be linked to Google Pay and Apple Pay.

Neither Revolut nor N26 currently offer credit cards in Germany.

You can apply for a loan with both banks though (up to 50000€ with Revolut and 25000€ with N26). N26 also offers the possibility of an overdraft up to 10000€ (Revolut doesn’t).

Cashback Benefits

Regarding cashback perks, Revolut stands out more in this area, as it offers cashback on booking with Revolut Stays up to 10%, depending on the plan.

There is also a cashback on all card payments for Metal and Ultra users (up to 0.1% in Europe; 1% everywhere else).

N26, on the other hand, does not offer cashback rewards on personal accounts.

On business accounts the digital bank offers you 0.1% cashback on all card payments and 0.5% for Business Metal customers.

Perks & Benefits

Both fintechs offer several online banking benefits that make life easier for their users.

The biggest advantage of Revolut is the multicurrency accounts, allowing transactions between over 25 foreign currencies.

However, with the integration of Wise on the N26 app you can easily send money abroad in different currencies as well.

The main perks of Revolut include global medical insurance, winter sports insurance, delayed flight, lost or damaged luggage insurance (Premium, Metal, and Ultra plans), as well as everyday insurance for purchases (except on the Standard plan).

You can also benefit from personal liability insurance and car hire excess insurance (Metal and Premium plans), trip and event cancellation insurance, plus airport lounge access (discounted on Premium and Metal; unlimited on Ultra).

With Revolut you can have a joint account with another person and split bills more conveniently, a savings account, as well as have access to a Revolut junior account for people between 6 and 17.

To top this off, you also have access to partner subscriptions (Financial Times Digital Premium, WeWork, NordVPN, and more) on Premium, Metal, and Ultra plans, plus trading of stocks, commodities, and cryptocurrencies.

With N26, the premium plans N26 You and N26 Metal offer you travel insurance, including medical emergencies, personal liability, baggage coverage, daily insurance, travel delay and cancellation, and trip interruption.

The Metal plan also offers phone coverage and purchase protection.

The German bank also gives its customers savings accounts, where you earn interest on your savings; up to 10 sub-accounts with unique IBANs to organize and save your money; joint account with up to 9 other people; discounts on partner brands; and banking solutions such as overdrafts and personal loans.

All in all, bank accounts from both N26 and Revolut have strong features that make banking easy and convenient for everyday use and traveling.

Investments

When it comes to investment options, Revolut clearly stands out over N26.

Revolut allows you to have a trading account to invest in stocks, shares, cryptocurrencies, and precious metals through the app. You can invest in thousands of shares at your own risk, starting from just 1€.

You can make a certain number of commission-free trades, within your plan’s monthly allowance (1 trade for Standard, 3 for Plus, 5 for Premium, and 10 for Metal and Ultra). After that, fees apply (0.25% for all the plans except Ultra, which has a 0.12% fee).

You can also buy, sell, and transfer cryptocurrencies such as Bitcoin easily through the app.

N26, on the other hand, only offers crypto trading at the moment. There are over 180 coins available to sell and buy.

N26 Metal customers will be able to make transactions with a 1% transaction fee applied for trading Bitcoin and 2% for all other available cryptocurrencies. All other customers have a 1.5% fee on Bitcoin and a 2.5% fee for other cryptocurrencies.

Mobile App

Both N26 and Revolut have very user-friendly mobile apps with sleek interfaces, making digital banking a seamless experience.

Revolut allows you to send money to other Revolut users instantly with no charges and without having to know their bank details.

You can easily track and analyze your spending and set up direct debits, and you will get instant push notifications every time you make a payment.

You can also organize and save your money with a feature called “Pockets” (which replaced Vaults).

It’s also possible to have a “Group Pocket” where a family or group of friends save money collectively towards a goal.

On the app, you can also easily access trading options, design your physical card, and create accounts for your children.

N26 has similar mobile features, including instant transfers to other users, real-time push notifications, and categorized spending insights.

The “Spaces” feature allows you to create virtual sub-accounts for specific savings goals, which you can also share with other users (with a premium account).

With the integration of Wise on the app, you can also send money in more than 38 currencies.

Security Features

Both banks put in place strong security features to protect your money.

They have very similar features, which include providing a PIN, biometrics (like fingerprint recognition), and SMS code to access your accounts.

If you suspect compromised card privacy, you can easily freeze and unfreeze your card.

You also receive instant notifications about each transaction and you can disable contactless payments if you wish.

Both Revolut and N26 also have location tracking to detect if the card is being used in a different location from where you are.

Revolut has an edge here, as it introduced disposable virtual cards for single use, making online shopping a safer experience.

Both N26 and Revolut have had complaints from customers about their accounts being wrongly suspended because of anti-fraud detection systems.

Customer Service

Based on Truspilot’s rating, it seems like Revolut holds a lead when it comes to customer service.

With 4.3 stars, Revolut gathers better feedback than competitor N26, which currently has 3.7 stars on the rating website.

With Revolut, you can get support through the in-app chat option, where you will talk with a chatbot, and if needed, a live agent.

Ultra customers have access to their 24/7 outbound phone support service, which you can access through your Revolut app, currently in English only.

With N26, you can reach one of their agents through the website, or by using the chat function in the app. They are available from 7 am to 11 pm CET, every day.

There is also a phone line, but only for premium members.

You can also send them an email or reach out to Neon, an automated N26 Chatbot, 24 hours a day. The service is also available in English.

One of the most recurring complaints about both banks is that the support is sometimes unresponsive or simply unhelpful.

This is not uncommon for online banks without physical branches.

Verdict: Which One Is Better?

Both online banks showcase strong features with competitive prices and user-friendly services.

Based on our research, N26 can be a better option for fee-free foreign transactions. It’s also a better option when it comes to cash withdrawals worldwide, as Revolut is more limited in this matter.

The German digital bank also offers access to overdrafts if needed.

Overall, if you are looking for low-cost banking features, N26 is probably the better option for you.

There is also the advantage of having a phone line for premium users, which Revolut doesn’t have.

Revolut, on the other hand, is still a great card for travelers and digital nomads as it offers good exchange rates. However, you need to be aware of weekend fees.

For digital payments, Revolut Premium is a great option because of its cash-back rewards on purchases.

If you are looking for investment opportunities, Revolut will also be the best option for you, as N26 is way more limited here.

Customer satisfaction also seems to be higher with Revolut based on online reviews.

All in all, both banks offer great features that make everyday banking easy. The best option for you will depend on your preferences and individual needs.

FAQs

Revolut is cheaper than N26.

Although both offer free bank accounts, the paid plans of Revolut start at 2.99€, while N26 starts at 4.90€ a month.

However, when it comes to banking fees, N26 may turn out cheaper in the long run.

Revolut is not necessarily better than N26, although it outperforms it in certain aspects, especially when it comes to the multicurrency aspect, the cashback rewards, and the investment options.

N26 is better for some banking actions, such as ATM withdrawals or international transfers through Wise.

Yes, Revolut has a banking license in the EU and offers deposit protection up to 100,000€, just like N26, which is licensed by the German Central Bank.

Conclusion

Both Revolut and N26 offer competitive online banking services with advantageous features for expats.

While N26 stands out for fee-free foreign transactions and worldwide cash withdrawals, Revolut excels with its multicurrency accounts, cashback rewards, and investment options.

Both banks have great mobile banking features, so ultimately the choice will come to your personal preferences and needs.

Hopefully, this article provides you with enough information to make the best decision for yourself.