If you’re looking for a good credit card in Germany and are considering one from Barclays, you may be unsure about the conditions, prices, and what exactly they offer.

Barclays credit cards are very popular in the German market and, generally, they are reviewed positively. But what exactly are these credit cards offering, and what are their pros and cons?

In this article, we will compare in detail the Barclays Visa, Barclays Gold Visa, and Barclays Platinum Double, reviewing their features, benefits, and fees so you can see for yourself if one of these cards is the right match for you.

We cover in this article:

Comparison Table

Barclays Visa | Barclays Gold Visa | Barclays Platinum Double | |

Annual Fee | 0 € | 59 € | 99 € |

Cash Withdrawal fee | 0% | 0% in the Eurozone. 1.9% Otherwise | 0% |

Foreign currency fee | 0% | 1.90% | 0% |

Effective Interest Rate | 23.74% | 23.74% | 23.74% |

Flexible Repayment | Yes | Yes | Yes |

Trip cancellation and trip interruption insurance | ✘ | Yes Up to 5,000 euros | Yes Up to 10,300 euros |

International travel health insurance | ✘ | Yes | Yes |

Rental Car insurance | ✘ | ✘ | Yes |

Product protection and extended warranty | ✘ | ✘ | Yes |

Partner card | Free (Up to 3 cards) | 29.00 € | Free (Up to 3 cards) |

24-hour emergency hotline | Yes | Yes | Yes |

Google & Apple Pay | Yes | Yes | Yes |

3-D Secure | Yes | Yes | Yes |

Bank app | Yes | Yes | Yes |

Contactless payments | Yes | Yes | Yes |

Customer service In English | May be limited | May be limited | May be limited |

Which Is The Best Barclays Credit Card For You?

The best Barclaycard for you will depend on your personal circumstances, preferences, and needs. These are our recommendations.

Quick Summary

- The best card for everyday use: Barclays Visa

Barclays Visa is a great option for anyone who wants a card for everyday use. Although it doesn’t offer any exciting bonuses, it is a reliable card with no annual fees and no fees to withdraw cash and for foreign transactions.

- The best card for traveling: Barclays Platinum Double

The premium of Barclaycards is the best option for anyone who travels with some regularity. It offers free payments and withdrawals worldwide, as well as a comprehensive travel insurance package of up to 10,300€, making it the best travel card companion.

- The best card for students: Barclays Visa

Students who want a credit card but don’t want to have a lot of extra costs will find it beneficial to have a completely free card. This visa is the best option here.

- The card with the best bonuses: Barclays Platinum Double

Although Barclaycards don’t have a big focus on rewards and bonuses like other cards, the Platinum Double has benefits related to travel and rental car insurance, as well as product protection and extended warranty on some appliances paid by the card.

Best Barclays Credit Cards In Germany 2024

Barclays Bank is a British Universal Bank headquartered in London and providing services in more than 50 countries.

Before reviewing each card, there are a few characteristics that are the same for all of the 3 cards. Let’s take a look:

a) Credit Limits

All three Barclay credit cards offer a credit line of up to 10,000€.

The credit limit, which is the amount the bank will lend you, will depend on your credit history and some other factors.

The limits for cash withdrawals in Germany and other countries are a max. 500€/daily.

b) Repayment Options

For all cards, you can keep your current account. A monthly repayment via direct debit is preset to 3% of your total balance or at least €30. You can change these settings in the app.

You receive your bill at the end of every month and can decide for up to 4 weeks how you want to settle your balance.

Barclaycards give you flexibility when it comes to repaying your balance. The options are:

- Flexible Installments – you decide how quickly you will pay your monthly bill. You can adjust your repayment amount in the app. It will then be debited from your bank account by direct debit.

- Fixed Installments – you determine a payment plan with fixed installments.

- Pay the full amount at once (recommended) – you can pay the full amount each month, and enjoy an interest-free period of 8 weeks.

Important

Be cautious, because if you decide to make partial repayments, high interest rates will accrue.

c) Digital Solutions

Barclays Bank offers modern digital solutions for all its cards. Online banking is made easy through the app. Unfortunately, the website is only available in German.

In the Barclays Mobile App, you can:

- Access your card PIN securely at any time and change it if you want

- Temporarily block your card if you lose it

- Call via app to their customer service (which can be faster)

- Use face recognition to log in

- Do your repayments and transfers

- Overall, have your finances under control.

The card provider also offers the option for contactless payment on all cards, and you can activate your card for both Google and Apple Pay.

d) Security Features

Barclays keeps everything as safe as possible.

You are always informed about every transaction of 25€ or more via message or email. And you always have to confirm your online payments via SMS.

The app also allows you to change your PIN, report your card if it’s lost or stolen, and temporarily block it. The provider also uses the 3D secure Visa protocol for extra security on your online purchases.

Now, let’s take a more detailed look at how each of the Barclays credit cards performs in terms of fees and benefits, where you’ll find some differences.

1. Barclays Visa Credit Card

Barclays Visa is completely free, meaning it doesn’t have an annual fee, no fee to withdraw cash, no fee for foreign currencies or any transactions, domestic or abroad (ATM fees may apply).

Barclays Visa

| Annual Fee | €0 |

| Effective Interest Rate | 23.74% |

| Domestic payments | €0 |

| Payments abroad | €0 |

| Domestic withdrawals | €0 (Above €50) |

| Foreign withdrawals | €0 (Above €50) |

| Limits for cash withdrawals in Germany and abroad | Up to €500 Daily |

| Credit Card limit | Up to €10,000 |

| Partner card | €0 (Up to 3) |

Permanent €0 annual fee.

Free of charge for foreign currencies.

Free of charge to withdraw money (ATM fees may be present).

Flexible repayment (No charges for up to 2 months).

0% installment purchases for 3 months up to €500.

Apple & Google Pay are available.

Free withdrawals only from €50.

No traveling insurance included.

- 3 free partner cards for family and friends.

- 5% discount on travel packages from selected partners.

- €500 emergency cash in case your credit card gets lost or stolen.

There are no extra bonuses like travel insurance, but as an additional benefit, Barclays gives up to 3 partner cards for family and friends at no extra cost.

2. Barclays Gold Visa Credit Card

At 59€ a year, the Barclays Gold Visa gives you a few extra features compared to the previous card.

Barclays Gold Visa

| Annual Fee | €59 |

| Effective Interest Rate | 23.74% |

| Domestic payments | €0 |

| Payments abroad | 1.9% fee (Outside the Eurozone) |

| Domestic cash withdrawals | €0 (Above €50) |

| Foreign cash withdrawals | 1.9% fee (Outside the Eurozone) |

| Limits for cash withdrawals in Germany and abroad | Up to €500 Daily |

| Credit Card limit | Up to €10,000 |

| Partner card | €29 |

Zero fees in the Eurozone.

Travel insurance included.

Flexible repayment (Interest-free for up to 2 months).

0% installment purchases for 3 months up to €500.

Apple & Google Pay are available.

A foreign transaction fee of 1.9%

No rental car and liability insurance.

Travel cancelation or interruption insurance coverage only up to €5,000

Partner card is not free (€29).

- Travel health insurance and trip cancellation/interruption insurance for you and up to 6 family members.

- International travel advice and emergency hotline.

- 5% discount on travel packages from selected partners.

- €500 emergency cash in case your card gets lost or stolen.

The main extra of this Barclaycard Gold is certainly the travel insurance: Gold Visa includes travel health insurance (up to 1 million) and trip cancellation/interruption insurance (up to €5,000) for you and up to 6 family members.

Trip cancellation or interruption insurance is tied to the card, so you have to pay with it to benefit.

Important

Always look at the conditions of the travel insurance.

In this instance, the insurance covers you on trips for up to 42 days. However, they need to begin and end in the same country (for example, Germany, in your case).

One of the main downsides of this Barclaycard Visa is that it charges a 1.9% fee on foreign currencies outside the Eurozone.

3. Barclays Platinum Double Credit Card

At €99 a year, the attractive Barclays Platinum Double offers you a comprehensive travel insurance package combined with the benefit of no domestic or abroad fees where the currency doesn’t matter.

Barclays Platinum Double

| Annual Fee | €99 |

| Effective Interest Rate | 23.74% |

| Domestic payments | €0 |

| Payments abroad | €0 |

| Domestic cash withdrawals | €0 (Above €50) |

| Foreign cash withdrawals | €0 (Above €50) |

| Limits for cash withdrawals in Germany and abroad | Up to €500 Daily |

| Credit Card limit | Up to €10,000 |

| Partner card | €0 (Up to 3) |

Zero transaction fees, domestic and abroad.

Extended warranty (Electronics and appliances) and product protection.

Flexible repayment (interest-free for up to 2 months).

Up to 3 free partner cards.

0% installment purchases for 3 months up to €500.

Apple & Google Pay are available.

No special rewards or points programs.

€99 annual fee.

- Comprehensive travel insurance package with high coverage amounts.

- Trip cancellation/interruption insurance.

- Rental car and liability insurance.

- Travel advice and emergency hotline.

- 5% discount on travel packages from selected partners.

- €500 emergency cash in case your card gets lost or stolen.

The insurance policies included with this credit card are:

- International travel health insurance (Up to 1 million)

- Trip interruption and trip cancellation (Up to €10,300)

- Rental car insurance (Up to €100,000)

- Liability insurance (Up to 1 million), for trips up to 90 days.

Except for car rentals, the remaining insurance is independent of the use of the Platinum Double, a benefit you don’t find in many other banks.

Money transactions are not an issue either for this premium Barclaycard, since you can make payments and withdrawals everywhere at no extra charge.

On the downside, and compared to other premium cards, this card has no special rewards program or point collection.

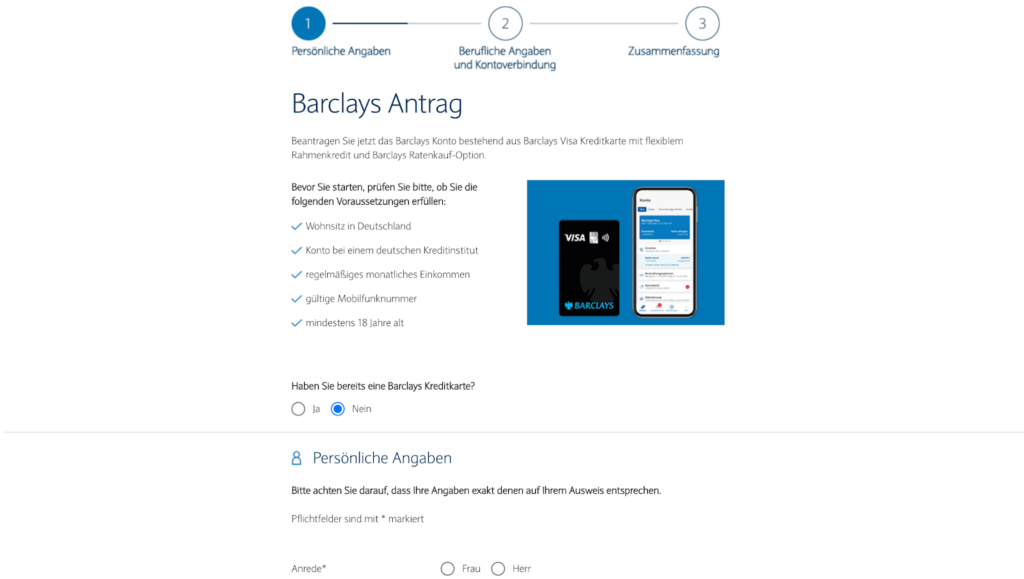

How Do You Apply For A Barclays Credit Card In Germany?

The requirements to get a Barclays card include:

- Residence in Germany

- A German bank account

- Regular monthly income

- Valid mobile number

- At least 18 years of age

- A positive Schufa check

To apply, you have to fill out an application form on the website, and then use a video ID to prove your identity.

During the application, you have to provide personal information such as your address and contact details, as well as information about your living situation and employment relationship.

Important

The approval of your application will depend on your borrowing history, so you may get rejected if the Barclaycard bank thinks you pose a financial risk.

If you don’t get rejected, you will receive your card by post around a week after applying for it.

FAQs

Barclaycard is a brand of Barclays Bank. Barclays Visa is a product of Barclays and is a Barclaycard, so there isn’t really a difference here.

Barclays visa cards have a good reputation in Germany and are quite popular.

The bank provides a good service, and the cards have generally favorable conditions. It’s a card we can recommend.

Barclays Visa card is a revolving credit card, meaning a card with an open-ended credit line.

Conclusion

Barclays offers reputable credit cards with attractive features. The Barclays Visa, Barclays Gold Visa, and Barclays Platinum Double offer you financial flexibility, security, and digitized services.

The best Barclaycard for you will depend on your personal circumstances and preferences.

While the free Barclays visa is great for everyday use, the Gold and especially the Platinum card are more suited for people who travel regularly.

Hopefully, this article provided you with a clearer picture of what Barclays cards bring to the table, so you choose with confidence the best option for you.