Virtual cards are the future (and present) of payments. They’re fast, convenient, and highly secure.

But how do you find the best one in Germany when you can’t understand the features and T&Cs of all?

Well, this 2023 guide will simplify your quest for the ideal virtual credit card.

In this detailed article, we’ll delve into the world of virtual cards, how to find the best one, and what are the most popular virtual credit card options available in Germany.

Whether you’re eager to optimize your online transactions or establish your creditworthiness, we’ve got you covered. So, let’s jump in!

We cover in this article:

Comparison Table

Revolut Virtual Cards | Bunq Virtual Mastercard | Vivid Virtual Visa | VIMpay Virtual MasterCard | |

Issuing Fee | €0 | €0 | €1 | €0 |

Monthly Fee | €0 | €8.99 | €0 ** €3.90 per month if inactive | €4 |

Number Of Virtual Cards | Unlimited | 25 | Unlimited (With issuance fee) | Unlimited |

Foreign Transaction Fee | €0.3 to €5 | The real Mastercard exchange rate + 0.5% (network fee) | Free | Free |

Multiple Currencies | Yes Up to 36 | Yes Up to 16 | Yes Up to 40 in Standard Plan | No Only Euros |

Limit | €10,000 | Unlimited | Unlimited | €10,000 |

Cashback | 0.1% to 10% | 1% to 2% | 4% to 10% | No |

Customer Support | No Live Support 24/7 in-app and call support in paid plans | 24/7 in-app support | No Live Support | 24/7 in-app support |

English Customer Support | Yes | Yes | Yes | ✘ |

Insurance Benefits | Yes | Yes | ✘ | ✘ |

English Website | ✘ | Yes | ✘ | ✘ |

Free Trial | ✘ | Yes | Yes | ✘ |

Which Is The Best Virtual Credit Card For You?

There is no one-size-fits-all answer for this. The best virtual card depends on your requirements and priorities.

You need to decide what’s your priority. This could be a user-friendly app, the ability to hold multiple currencies, English customer support, or having access to insurance and discounts.

Quick Summary

What Is A Virtual Credit Card?

A virtual credit card is like a regular credit card, but it only exists on your computer or phone.

All the important details of the card, like the virtual credit card number, CVV, and the name on the card, are digital. This makes it really easy to create new virtual cards when you need them.

You can usually make these virtual cards through your bank’s app. Sometimes, you can create a lot of them, and in some cases, you might even get unlimited virtual cards with your banking plan.

The best part is you can get a virtual credit card instantly. You don’t have to wait for a physical credit card to arrive in the mail. This means you can use it for online shopping and payments right away.

How Do Virtual Credit Cards Work?

Well, they operate much like physical credit cards but with a digital twist, specifically designed for online transactions.

You can use them to buy things on the internet or even make payments through your smartphone, as long as your virtual card provider supports mobile wallets like Google Pay or Apple Pay.

And are they legal and safe? Yes, they’re completely legal and issued by trustworthy companies, just like normal credit cards. The difference is that they’re all digital.

Plus, some virtual cards come with extra security features, like two-factor authentication, to keep your online purchases safe. Some people even think they’re safer than regular cards because they can’t be stolen from your wallet – they only exist online!

How Popular Are Virtual Credit Cards In Germany?

Fintech and digital banking solutions are on the rise in Germany, and this trend is leading to an increased interest in virtual credit cards.

People in Germany often turn to virtual credit cards for online shopping and for making contactless payments in places that accept e-wallets like Google Pay or Apple Pay.

However, when it comes to in-store purchases, cash, and traditional physical debit and credit cards continue to be the preferred and more commonly used payment methods.

Advantages And Disadvantages Of A Virtual Credit Card In Germany

Now, let’s look at the pros and cons of using a virtual credit card in Germany.

Advantages of Virtual Credit Cards

- Readily Available

Virtual cards are delivered instantly to your email inbox, eliminating the wait for a physical card to arrive in the mail and enabling immediate use.

- Security

Online credit cards offer increased safety and reliability, as they are more challenging to steal compared to physical cards in a wallet. However, it’s crucial to exercise caution when entering your credit card information on websites.

- Flexibility

Virtual credit cards offer unexpected flexibility, thanks to popular e-wallet apps like PayPal, Google Pay, and Apple Pay. You can order multiple virtual cards based on your needs, and different providers offer various services and customization options.

- No New Account Needed

You don’t need to open a new bank account to use virtual credit cards. If you already have an existing account, you can easily load funds onto your new virtual card by transferring money.

Disadvantages of Virtual Credit Cards

- Not Traveler-Friendly

Virtual credit cards may not be the ideal choice for traveling or going abroad. While they work well for booking and paying for hotels online, some physical card transactions may still be necessary upon arrival, such as hotel deposits.

- No Cash Withdrawals

Virtual credit cards cannot be used for cash withdrawals at ATMs, limiting their functionality to online shopping and money transfers.

- High Fees

Depending on your provider, fee structures can vary significantly.

Some providers charge a percentage of the card balance for inactivity, while others require an annual fee.

So, it’s essential to review the fee details before signing up, as providers are required to disclose these fees in compliance with German consumer protection laws.

Now, let’s look at the best available options in Germany.

Best Virtual Credit Cards in Germany 2024

1. Revolut Virtual Cards

Revolut, established in 2015, has rapidly evolved from a travel card offering competitive exchange rates into a comprehensive digital bank with banking licenses in multiple countries.

It has over 35 million private customers and 500,000 business customers.

Revolut Virtual Cards

| Credit Card Plan Options | 5 (Standard, Plus, Premium, Metal & Ultra) |

| Interest Rate | 0% if you pay within 2 months Starts at 15% (Varies by repayment period) |

| Fee-Free ATM Cash Withdrawals | €200/Month or 5 withdrawals |

| Currency Exchange Without Additional Fees (On Weekdays) | Starts at €1,000/Month |

| Cashback On Accommodation | Up to 3% for Standard and Plus plans 5% for premium Up to 10% for Metal and Ultra |

| Travel Benefits | Yes But mostly for the Ultra subscription plan |

Customer support in English.

Can hold multiple (over 29) currencies.

Insurance benefits and discounts with paid plans.

Customizable spending limits.

Limited customer support in the free plan.

No German IBAN.

- You can get multiple virtual cards.

- Apart from the standard/default, paid plans also give you the first two physical cards for free.

- Up to 0.1% cashback on all payments in Europe and the UK, and 1% everywhere else.

- Priority customer support as an Ultra account holder.

- Avail 20% and 40% discount on international transfers. Plus, you get free international transfers with the Ultra plan.

- Get discounted and unlimited airport lounge access with paid plans.

- Travel, medical, car, luggage damage, personal liability, and other insurances with paid Revolut plans.

- Get 3% to 10% cashback when you book accommodations with Revolut cards.

It’s actually a debit card, but you can apply for a credit limit of €10,000 and activate your virtual card within minutes.

What’s more amazing is that you can get an extended grace period of up to 2 months when you repay in full before the next calendar month ends.

What’s the interest rate?

Well, here’s how the Revolut website explains it:

A credit limit of €4,400 comes with a fixed annual interest rate of 15%. If you utilize the credit limit over a period of 3 months, the total amount repayable would be €4,566.52, resulting in an Annual Percentage Rate (APR) of 16.1%.

How will you pay back?

Now, your monthly payment will be 5% of the utilized credit, but not less than €5, in addition to any accrued interest.

Thankfully, if you choose not to use the credit, no monthly payments or interest charges will apply.

However, there is a drawback: a Revolut account won’t get you a local German IBAN. Plus, the Revolut credit card is currently only available in the USA, Poland, Lithuania, and Ireland.

But thankfully, debit cards (both virtual and physical) are available in Germany.

2. Bunq Virtual Mastercards

Bunq, the innovative Dutch bank, is redefining the way we manage our finances in the digital age. With a European banking license based in the Netherlands, bunq extends its services across many European countries, including Germany.

As a “smartphone bank,” bunq offers a seamless, user-friendly experience, allowing you to open a bank account in just minutes via your mobile device.

Bunq Virtual Mastercards

| Bunq Easy Money | Bunq Easy Green | |

| Monthly Fee | €8.99 | €17.99 |

| Physical Cards | 3 | 3 |

| Virtual Credit Cards | 25 | 25 |

| 1% Cashback (On restaurants and bars) | Yes | Yes |

| 2% Cashback (On public transport) | No | Yes |

| Apple & Google Pay | Yes | Yes |

| Receive MassInterest | 1.56% Annually, paid weekly | 1.56% Annually, paid weekly |

| Receive MassInterest for Multi-Currency Savings (USD) | 3.71% Annually, paid weekly | 3.71% Annually, paid weekly |

| Sending/receiving (instant) payments or sending (instant) requests | Free | Free |

| Card Payment in Foreign Currency | The real Mastercard exchange rate + 0.5% (network fee) | The real Mastercard exchange rate + 0.5% (network fee) |

| 24/7 Online Support | Yes | Yes |

| Free 30-Day Trial | Available | Available |

You can hold 16+ currencies in your Bunq account.

English website and customer support.

Quick sign-up with No SCHUFA or credit check.

Funds protection up to 100,000 even as a digital bank.

Free 1-month trial.

High monthly fees.

- Sub-Accounts are like little pots where you can easily divide your money. With an Easy Money or Easy Green account, you can create up to 25, one for each section of your budget.

- A tree planted for every 100 euros spent by an Easy Green user.

- Zero foreign exchange fees.

Bunq offers virtual MasterCard credit cards that come with amazing features and benefits.

How can you get them?

Well, bunq offers four different plans for both personal and business accounts. (We’ll stick to Personal accounts only for now.)

The four plans are:

- Easy Savings

- Easy Bank

- Easy Money

- Easy Green

Virtual credit cards are only accessible with Easy Money and Easy Green accounts.

3. Vivid Virtual Visa Card

Vivid Money is a rather new entrant in the German neobanking industry that started in 2019. However, it has quickly made a name for itself because of its cashback programs.

Vivid Virtual Visa Card

| Vivid Standard | Vivid Prime | |

| Monthly Fee | €0 ** €3.90 per month if inactive | 1st month free After that €9.90 |

| Free Virtual Credit Card | No | Yes |

| Virtual Card Issue Fee | €1 | 1 for free €1 after that for each card |

| Virtual card usage monthly fee | Free for 1 card €0.99 for each additional card | €0 |

| Local and foreign payments and transfers | Free | Free |

| Pocket accounts (Sub-accounts) | 3 | 15 |

| Currencies in Pocket accounts | Up to 40 | Up to 107 |

| Cashback | 4% to 20% Up to €20 per month ** Not available on all brands | 4% to 20% Up to €100 per month |

| Live customer support chat | No | Yes |

English website.

15 Sub-accounts with unique IBANs.

Live chat support.

Free foreign currency transactions.

Can hold up to 107 different currencies.

Free trial available.

No credit history or SCHUFA check.

Monthly inactivity fee (€3.90) applies even if you’re on the standard plan

A high monthly fee of €9, if you want premium benefits.

It’s a new bank. They’re still developing their terms and policies.

- Complete spending analytics and control. You can set limits for different shopping categories and get instant notifications if you exceed them.

- Up to 15 sub-accounts (pockets) with unique IBANs for saving your money.

- Drag-and-drop money between different pockets without incurring any fees.

- Hold as much as 107 currencies in your account and spend anywhere without foreign transaction fees.

- Try all the premium benefits of Vivid Prime for a month for free.

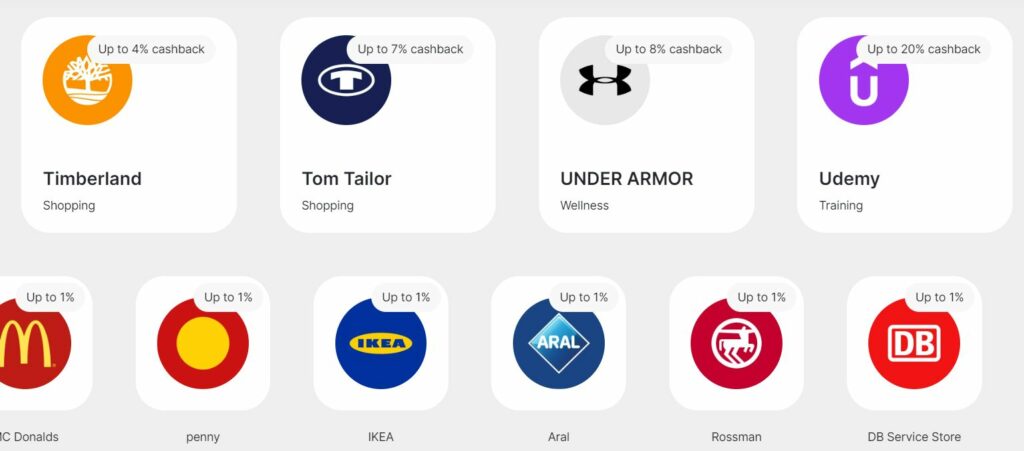

Each month, you specify the industry categories for which you would like to receive cashback. For example, you can choose from food, clothing, furniture, and others and have different percentages of cashback for each. (See the below image for an example)

With its Standard and Prime plans, you can choose up to three and four categories, respectively.

However, there’s one catch. You will only be eligible for cashback if you have a balance of at least €1,000 or have €100 in assets or investments.

But this one little caveat doesn’t take away the flexibility and freedom that Vivid offers. You get multiple sub-accounts, known as Money Pockets (or pocket accounts), which help you store multiple currencies and use them for savings.

Vivid automatically detects the payment currency and ensures that the money always comes from the correct Money Pocket. This way, you don’t accidentally pay more for the exchange rate or have to constantly connect your card to the right pocket.

Moreover, Vivid offers incredibly low commission fees for investing in shares and low fees for investing in cryptocurrencies. So, it’s an excellent choice if you’re into investing in these commodities.

4. VIMpay Virtual Mastercard

VIMpay is a Freising-based unique startup in Germany that provides cashless payments for wearables.

Yes. The company provides an online platform that lets you make payments via the app itself, plus wearables like Garmin smartwatch, bracelet, keychain, and QR codes.

VIMpay Virtual Mastercard

| Beginner Plan | Lite Plan | Basic Plan | Comfort Plan | Premium Plan | Ultra Plan | |

| Monthly Fee | €0 | €0 | €0 | €2 | €4 | €8 |

| Max. Card Balance | €150 | €150 | €2,500 | €10,000 | €10,000 | €10,000 |

| Additional Cards | 1 | 1 | 2 | Unlimited | Unlimited | Unlimited |

| Own IBAN | No | No | Yes | Yes | Yes | Yes |

| Checking Account | No | No | No | No | Yes | Yes |

| Send Money | No | Yes | Yes | Yes | Yes | Yes |

| Receive Money | Max. €150 | Max. €150 | Unlimited | Unlimited | Unlimited | Unlimited |

| Foreign Payments | No | Yes | Yes | Yes | Yes | Yes |

| Connect Multiple Bank Accounts | No | No | Yes | Yes | Yes | Yes |

| Manage All Banks | No | No | No | No | Yes | Yes |

| Foreign currency transaction | 2% | 2% | 2% | Free | Free | Free |

Multiple ways to use your VIMpay balance, including virtual card and wearables.

Send money to friends via VIMpay chat in real-time.

Send money via QR code.

Economical price of €4 per month for premium features.

Free trial available.

No English website and support.

Not exactly a credit card.

Some people find the app interface confusing.

- Use VIMpay as your salary account and use the balance directly.

- Link more than one account from Multiple banks with your VIMpay app.

- Get unlimited virtual cards.

- Access deals and discounts with the premium account.

- Connect your wearables with the VIMpay account and make contactless payments.

Besides the above modes for contactless payments, VIMpay also offers a virtual MasterCard, which is actually a prepaid credit card. This means you have to top-up the card before you can use it.

Also, VIMpay’s fintech is powered by PayCenter, which is a reliable e-money institution regulated by the Federal Financial Supervisory Authority (BaFin).

This means your card balance is protected in events of insolvency.

However, there are a few concerns about VIMpay. First, there aren’t many latest online reviews about the app, and the reviews from last year aren’t that good either.

Plus, although the website says that you get access to “the best offers in the deals world,” there aren’t any specifics listed on the website.

Things To Keep In Mind While Choosing A Virtual Credit Card In Germany

Now that we know some virtual credit card options let’s see what factors you need to consider before getting one.

Virtual Card Management

Evaluate the user-friendliness of the virtual card management platform (mobile app or website).

A well-designed app can enhance your overall experience in creating, monitoring, and managing virtual cards.

Plus, look at the features. Can you easily block and unblock your card? Can you control spending limits?

This usability factor is really important because it determines your future experience with the card. Reading reviews on different forums and Facebook groups can help you figure this out.

Associated Fees

Understanding the fee structure helps you see if the card suits your affordability and preferences in the long term.

So, check out all the fees like issuance fees, account management fees, monthly fees, and other transaction fees.

Customer Support

Consider the availability and responsiveness of customer support.

Ideally, look for a provider with English-speaking support and 24/7 service.

Prompt assistance can be crucial, especially in case of emergencies or account-related issues.

Interest Rates

Understand the interest rates associated with the virtual credit card.

While some virtual cards may offer interest-free periods, others may have fixed or variable rates.

Be aware of these terms so that you’re not surprised by unexpected costs.

Limits

Some cards have lower spending and credit limits. Choose the one that aligns with your spending behavior and shopping preferences.

Funding Options

Some companies offer “prepaid credit cards,” which only allow you to use your card balance.

In that case, you want to be sure you can easily top up your card. So, check out what funding options are compatible with your virtual card.

Security Features

We’re listing it last, but security takes precedence over everything, especially when making online payments. You want to keep your hard-earned money safe.

First of all, see if the bank or online money institute has a credible history or not.

Then, look for features such as biometric authentication, transaction alerts, and the ability to freeze or block the card in case of unauthorized access.

Whether you’re looking for a virtual debit card or credit card, these are some of the crucial things you need to consider to make the right choice.

FAQs

Commerzbank and N26 give virtual cards instantly. Commerzbank is a well-established physical bank, and N26 is a neobank with a complete German license.

Opening an account with Commerzbank may take some time, but you can get your virtual card as soon as you order it in the app.

Yes. You can use a virtual credit card for offline purchases (in stores) if you connect it with mobile wallets like Apple Pay, Google Pay, Garmin Pay, and others.

Yes. Virtual credit cards are typically safe to use.

These cards come with multifactor authentication factors, and your card information is only stored in your app.

So, there aren’t any chances of information leaks or unauthorized transactions unless you fall prey to phishing scams and leak your own information.