Picking a Deutsche Bank credit card in Germany can be puzzling, especially if you’re an English speaker living here. You want perks and benefits, but which card is the real winner?

In this blog, we’re breaking down all the options to help you choose. Whether it’s travel perks, cashback, or something else, we’ll explore what each card offers.

By the end, you’ll have a clear idea of which card suits you best for your life in Germany as an expat. Let’s find your ideal card in the Deutsche Bank lineup!

We cover in this article:

Recommendations

Quick Summary

- Best For General/Basic Use: Deutsche Bank MasterCard Standard

This card is for you if you just want to have a credit card for the sake of it. Since some hotel bookings, car rentals, and other online purchases require a credit card, you can get this basic card for a mere €39 per year.

As a bonus, you get insurance for the things you buy using this card,

- Best Overall: Deutsche Bank MasterCard Gold

The Gold card is for you if you travel occasionally or go on vacations every year. This card covers your travel health insurance and also lets you save 6% if you book your trip with Deutsche Bank’s partner agency.

You still get the goods protection insurance with it.

- Best For Travel: Deutsche Bank MasterCard Travel

If you travel frequently, this card can be your best friend. It comes with free foreign transactions, reduced fees on cash withdrawals abroad, and incredible travel insurance benefits.

Although it comes at a high cost, it does give you good value for money.

Comparison Table

Deutsche Bank MasterCard Standard | Deutsche Bank MasterCard Gold | Deutsche Bank MasterCard Travel | |

Annual Fee | €39 | €82 | €94 |

Annual Fee if you have a db BestKonto account | €39 | Free | €60 |

Family Member’s card | €15 | €46 | €60 |

Payments in EU/EEA (Euro) | Free | Free | Free |

Foreign Transaction fee (Made in foreign currencies) | 1.75%, min €1.50 | 1.75%, min €1.50 | Free |

Currency Conversion Fee | 0.5% | 0.5% | 0.5% |

Cash Withdrawals (In Euros or Within EU States) | 2.5% Min. withdrawal amount EUR 5.75 | 2.5% Min. withdrawal amount EUR 5.75 | 2.5% Min. withdrawal amount EUR 5.75 |

Cash Withdrawals (In Foreign Currency or outside the EU) | Above Fee + 1.75% Foreign Transaction Fee | Above Fee + 1.75% Foreign Transaction Fee | Above Fee + 0.5% Currency Conversion Fee |

Product Protection Insurance | Yes | Yes | ✘ |

Health insurance for international travel | ✘ | Yes | Yes |

Travel Cancellation Insurance | ✘ | ✘ | Yes |

Trip Curtailment Insurance | ✘ | ✘ | Yes |

Insurance Coverage For Lost/Late Baggage | ✘ | ✘ | Yes |

How Do You Apply For A Deutsche Bank Credit Card In Germany?

The application process for a Deutsche Bank credit card in Germany is simple and can be completed in a few easy steps.

But keep in mind the conditions before you can apply.

Requirements

You have to be:

- At least 18 years old

- Employed (not self-employed)

- Creditworthy with a good credit score or standing

- Holding a valid, current account anywhere within the EEA area.

Important

Remember, you can apply for a Deutsche Bank credit card even if you don’t have an account with them.

Got it? Let’s get to the application now.

Application Process

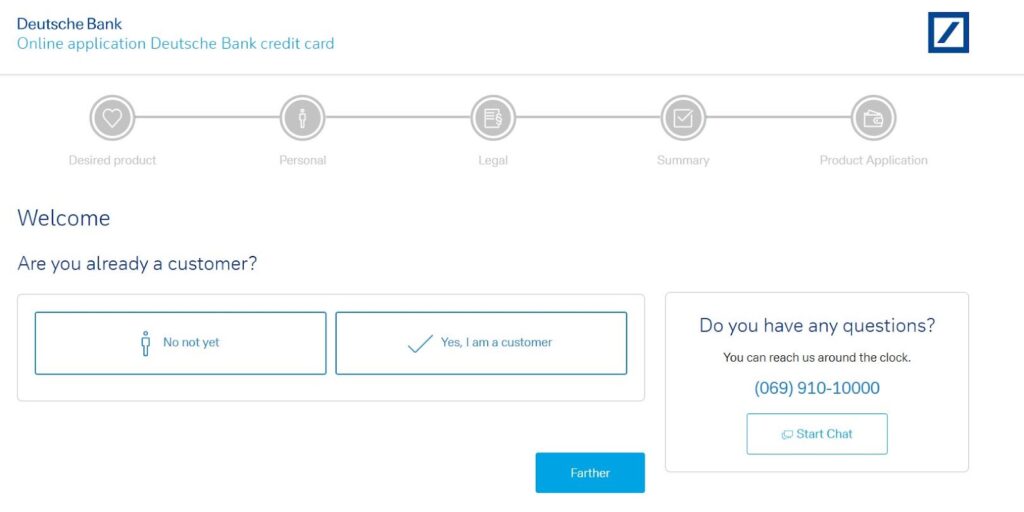

Step 1: Log on to the bank’s special English website version for residents in Germany.

Step 2: Go to “Cards” on the top menu bar.

Step 3: Under your desired credit card option, click “Apply now in German.”

You will reach the following page:

Answer whether you’re already a customer or not.

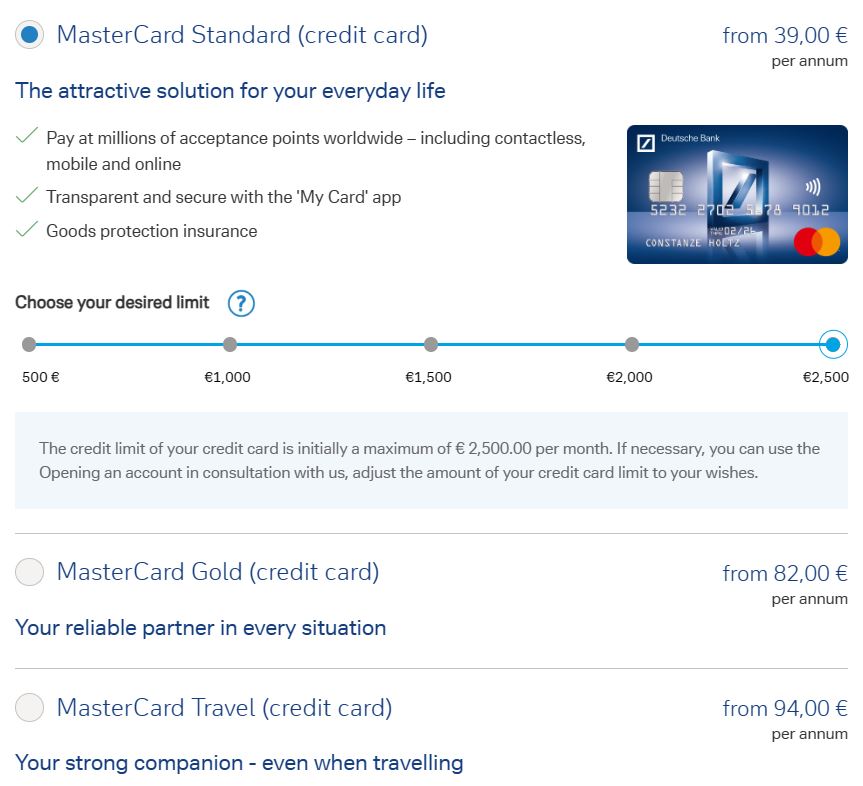

Step 4: Then, choose your desired (product) card and monthly limit.

You’ll have the following options for a monthly limit:

- €500

- €1000

- €1500

- €2000

- €2500

Choose one and scroll down.

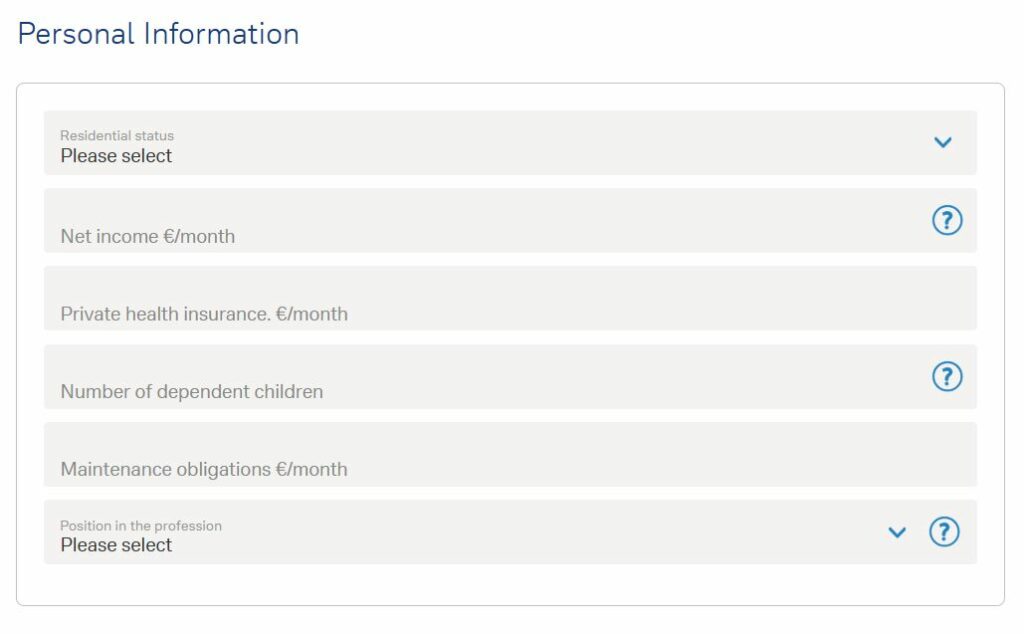

Step 5: Fill in the personal information as shown in the image below:

After this, you will be asked for your EEA IBAN and some legal information, and then you can review the final application summary to submit it.

That’s it. If approved, your card will arrive in a few days.

Deutsche Bank Credit Cards Review For 2024

Deutsche Bank offers three credit cards: Deutsche Bank Mastercard Standard, Gold, and Travel.

All of these cards come with the following:

Features & Benefits

- Full transparency and control with the “My Card” (Meine Karte) mobile app

- Apple Pay for iOS and mobile payment with Android

- Cashless and contactless payments around the world

- Security guarantee (Immediate blocking upon loss)

- Free SMS service for suspicious transactions

- Contactless payments

- Worldwide acceptance and cash withdrawal

- 24-hour customer service

Fees & Payments

- Monthly debits from your current account

- Individual credit card limit

Deutsche Bank Credit Cards Fees | |

Local Transactions in Euros or within the EU | Free |

Currency Conversion Fee | 0.5% |

Change card image | €7.99 |

Now, let’s review the individual features of each card.

1. Deutsche Bank MasterCard Standard

This is the bank’s most basic and cheapest credit card option.

Deutsche Bank MasterCard Standard

| Annual Fee | €39 |

| Foreign Transaction Fee (For payments in foreign currencies) | 1.75% (min. fee is €1.5) |

| Cash Withdrawals (In Euros or Within EU States) | 2.5% Min. withdrawal amount EUR 5.75 |

| Cash Withdrawals (In Foreign Currency or outside the EU) | Above Fee + 1.75% Foreign Transaction Fee |

| Additional Card For Family Members | €15 |

Affordable annual fee.

Cheaper to buy a family member’s card.

Very few benefits.

- Goods protection insurance.

2. Deutsche Bank MasterCard Gold

This is one of the top-tier cards that offers all the features of the STANDARD card plus some additional benefits.

Deutsche Bank MasterCard Gold

| Annual Fee | €82 |

| Foreign Transaction Fee (For payments in foreign currencies) | 1.75% (Min. fee is €1.5) |

| Cash Withdrawals (In Euros or Within EU States) | 2.5% Min. withdrawal amount EUR 5.75 |

| Cash Withdrawals (In Foreign Currency or outside the EU) | Above Fee + 1.75% Foreign Transaction Fee |

| Additional Card For Family Members | €46 |

Added insurance benefits (goods + travel health).

Trip booking facility with a 6% refund.

Slightly expensive.

- Goods protection insurance.

- International travel health insurance.

- Book a trip online or by telephone via Deutsche Bank’s travel agency partner, PTG.

- 6% refund when you book a trip with PTG.

3. Deutsche Bank MasterCard Travel

This is the most expensive among the three credit cards and is recommended for travelers.

It has all the features and benefits of STANDARD and GOLD cards except for Goods Protection Insurance.

Deutsche Bank MasterCard Travel

| Annual Fee | €94 |

| Foreign Transaction Fee (For payments in foreign currencies) | Free |

| Cash Withdrawals (In Euros or Within EU States) | 2.5% Min. withdrawal amount EUR 5.75 |

| Cash Withdrawals (In Foreign Currency or outside the EU) | Above Fee + 0.5% Currency Conversion Fee |

| Additional Card For Family Members | €60 |

Added insurance benefits.

Free foreign transactions.

Low fees on cash withdrawals abroad.

Expensive.

No goods protection insurance.

- International travel health insurance.

- Travel cancellation insurance.

- Travel interruption (delays etc.) insurance.

- Insurance coverage for lost/late baggage.

- Book a trip online or by telephone via Deutsche Bank’s travel agency partner, PTG.

- 6% refund* when you book a trip with PTG.

FAQs

Deutsche Bank’s credit card doesn’t offer any specific rewards or discounts.

However, you do get insurance benefits with Deutsche’s credit cards. Also, you can get a 6% refund if you book your trip using their partner travel agency.

Yes. You can use a Deutsche Bank credit card internationally.

The Standard and Gold cards have a foreign transaction fee of 1.75%, while the Travel card offers free foreign transactions.

Yes. You can increase your credit card limit with Deutsche Bank if you have a good credit history.

Deutsche Bank bills the credit card invoice on the 25th of each month. If that is not a working day, the billing will be created on the previous working day.

The amount will be debited from your linked account two banking days after the statement is created.