If you are considering a non-traditional banking option in Germany, you likely came across Revolut.

The innovative digital bank that challenges conventional banks has rapidly become popular, gathering millions of customers worldwide.

You may be wondering if having Revolut is worth your trust. It promises many features that challenge conventional bank accounts, but is it worth the hype?

In this Revolut review for German residents, we will take a closer look at all of its subscription options and features, fees, and benefits, weighing in on the pros and cons so you can make an informed decision about Revolut.

We cover in this article:

Revolut Germany: Key Takeaways

Quick Summary

- Revolut is great for multi-currency exchanges, operating with more than 25 currencies.

- You can make and receive payments instantly and without fees between Revolut clients globally.

- It offers 5 subscription plans, from Standard (free) to Ultra (50€ a month)

- You can trade stocks, cryptocurrencies, and precious metals directly through the app.

- No German IBAN: only a Lithuanian IBAN is provided.

- There are limitations on free withdrawals and currency exchanges in certain plans.

- There are reports of ineffective customer support

- The Premium plan is our recommendation for balancing cost-effectiveness with additional benefits like travel insurance and higher limits.

Comparison Table

Let’s take a look at the different plans Revolut offers.

Default | Plus | Premium | Metal | Ultra | |

Monthly Prices | Free | €2.99 | €7.99 | €13.99 | €50.00 |

Foreign exchange fee* | Free up to €1,000 a month (1% if you go above the limit) | Free up to €1,000 a month (0.5% if you go above the limit) | Free (Unlimited) | Free (Unlimited) | Free (Unlimited) |

Cash withdrawals | Limit: €200/Month or 5 withdrawals (2% fee if you go above the limit) | Limit: €200/Month (2% fee if you go above limit) | Limit: €400/Month (2% fee if you go above limit) | Limit: €800/Month (2% fee if you go above limit) | Limit: €2,000/Month (2% fee if you go above limit) |

International payments fee (Outside Eurozone) | Between €0.30 and €5 | Between €0.30 and €5 | 1 free payment per month | 3 free payments per month | Unlimited free payments per month |

Stock trading fees | 0.25% | 0.25% | 0.25% | 0.25% | 0.12% |

Worldwide medical insurance | ✘ | ✘ | Yes | Yes | Yes |

Cancellation insurance for trips and events | ✘ | ✘ | ✘ | ✘ | Yes |

Everyday purchases insurance | ✘ | Yes | Yes | Yes | Yes |

Cashback on card payments | ✘ | ✘ | ✘ | Yes (Up to 0.1% in Europe; 1% everywhere else) | Yes (Up to 0.1% in Europe; 1% everywhere else) |

Cashback on accommodation with Revolut partners | Up to 3% | Up to 3% | 5% | Up to 10% | Up to 10% |

Prioritized customer support | In-app chat | In-app chat | In-app chat | In-app chat | In-app chat or callback |

Exclusive card | ✘ | Personalized Plus Card | Personalized premium card | Personalized metal card | Platinum plated card |

Replacement card | €6 | 1 free card every year (€10 for additional cards) | 1 free card every year (€10 for additional cards) | 2 free metal cards (€40 for additional metal cards or €10 for standard cards) | 2 free Ultra cards (€50 for additional ultra cards or €10 for standard cards) |

Linked accounts for children below 18 | 1 account with limited features | 2 accounts with full access | 2 accounts with full access | 5 accounts with full access | 5 accounts with full access |

Schufa check | ✘ | ✘ | ✘ | ✘ | ✘ |

* 1% fee on weekends. | |||||

How Do You Open A Revolut Account In Germany?

Opening a Revolut account is a simple process. You are only able to register through the app, so the first step is to download the application. The account opening is free. Let’s take a look at the steps:

Step 1 – Download the Revolut App

Step 2 – Enter your phone number

Step 3 – Enter the 6-digit code that Revolut will send you by text message

Step 4 – Enter the personal data requested (name, address, birthday, email address)

Step 5 – Read and accept the Terms and Conditions

Step 6 – Take a selfie with your phone through the app (used for verification purposes)

Step 7 – Create a 4-digit PIN

Step 8 – Submit your ID document (back and front)

Step 9 – Enter your tax number

Step 10 – Choose the plan you want to have

Step 11 – Choose between a virtual card or a physical card (you can also do it later)

Step 12 – Add some money to your Revolut account through your current account

It may take a bit of time until all functionalities of the app are available, but other than that you’re good to go pretty much right away.

Regarding documentation, you only need to provide an identification document.

At the moment, Revolut only works with people living in the European Economic Area (EEA), Australia, New Zealand, Singapore, Japan, Brazil, Switzerland, the United Kingdom, and the United States. Anyone above 18 years old is eligible to create a Revolut account, and there is no Schufa check.

Teenagers are also able to create an account with parental approval. In Germany, if you are above 16, you can have access to the instant payment feature.

Revolut Germany Review For 2024

Revolut was founded in 2015 and is headquartered in London. In 2018 it secured a challenger bank license from the European Central Bank, facilitated by the Bank of Lithuania. In 2021 Revolut applied for a UK banking license, which has yet to be granted.

As Revolut states on its website, the British fintech is not considered a bank everywhere because they don’t have a banking license from each region they operate in.

For now, they only secured a license for the European Economic Area. In Germany, Revolut has had a bank status since the beginning of 2022.

The so-called neobank allows German residents to open a multi-currency account (you can send money in more than 29 currencies) with no paperwork, and that is one of the reasons why it has become so popular.

Subscription Plans

Revolut offers you 5 plans: Standard (free), Plus (2,99€/month), Premium (7,99€/month), Metal (13,99€/month), and Ultra (50€/month).

a) Standard (Free)

The free plan offers all of the multicurrency benefits but with limitations.

There is no currency exchange fee, only up to 1,000€ a month. After that, you have a 1% fee. There are also limitations when it comes to withdrawals, as there’s a limit of 200€ a month.

In the free plan, you have no insurance. You can have one linked account for children and can order a physical card (although you have to pay shipping costs).

b) Plus (€2.99/Month)

The Plus plan is similar to the standard, but you have a reduced fee if you go above the limit for foreign transactions.

In this plan, you also have the benefit of having insurance for everyday purchases, and 2 linked accounts for children below 18.

Unlike the standard plan, you can also personalize your Plus card.

c) Premium (€7.99/Month)

With a Premium account, you have travel insurance, higher limits on currency exchanges, and ATM cash withdrawals.

You also have a 20% discount on fees when you transfer money internationally. You can also personalize your card and have 2 linked children accounts.

d) Metal (€13.99/Month)

The Metal plan offers you fewer restrictions when it comes to payments and withdrawals, and adds a 40% discount on all international money transfers.

You also benefit from an insurance package that protects you when traveling, and cashback on card payments (0.1% in Europe and 1% everywhere else).

With Metal, you can link up to five <18 accounts and have an exclusive Revolut Metal card.

e) Ultra (€50/Month)

With a monthly fee of 50€ a month, the Ultra Revolut card offers you an elite experience, where you have access to a large number of lifestyle subscription plans (fitness, food delivery, work, and even Tinder Gold).

Ultra also offers you a comprehensive insurance package, including trip cancellation, unlimited free international transfers, and a limit of 2000€ for withdrawals.

f) Revolut Pro

In all personal plans, you are able to add Revolut Pro, a service for freelancers, where you can manage your own business expenses and revenue.

With Pro, you can create and send invoices, and request professional payments through a link or QR code.

You can accept and make payments in 36 currencies at great exchange rates, and earn up to 1.2% cashback on every purchase with your Pro card.

A Revolut business account, on the other hand, is similar to Pro, but instead of being targeted towards individuals, it is made for companies, with several features to help you manage your business finances.

g) Revolut <18

Teenagers above 16 years old can create a Revolut account to make and receive payments with parental consent.

For children who are 15 or below, a parent must create an account for them via the Revolut app.

Fees & Charges

There are a few fees associated with Revolut, but if you stay within the limits, you can use its functionalities for free.

For paid account plans, you can expect fewer limitations and fees, but progressively higher monthly fees. You can check all fees here.

With the free Standard card, you can do free currency exchange up to 1000€ a month and if you go beyond that, you pay a 1% fee.

This also applies to the Plus account (but with a 0,5% fee). In the Premium and Metal, as well as the Ultra, you have a completely free foreign exchange fee.

Important

However, be careful because free foreign exchange fees only apply Monday to Friday. On weekends there is a 1% fee.

Regarding ATM withdrawals, in the Standard and Plus plans you can only take up to 200€ a month for free. Above that, you have a 2% fee.

Keeping your high street bank account for withdrawals may be recommended because of this.

With Premium, Metal, and Ultra, you can withdraw more money per month, but there is still a cap amount before you get the 2% fee.

You can do instant money transfers to other Revolut users globally. Local Revolut payments and payments within the Single Euro Payment Area (SEPA) are also free.

When it comes to international payments outside SEPA, a fee applies (except with Ultra, which is always free). This fee is variable, depending on the amount you are paying and the currencies in question, and it goes between 0,30€ and 5€. You can check it here in more detail.

Premium and Metal users have a 20% discount and 40% discount respectively on international transfer fees.

There are also costs associated with replacement cards. In the standard plan, you pay 6€ plus shipping costs. In the other plans, you have free additional cards offered to you before you need to pay for one.

If you use Revolut Pro, the following payment processing fees will apply: 2,5% for online payments and 1,5% for offline payments.

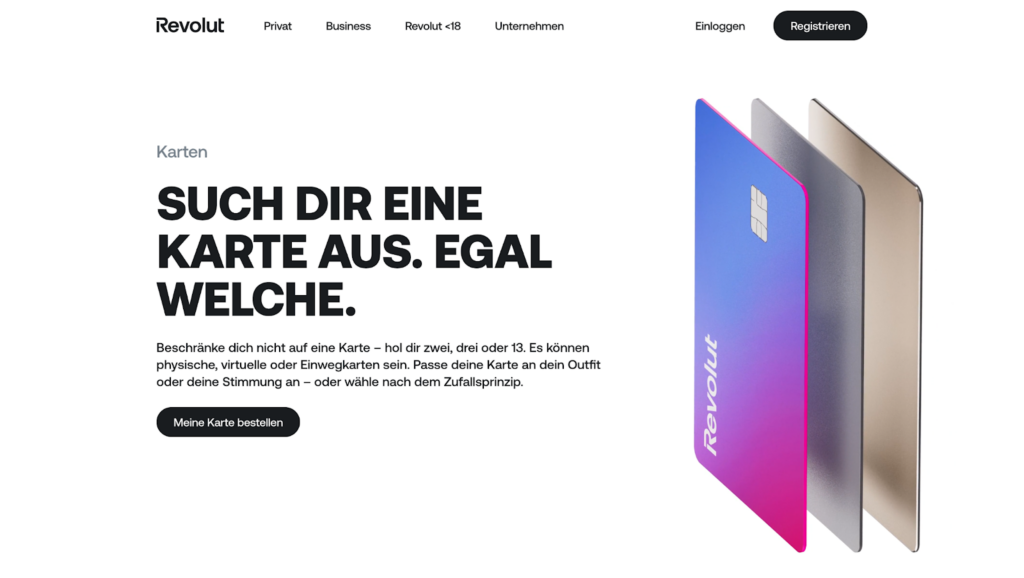

Revolut Cards

Revolut cards are prepaid debit cards.

This means you charge a specific amount to your Revolut account from your linked checking account, and you can use it normally like a debit card up to the loaded amount.

Revolut works with Mastercard and Visa, so your Revolut debit card will be accepted widely.

You can also conveniently link your card to Apple Pay and Google Pay wallet.

Revolut offers a credit card with a credit line of up to 10,000€, but it is not available in Germany.

Currently, only Revolut customers from Poland, Lithuania, the USA, and Ireland, are able to get a Revolut credit card.

Revolut Perks & Benefits

- Multi-currency accounts, allowing transactions between 25+ foreign currencies

- Good exchange rates at mid-market exchange rate

- Free transactions between Revolut users globally

- Free international transfers (with limitations)

- Everyday insurance for purchases (except Standard plan)

- Global medical insurance, winter sports insurance, and delayed flight, lost or damaged luggage insurance (Premium, Metal, and Ultra plans)

- Personal liability insurance and car hire excess insurance (Metal and Premium plans)

- Trip and event cancellation insurance (Ultra plan)

- Airport lounge access (discounted on Premium and Metal; unlimited on Ultra)

- 0,1% cashback in Europe and 1% cashback everywhere else on card payments (Metal and Ultra)

- Cashback on accommodations with Revolut Stays, up to 10%.

- Partner subscriptions (Financial Times Digital Premium, WeWork, NordVPN, and more) (Premium, Metal, and Ultra plans)

- Priority customer support 24/7 (except Standard plan)

- Possibility of having a joint account to share and organize expenses

- Specialized accounts for freelancers (Revolut Pro) and young people below 18 (Revolut <18)

- Trading of stocks, commodities, and cryptocurrencies

- Commission-free stock trades (limited time)

Investment Options

Revolut gives you the opportunity to have a trading account to invest in stocks, shares, cryptocurrencies, and precious metals through the app.

There are thousands of shares you can invest at your own risk, from Apple to Tesla, starting from just €1.

You are allowed to make a certain number of commission-free trades, within your plan’s monthly allowance (1 trade for Standard, 3 for Plus, 5 for Premium, and 10 for Metal and Ultra). After that, fees apply (0.25% for all the plans except Ultra, which has a 0.12% fee).

DriveWealth, LLC, Revolute’s third-party broker, executes all trades transmitted by Revolut.

You can buy, sell, and transfer cryptocurrencies such as Bitcoin easily through the app.

Important

Please remember that there are risks associated with these types of investments, so be cautious with your money.

Mobile App Features

Revolut’s mobile app is very user-friendly and has a great design, offering you a very smooth and simple solution for your money management.

You can easily link your Revolut bank account to your external bank account to deposit money by bank transfer.

You can request money or send money abroad and exchange currencies with a single tap. Revolut transfers to another Revolut user are instant and free, and you can personalize them with a message.

You can easily track and analyze your spending, and you will get instant notifications every time you make a payment.

You can also save money with a feature called “Saving Vaults” and earn interest over time.

It’s also possible to have a “Group Vault” where a family or group of friends save money collectively towards a goal.

On the app, you can also easily access trading options, design your physical card, and create accounts for your children.

Security Features

Revolut prioritizes security, putting in place measures that safeguard your money.

- You are required to provide a PIN, biometrics, and SMS code when using the mobile app, or confirm login requests via the mobile app when using the desktop app.

- When making online purchases, you must confirm transactions via the app.

- Payments to new recipients require confirmation, and in-app warnings are provided if a payment is detected as potentially fraudulent.

- You can create disposable virtual cards.

- You can easily freeze and unfreeze your Revolut debit card in the app.

- Revolut may freeze your account if there is suspicion of fraud or scam

In 2020, Revolut’s anti-fraud algorithm suspended several accounts in error for weeks or even months at a time, which gathered many complaints.

However, it seems like the problem has been resolved or attenuated since then.

Customer Service

You can contact Revolut’s customer support through the in-app chat option, where you will talk with a chatbot, and if needed, a live agent.

Ultra customers have access to their 24/7 outbound phone support service, which you can access through your Revolut app, currently in English only.

You can also send an email, but the company itself says that the chat option will be faster.

Although you can find users complementing Revolut’s responsive customer support, there are also unfortunately many negative opinions about the effectiveness and lack of response from their support team.

Revolut Germany Pros & Cons

Pros

Multi-currency bank account (Transfer and exchange money in over 25 foreign currencies) – great for traveling.

Free, instant transactions between Revolut clients globally.

Free withdrawals (With limitations).

Very competitive exchange rates.

Very easy application process with no Schufa check.

You can add a physical card to your virtual Revolut card.

Saving money is possible through the “vaults” available in the app.

You can save money with family or friends through the “group vaults”.

You can invest and trade stocks and crypto.

Specialized accounts for freelancers and children.

Cashback on Revolut payments.

Insurance packages included in some plans.

You can personalize your cards in some plans.

Very simple, user-friendly mobile app.

Cons

Revolut doesn’t provide you with a German IBAN (Only a Lithuanian one). That can bring problems with direct debits because some providers require a German IBAN.

In the Standard plan, fee-free withdrawals are limited to 200€ a month.

Currency exchanges with no fees are limited to €1,000 per month in the standard and plus plans.

No credit line offered in Germany.

Issues with customer support (Complaints about it being unresponsive and ineffective).

Revolut After Brexit: What Has Changed?

After the exit of the United Kingdom from the European Union in 2020, Revolut underwent changes in how it operates.

With Brexit, Revolut migrated many customer accounts to their European entity in Lithuania, and new IBANs had to be issued, which complicated things for some people.

After Brexit, investments are no longer covered under EU regulation. However, they are still covered under UK regulations, which have equally strict requirements.

FAQs

Revolut is a bank in Germany. It is able to operate as a bank within the EU because they have a European banking license, facilitated by the Bank of Lithuania.

But it’s not licensed as a bank everywhere. Currently, Revolut does not provide a German IBAN.

Yes, Revolut cards are accepted in Germany. Since Revolut cards are Mastercards or Visa cards, they are widely accepted in most places.

If you go over the limits imposed by Revolut on ATM withdrawals and international payments, you will have to pay fees. You can check them here.

Customers’ money in Germany is protected under the deposit guarantee scheme.

Revolut secures your money through the Lithuanian State Company Deposit and Investment Insurance of up to 100,000€.

This makes Revolut as safe as any other banking institution.

A premium Revolut plan has extra benefits, such as travel insurance, fewer restrictions for free withdrawals and payments, unlimited foreign exchanges in different currencies, and other lifestyle perks.

Conclusion

Revolut is a practical banking solution for people in Germany, including expats.

While it’s not without its limitations, the competitive rates, multi-currency service, and innovative features make the British fintech a strong banking option, especially as a secondary account.

Hopefully, this Revolut review provided you with valuable information about the intricacies and features of this virtual bank so you can make an informed decision.